Insight Focus

- Recent massive capacity expansion fuelling a surge in Chinese PET resin exports.

- South Korean drift lower on seasonal trends, whilst continuing to target the US market.

- Brazil’s imports continue to outstrip exports on reduced volumes.

China’s Bottle-Grade PET Resin Market

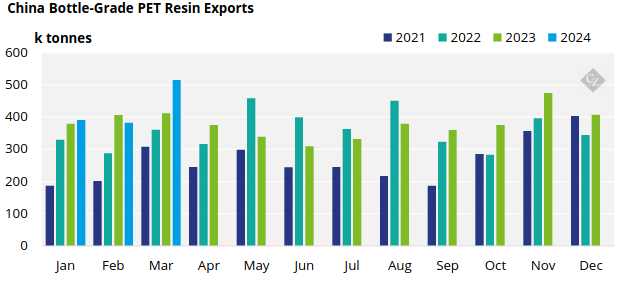

Monthly Exports

- Chinese bottle-grade PET exports (HS 39076110) surged in March, as is typically the case following the Chinese New Year slowdown.

- However, this March, volumes have continued to break record highs, with exports reaching over 515k tonnes, resulting from massive capacity expansion in 2023, and further subsequent additions in early 2024.

- New order intake in March is also thought to have been around 500k tonnes, with some of this volume expected to bleed into April and export levels remaining at record highs.

- The UAE was the largest end destination for Chinese PET resin in March, with around 28.7k tonnes, up 144% from the previous month; increasing 66% from March 2023.

- Monthly exports to Saudi Arabia also leapt by over 5 times, from typical levels of just 3-4k tonnes to 24.7k tonnes in March, likely because of a large breakbulk arrival. Year-on-year this represented a 191% increase.

- Russia and India ranked 3rd and 4th largest destinations in March, both with over 21k tonnes.

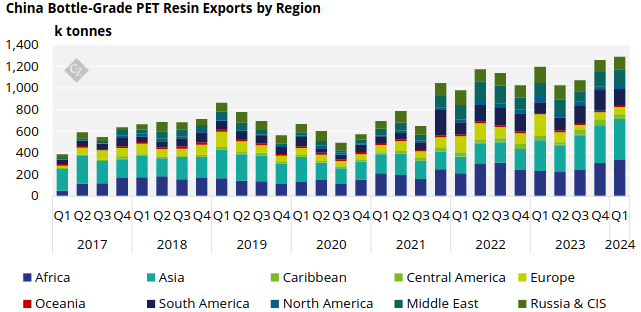

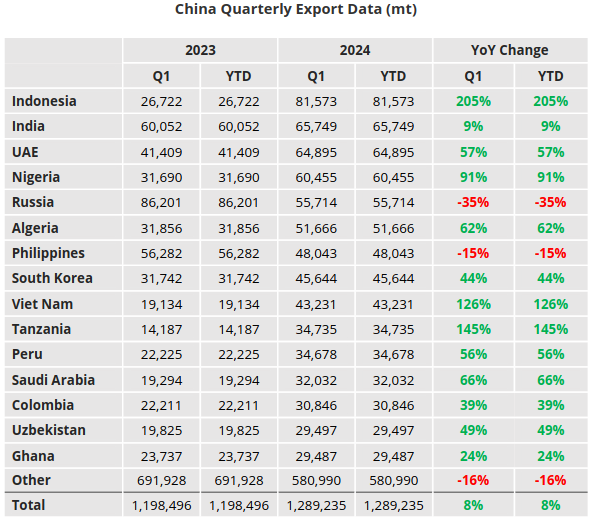

Quarterly Exports

- Looking at the latest full quarter, Chinese bottle-grade PET Resin exports totalled 1.29 million tonnes in Q1’24, up 2.5% versus Q4’23, and an 8% increase compared to Q1’23.

- Once again, Chinese PET resin exports set a record high in Q1’24, surpassing the previous all-time high in Q4’23.

- With massive capacity expansion in 2023, and a continuing build program in 2024. Chinese exports are expected to continue to set new records in 2024.

- Indonesia, India, and the UAE were the top three destinations for Q1’24, with around 82k tonnes, 66k tonnes, and 65k tonnes respectively.

- Exports to Indonesia experienced a 56% quarterly increase, 205% up from a year earlier.

