Insight Focus

Global urea markets are now awaiting price guidance from the India tender closing July 8. Processed phosphate prices are going up across the board due to limited supply while global potash markets are bearish with abundant supplies.

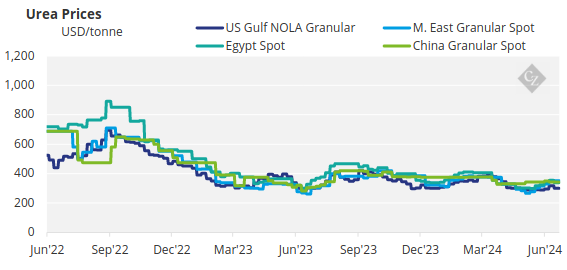

Urea at a Standstill

The global urea market has come to a standstill this week with all eyes on the India urea tender closing on July 8 with shipments to arrive in India on or before August 27. Price indications for the India tender have varied but it seems to be in a range of between USD 345-380/tonne CFR, with the most likely number either side of USD 350/tonne CFR.

Traders and producers alike are reluctant to make any commitment until they see price guidance from India. The biggest issue is how much India will buy with only two regions — Russia and the Middle East — with availability for August shipments.

It is expected that Russia could come in with around 400,000 tonnes and that the Middle East would contribute around 300,000 tonnes. A couple of cargoes could come in from Southeast Asian producers although it looks like only Indonesia may have availability. This movement could still be prevented by continued congestion at Bontang.

The Bintulu factory of Petronas is said to be down still, and BFI of Brunei is reported by traders to have sold out for August with prices above USD 350/tonne FOB.

Chinese participation is not to be expected with export restrictions still in place to keep domestic prices lower. Egyptian producers are now said to be back to full production, and they will be kept busy shipping already-committed cargoes to the tune of 100,000-150,000 tonnes, mainly for the European market.

Brazil is showing very little interest at the moment with offers around the USD 360-370/tonne CFR levels and bids coming in around the USD 355/tonne CFR. However, the main buying season is coming in Brazil, and we could expect to see major movement in this direction in the next couple of months.

To date Brazil is reported to have imported 2.4 million tonnes, which is on par with the same level of imports last year. Iran is reported to have sold at USD 305/tonne which is USD 10/tonne lower than the previous sales.

The current outlook for the urea market appears to be bearish but subject to India clearing out Russian and Middle Eastern volumes for August, we could expect to see urea prices to go up from September onward.

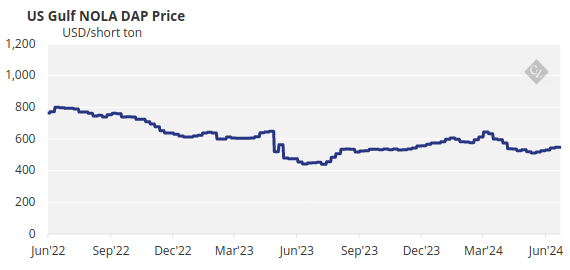

Processed Phosphate Market Rises

The processed phosphate market is on fire due to lack of availability. India had to bite the bullet and paid USD 551/tonne CFR for a DAP cargo which is up USD 12/tonne on deals previously done. Chinese producers are aiming for USD 600/tonne FOB with the latest achieved at around the USD 575/tonne FOB level.

MAP prices in Brazil saw a big jump this week and are now at USD 630/tonne CFR. Both Brazil and India have low stocks and seasonally strong demand. Imports by both countries have dropped so far this year and India should need to buy more DAP despite the current trepidation of its buyers. This will likely continue to support DAP/MAP prices in other key global markets, at least over the remainder of Q3.

Price upside in Latin America is probably more limited than it is east of Suez as crop price declines and DAP/MAP price increases have already impacted affordability significantly.

The concern now is that buyers will switch to alternative products like NPK, NPS, TSP and even SSP. The outlook for processed phosphate prices is bullish, with limited availability driving prices up.

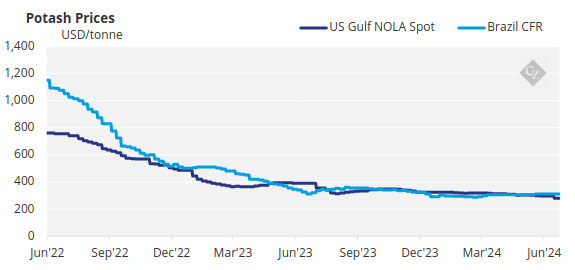

Potash Under Pressure

There is very little excitement on the global potash markets with prices in Southeast Asia on standard products going down with both Indonesia and Malaysia, putting pressure on prices. The average standard MOP price fell to USD 281.50/tonne CFR, the lowest level since May 2021.

India has yet to conclude its annual contract and there is again a rumour that the settlement will take place some time in or around the end of July at around the USD 280/tonne CFR level.

Rumours of a contract settlement in China at around the USD 270-275/tonne range excited the market somewhat, although there has been no confirmation of this deal. The outlook for global potash prices is bearish over the next few months with abundant supply.

Ammonia Spot Demand Cools in Far East

The key news of the week emerged from Tampa, where Yara and Mosaic agreed the July contract settlement at USD 415/tonne CFR, up USD 15/tonne on the June contract.

Given ongoing gas curtailments in Trinidad, talk of other production outages elsewhere in the West and last week’s USD 375/tonne FOB Trinidad sale by Nutrien, the news came as little to surprise to market participants. But availability out of the US Gulf remains healthy, with Trammo sourcing several spot part cargoes from the region over the past week.