Insight Focus

- Large parts of North America, Europe and Asia have been hit by a series of extreme heatwaves.

- PET industry faces electricity restrictions in China, severe droughts across Mexico.

- European retailing is being disrupted by extreme temperatures, ‘heatflation’ may hit consumers.

Heatwaves have swept across much of the Northern Hemisphere, leaving parts of North America, Europe, and Asia sweltering.

Warmer temperatures are typically welcomed by the food and beverage industry because they spark higher sales and demand for PET packaged goods.

However, in many regions, uncomfortably high temperatures have had the reverse affect, reducing mobility as consumers shelter from the heat in their homes.

In this article, we explore the impact of these heatwaves on PET resin supply chains in key markets.

China Set to Experience its Third Heatwave of 2022

China, the world’s largest producer as well as consumer of PET resin, is set to face its third heatwave of the year.

Early August temperatures are expected to spike to over 40°C again in some provinces around “Big Heat” day in the traditional Chinese calendar.

In heatwaves in June and July temperatures in Shanghai hit 40.9C, equalling its hottest-ever day.

Several cities, including in Shanghai and Zhejiang province, have already issued red alerts for the coming weekend, for many this will be the third time this summer they have issued extreme heat warnings.

Whilst hot weather is normal in China during the summer, this summer’s series of heatwaves have been stronger in intensity, and longer in duration, frequently lasting over 10 days in some regions.

Higher temperatures have resulted in a wider economic impact. Electricity supply, domestic and industrial water supply, transportation, agricultural production, and manufacturing have all been adversely affected.

Chinese Electricity Restrictions Cut PET Production

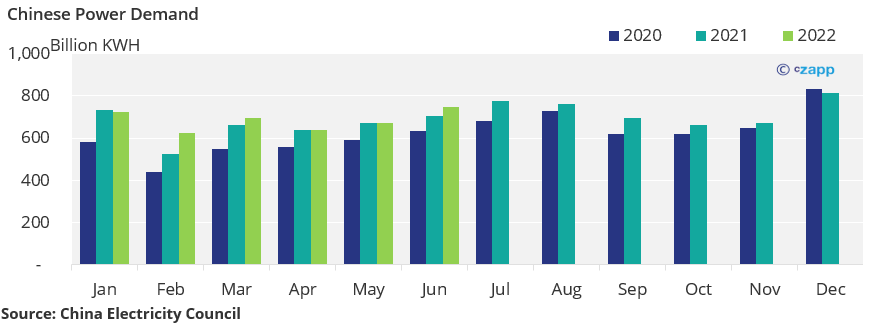

In June, the China Electricity Council (CEC) reported that domestic electricity consumption by urban and rural residents had increased by 17.7% year-on-year.

As the temperatures have risen over the summer months, the power grid has come under increased pressure due to greater demand for air conditioning in homes and offices.

Electricity use in major cities, such as Henan, Shaanxi, Shanghai, Hebei, and Chongqing, has leapt by more than 50% year-on-year. Whilst electricity consumption in Shandong and Henan provinces posted record highs.

To avoid the type of widespread electricity rationing seen last year, local authorities have taken steps to restrict the consumption of high energy-consuming companies.

In Zhejiang province, polyester fibre as well as bottle-grade PET resin production has been affected. For example, power restrictions caused Wankai to cut its PET resin production operating rates in Haining by around 30% in July.

Northern Mexico Faces Severe Drought and Water Shortages

On the other side of the world, more than half of Mexico is currently facing moderate-to-severe drought conditions, according to the federal water commission CONAGUA, following a succession of heatwaves linked to this year’s La Niña climate pattern.

In the Northern city of Monterrey, Mexico’s third largest city with a population of around 5 million people, many residents are now without running tap water, reliant on trips to the municipal water tank and bottled water.

Known as the heart of Mexico’s manufacturing industry, Monterrey contributes around 12% of the country’s GDP, and is close to running dry.

Of the three reserves supplying water to Monterey’s municipal area, two are basically empty, with the third at less than half capacity – 60% of the town’s water comes from these reservoirs and the rest is from wells.

In June, the city began limiting water access, which sparked panic buying of bottled water.

Since then anger has grown against soft-drinks and beer manufacturers in the region, which have been allowed to continue to extract water.

This led President, Andrés Manuel López Obrador (AMLO), to call on local soft-drinks bottlers and breweries to halt production to reduce water consumption.

In July, Cuauhtémoc Moctezuma Brewery, a subsidiary of Heineken, announced it would donate 20% of the water consumption at its Monterey plant back to the city, as well as donating around USD1 million to build a new well.

With the hottest months ahead, the crisis is expected to continue.

Retail Sales Fall Flat in Europe, ‘Heatflation’ Risk

On the other side of the Atlantic, Europe’s latest heatwave has begun to fade. However, for large swathes of the continent this was just the latest in a series of heatwaves to hit this year.

Southern France, Spain and Italy have sweltered under a series of blistering heatwaves since May, which has seen record temperatures tumble, frequently exceeding 42°C across the region.

Extreme temperatures have also stoked wildfires in many countries and left much of the continent facing lengthy droughts.

In the UK, although the July heatwave lasted just a week, footfall at all retail destinations was hit hard by the higher temperatures, with much of the public sheltering in-doors.

City centres were particularly badly affected as more people worked from home and avoided the commute, reducing on-the-go food and beverage consumption, eerily reminiscent of last year’s COVID lockdowns.

European Consumer Now Face ‘Heatflation’

The inflationary effect of the heatwaves on food prices will also weigh on demand for PET and packaging in general.

According to the European Commission, much of the continent is facing a very high risk of drought due to lower winter-spring rainfall and compounded by the summer heatwaves.

According to the Commission’s latest report “water and heat stress are driving crop yields down from a previously already negative outlook for cereals and other crops.”

In Italy, the agriculture union, Coldiretti, has warned that drought is threatening 30-40% of the national seasonal harvest

Lower crop yields will mean higher food prices for the consumer, further adding to inflationary pressures on households.

As the world teeters on the edge of another global recession, the additional burden of ‘heatflation’ may weigh heavy on consumer spending, hitting future demand for discretionary PET packaged products.

Other Insights That May Be of Interest…

Plastics and Sustainability Trends in July 2022

European PET Market Stumbles as Producers Left Blind on Costs

PET Resin Trade Flows: China’s PET Exports Surge as Logistics Ease Post-COVID

Asia PET Market View: Chinese Consumption Rebound Drives New PET Orders