- And although exports to India fell 16%, to around 66k tonnes, volumes were still 9% above Q1’23, and 139% above Q1’22.

- Exports for Nigeria and Algeria also experienced strong quarterly increases in Q1, up 63% and 25% respectively. Volumes to Nigeria have almost doubled over the last year.

- By region, Asia was the largest destination last year, with around 29% of total Chinese PET resin exports, followed by Africa and 26%, and the Middle East moving up in ranking on 12%.

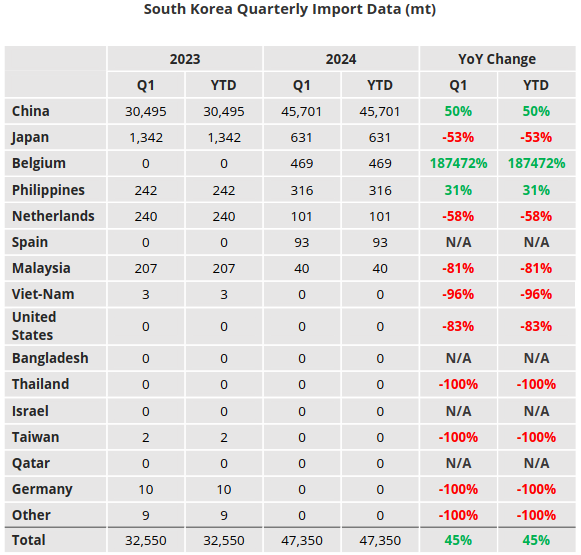

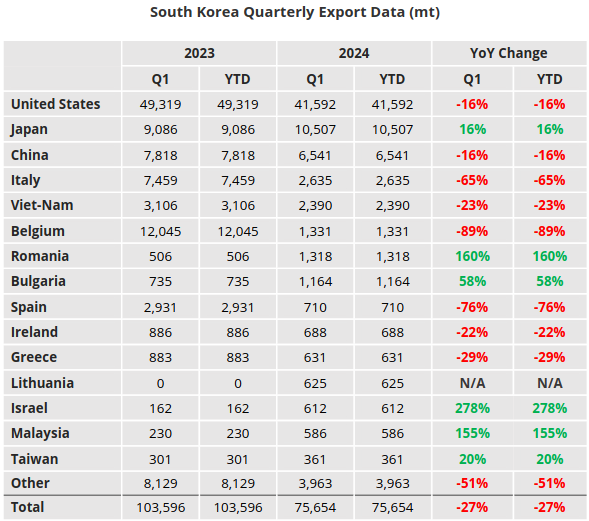

South Korea’s Bottle-Grade PET Resin Market

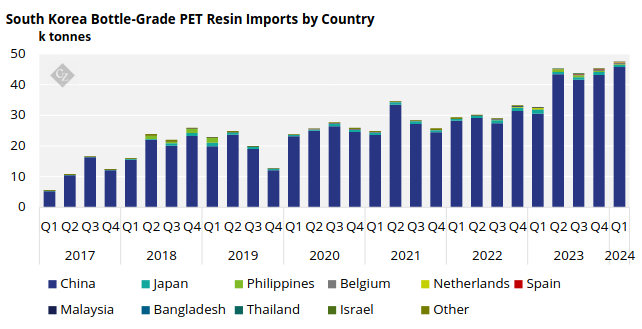

Quarterly Exports

- South Korean bottle-grade PET resin exports fell a further 4.3% in Q1’24 to 75.7k tonnes, down 27% versus the same period a year earlier.

- The United States remained the largest destination market with around 42k tonnes, equivalent to 55% of total Korean PET resin exports in Q1’24.

- As a result, South Korea has recently initiated an anti-dumping investigation on several main Chinese PET resin suppliers, including Yisheng and CRC.

