- This week, we look at the key producers of plastics and resins.

- We also focus on the regions where demand is most heavily concentrated.

- Through our discussion, we reveal how different geopolitical factors can shape global supply and demand.

Resin Production

For the production of resins, there’s a widespread distribution, but each region plays to its particular strengths and compensates for its weaknesses.

The Gulf Cooperation Council (GCC – Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and UAE)

This region is abundant in oil and supplies it to other countries for refining, which includes petrochemical and resin production.

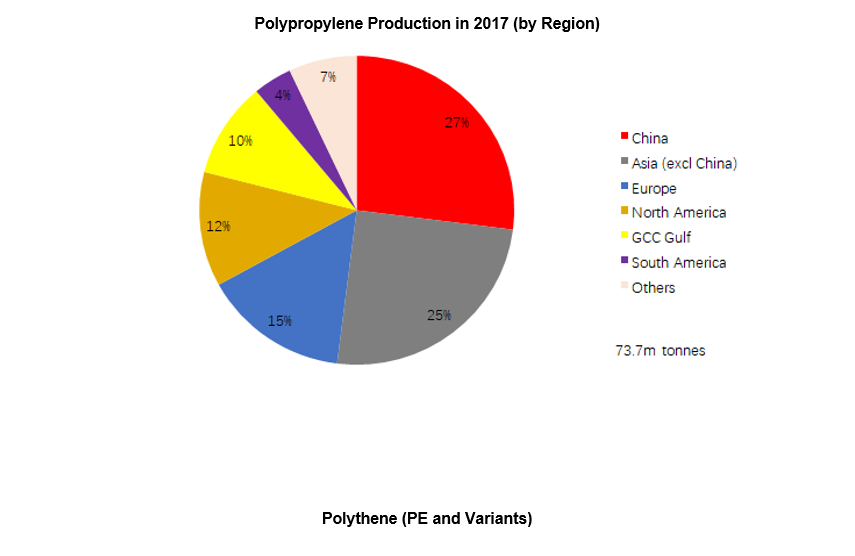

With the cheapest cost per barrel of production in the world, it has established some polypropylene (PP) and polyethylene (PE) production, but with oil sometimes above 100 USD/barrel this was often not the main focus.

Saudi Arabia dominates, with 67% of all resin production. The region has also invested heavily in other regions, with SABIC’s (Saudi Arabia Basic Industries Corporation) production spread over 40 countries and 60 manufacturing sites.

Europe

This region benefits from a long established petrochemical infrastructure, a large internal consumer base and high-tech capabilities.

North America

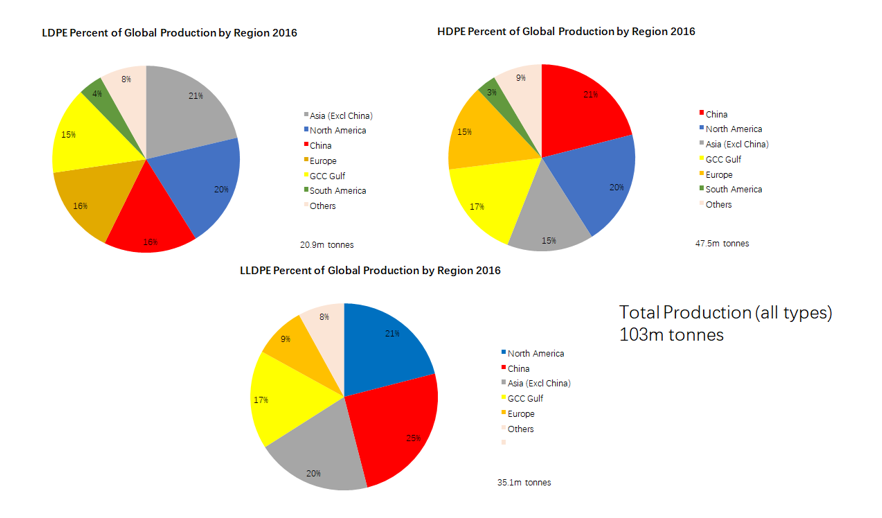

North America benefits from a large consumer base, global companies working in multiple regions and locations with several sector leaders. It has abundant cheap natural gas liquids, helping it be a major contributor to the PE sector.

