Insight Focus

Urea prices increased in all regions this week, but it is unclear whether this will continue past July. India was front and centre in the processed phosphate and potash markets, while price disparities between east and west still persist for ammonia.

Urea Market Perks Up

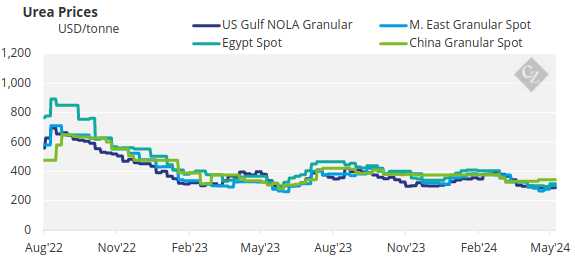

The urea market price moved up in most regions this week.

Again, the big question is if the rapid price increases are sustainable into July when Chinese exports are expected to come into the market. The urea price will be demand driven with markets in the southern hemisphere coming into play now that markets in the northern part of the world are approaching off-season.

Most producers are sold out for June thus in no rush to price aggressively. Middle East FOB levels reached USD 315/tonne on demand from Australia. Egypt FOB levels hovered between USD 315/tonne and USD 323/tonne. Even Iranian producers saw the opportunity and conducted sales tenders with prices reaching USD 276/tonne FOB.

A Pupuk Indonesia tender saw around 250,000 tonnes committed at a price slightly above USD 312/tonne FOB. It is expected that several cargoes may end up in Australia, although weather conditions both east and west of Australia are dry. However, if rain comes, demand should pick up substantially since products in inventory are mostly pre-sold but yet to be picked up.

No word has come out of India confirming a June urea tender, although rumours of this are circulating. This could give the market some positive sentiment, but Chinese expected July exports could dampen enthusiasm.

The outlook for the urea market is stable but we may see slightly increased prices over the next few weeks.

Chinese Processed Phosphate Sellers Hold Firm

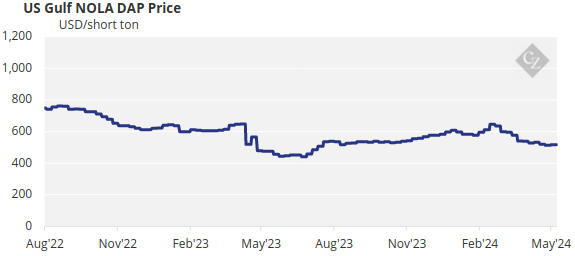

The processed phosphate market has seen an upswing in prices over the past week or so. There has been resistance from Chinese exporters for lower prices to assist traders covering shorts in India. As a result, traders are struggling to cover these shorts and are facing losses. They have now stopped selling shorts in India altogether.

Indian buyers are reluctant to give in to higher prices, but the market expects India to come into play due to low inventories from reduced domestic production. Imports to date have also been much reduced.

MAP prices in Brazil have finally moved up from USD 575/tonne CFR and have now reached levels above USD 580/tonne CFR.

Firmer market sentiment and more bullish fundamentals may support further DAP/MAP price increases in India, Brazil and the US over the coming weeks. Still, upside could be restricted by Chinese exports, which will come into full force in the next few weeks onwards.

Potash Awaits India

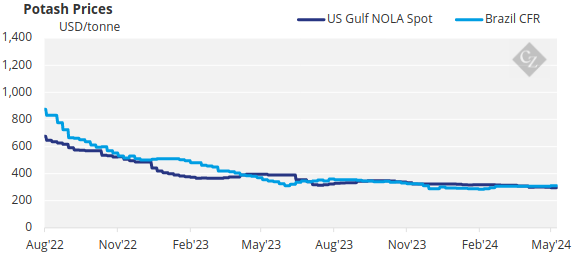

Potash market players are still awaiting the settlement of the new Indian import contract, with no fresh input coming out of the IFA conference in Singapore last week, although many suggest an agreement is looming. Meanwhile, global spot prices remained little changed this week.

Brazil’s granular potash spot prices held flat this week, although suppliers continue to push for higher levels of USD 320/tonne CFR. Brazilian MOP prices have rebounded since February and average prices are almost back to the USD 315/tonne CFR level seen at the beginning of the year.

Southeast Asian spot prices were also unchanged this week, but views on where the market might go are mixed. The average sMOP price in the region has hovered around USD 295/tonne CFR for six consecutive weeks now, reaching its lowest level since June 2021, and is now down 69% from its peak of USD 938/tonne CFR in July 2022.

Ammonia

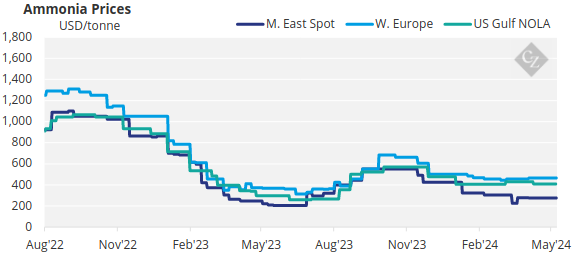

Ammonia prices continued to ease off West of Suez following the latest Tampa settlement announcement for June, which saw a USD 50/tonne reduction from the previous settlement. The new price is now USD 400/tonne CFR Tampa.

This is in stark contrast with indexes in the Eastern Hemisphere, where prices remain supported on regional supply issues. Amid ongoing supply constraints in the Arab Gulf and Southeast Asia, prices in the Far East remain propped up and could soon move beyond USD 500/tonne CFR, according to the most bullish of observers.

That being said, no confirmed business was heard out of China, South Korea or Taiwan, China this week. Loadings out of Indonesia have certainly dropped off of late, with little fresh availability either here or in Malaysia.

Prices appear to be losing support in the West, though prices East of Suez should remain propped up by supply constraints in the Arab Gulf and Southeast Asia through June.