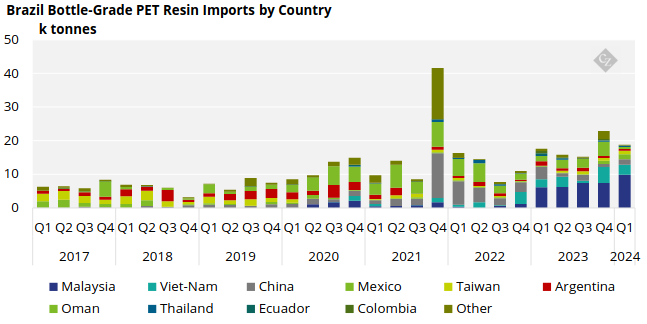

Brazil’s Bottle-Grade PET Resin Market

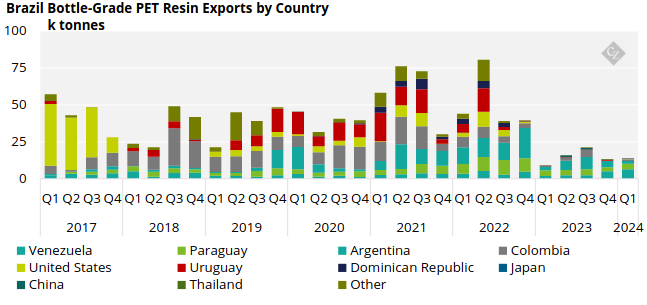

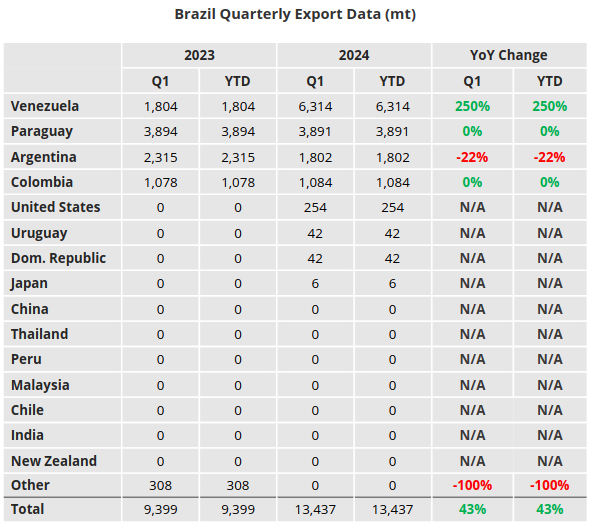

Quarterly Exports

- Brazilian PET resin exports remained low In Q1’24, totalling just 13.4k tonnes for the quarter, 43% down on Q1’23.

- Exports were almost exclusively destined for Venezuela, Argentina, Paraguay, and Colombia, which when combined accounted for around 97% of total quarterly exports.

- Exports to Venezuela continued to steadily grow, up a further 26% on the previous quarter, to just over 6k tonnes; a 250% improvement on the same period a year earlier.

- Whilst a relatively low levels, Brazilian exports to Paraguay also grew, 38% versus Q4’23, to around 4k tonnes.

- However, exports to Argentina remained extremely low at just under 2k tonnes.

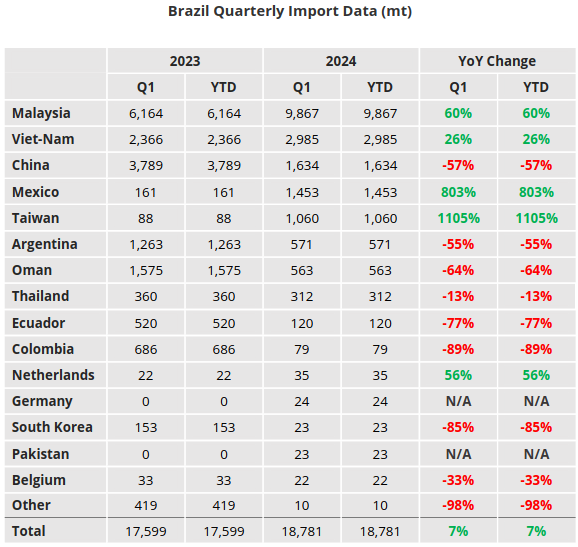

Quarterly Imports

- Brazilian PET resin imports fell 18% in Q1’24, after a strong seasonal increase the previous quarter, to just under 19k tonnes.

- Approximately 77% of total Brazilian PET resin imports in Q1 originated from Malaysia, Vietnam, and China, with 10k tonnes, 3k tonnes, and 1.6k tonnes respectively; imports from Argentina and Oman fell by over 50% to very low levels.

- Imports from Malaysia, the largest import origin, grew by around a third versus the previous quarter, and are up 60% versus a year earlier.

- Vietnamese volumes remained volatile shedding 37% on the previous quarter, whilst a small additional tonnage increase from China saw a much larger 87% quarterly increase.

Data Appendix

If you have any questions, please get in touch with GLamb@czarnikow.com.