Insight Focus

Smaller NZ dairy processors keep gaining share, though Fonterra is fighting back. EU production has been hampered by lagging German flows and Bluetongue impacting France. NZ SMP exports to China jumped 42% year over year, while Irish butter exports surged ahead of tariff risks.

New Zealand’s Milk Production Surge: Our Anticipated Growth Realized

NZ January milk collections rose 5.0% year over year to 211.9 million kgMS, moving this season up to third place in all-time year to date collections.

Following a strong January with a 4.6% year over year increase, Fonterra has revised its season projection to 1,510 million kgMS. This means that it must continue outpacing last season by 1.6% each month for the rest of the season.

Fonterra attributes January’s North Island growth mainly to unusually high sunshine levels in Waikato, which it says supported pasture growth there. However, this seems unlikely given the recent dry spell and the very low Pasture Growth Index reported in that region.

The data suggests that Fonterra is regaining market share in Waikato. Initiatives such as the Emissions Incentive payment, which rewards farmers with low emissions footprints (between 10-25 c/kgMS) and is backed by Mars and Nestlé, show how seriously Fonterra are taking on competition. An upcoming sale of its branded business could add a further one-off dividend for its farmer-shareholders and bolster its current appeal.

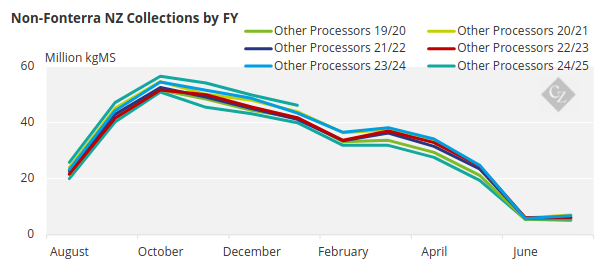

The non-Fonterra group saw a 6.4% year over year increase across New Zealand, continuing its strong growth trajectory. Open Country is believed to be up 3-4% in Waikato even excluding the incremental milk gained from the Pokeno farms. However, we have heard that they are now citing heat stress and dry weather as impacting their milk production downward.

Despite Fonterra’s gains in Waikato, the non-Fonterra group continues to outperform our modeled market share growth, now at 21.6% FYTD. Interestingly the sunshine argument is more valid for Westland, with January the sunniest ever recorded, while rain was at normal levels. Expect their milk production to be flowing very strongly. Synlait also has industry stalwart, Richard Wyeth, taking the helm from May in a clear show of the seriousness in its own turnaround and effort to retain supply.

After a cooler start to the year across NZ, much of the North Island is now much drier than normal according to NIWA. Taranaki recently had 14mm of rain in 24 hours and even this has not had much impact on soil moisture.

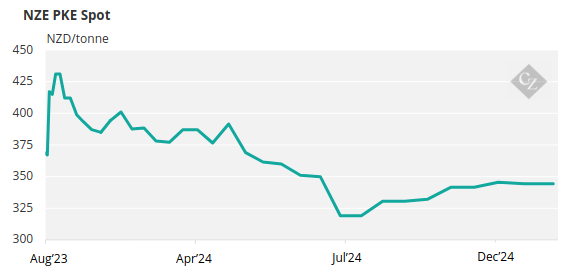

However, we are hearing the PKE loaders at many feedlots are running 24/7, which makes sense at the current milk price: that is, supplement will keep the milk flowing. Pricing of most feed grains in NZ is at the lower end of the range for the past two years, further supporting purchases.

Source: NZX

New Zealand farmers also can enjoy the tailwinds of falling interest rates and a weak NZD dollar compared to USD, providing lower debt servicing costs and higher NZD denominated values for the products exported abroad.

Putting all of this together, my expectation is that we should see the February 2025 milk production print above +1.7% year over year for a total above 171 million kgMS.

While the market has turned a little bearish, as is seasonally normal for NZ supply at this time, it is notable that:

- The 12-month forecast offer volumes on GDT for core products WMP, SMP and butter are all at the lowest levels in at least the past two years – so off-GDT sales must be strong.

- Even EU buyers are looking at NZ imports.

- China has been buying the vast majority of the SMP from New Zealand even at the comparatively higher pricing versus EU and US origin product. NZ SMP exports to China were up 42% year over year for December.

Infection Hangovers and Trade Dispute Headaches

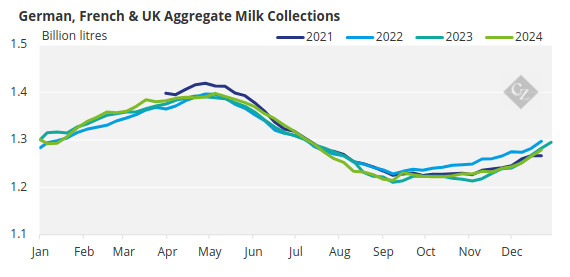

French milk collections seem to still be impacted by the ‘aftermath’ of Bluetongue virus. German milk flows have been weak early in the year, but SMP production has surged by 24.8% year to date through mid-January. This is most likely due to the storability of SMP while the country navigates through the uncertainty caused by its foot and mouth outbreak last year.

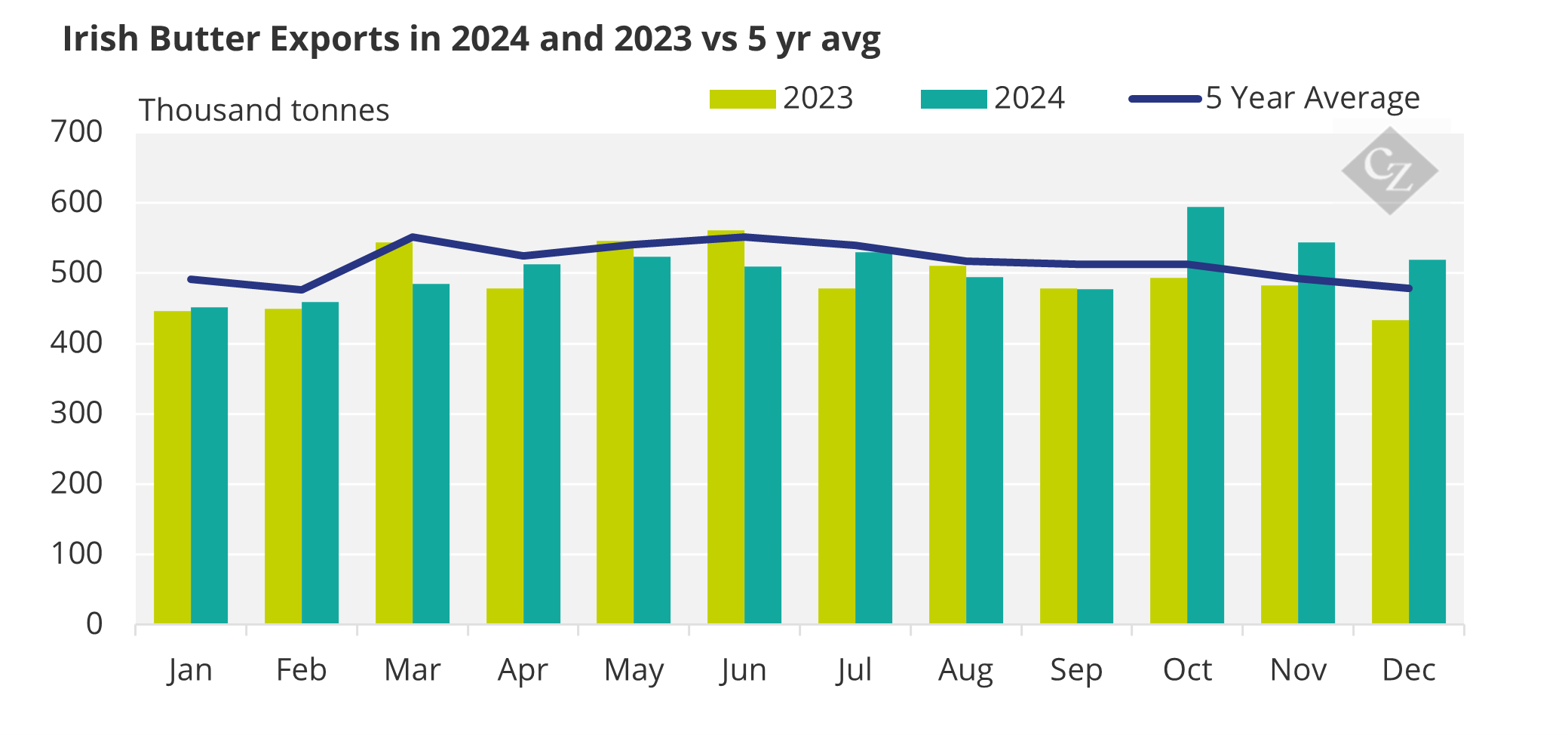

It is believed that Ireland front loaded its butter exports to the US, most likely to support the uber-successful Kerrygold brand on-shelf there prior to any potential tariffs being instated on Ireland or the EU. As we noted in our Dairy Disruption article, Ireland is particularly at risk of tariffs.

With strong milk flows expected in growth countries of Ireland and Poland, we expect a lot of Irish butter to be available for non-US flows for the remainder of H1 2025. At the current extreme high butter pricing, holding stocks creates a large working capital drain and we have heard the adage “you can’t store butter at this price” many times.

To understand CZ’s working capital solutions, particularly for products like butter, please do reach out.

Source: European Comission

As we predicted in our January Article, the German retail butter market has cooled somewhat. This appears to be due to a lack of export interest. We note that the lower milk and cream flows are helping to keep some degree of tension on pricing there.

Turning to the Algerian Government tender (ONIL), the results highlight strong milk flows in Poland and robust WMP sales from New Zealand earlier in the season.

- SMP: Mlekovita Poland closed around USD 2,850/tonne CFR (based on EUR 2,450-2,500/tonne ex works) for 11,000 tonnes. Two traders won the balance of 9,000 tonnes between them. Traders believed to have sold at circa USD 2,770/tonne CFR.

- WMP: all tonnage was won by traders (supposedly five won some tonnage). All supposedly sold South American origin short into the tender and are working on covering this still. Allegedly there is no New Zealand origin supply.

Milk collections in major producers Germany, the UK and France through week 4 of 2025 are down by 1.05% in total, based on our calculations. Week 4 collections were down just 0.59% year over year across the group. The UK gains continue to take up the slack from Germany and France losses.

The wider EU was up 0.7% on milk collections for the full year of 2024.