Rest of Asia (Excluding China)

Japan is a major consumer, producer and innovator in plastic production and recycling. Countries such as Vietnam and Indonesia are rapidly developing production capabilities. Although not particularly oil rich, Malaysia, India and Vietnam have significant untapped reserves.

China

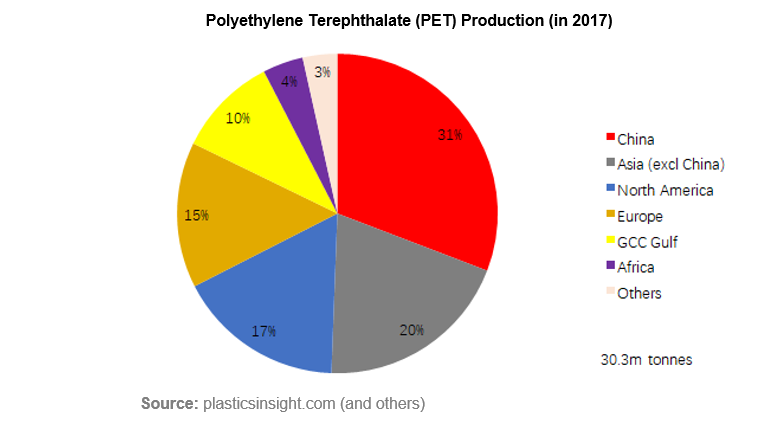

China has insufficient oil and gas reserves for its monster resin needs, although it’s a significant oil producer in its own right. It also has a huge consumer base and is the world’s largest exporter of plastics. China is the major player in the world by almost any metric. Many of the major foreign companies have resin production plants in China (often as a JV).

China is a major leader in PET production; charts 1-5 provide a more comprehensive breakdown.

Examples of Specific Sector Strength

1. High-Density PE: Abu Dhabi Polymers Ltd. Borealis (Austria), Reliance (India), PetroChina, Honam (Korea), Total (France), Eni (Italy) and INEOS (Switzerland).

2. Low-Density PE: BASF (Germany), LG Chem (Korea), SABIC (Saudi Arabia), Reliance (India), and China Petroleum and Chemical Corp.

3. Linear Low-Density PE: Borealis, Braskem (Brazil), Chevron Phillip (US), INEOS, and Nova Chemicals (Canada).

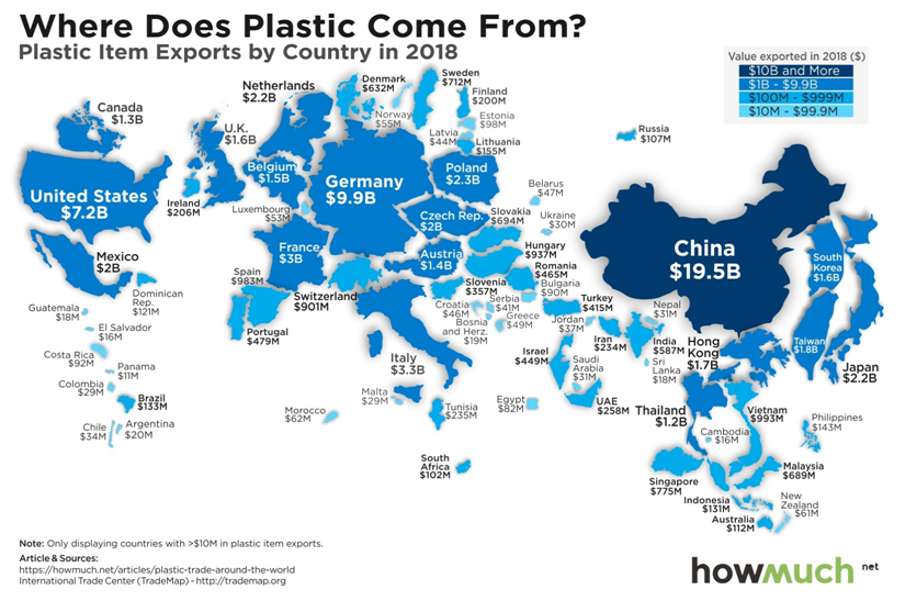

Both resins and plastics are also inter-traded between countries and regions and Europe is a good example of this. This particularly applies to specialist resins but also to the high volume ones. For example, in Europe, both resins and plastics are moving both ways to and from the US, China, Turkey, Switzerland and Russia.

Plastic Production and Imports

This part of the equation is completely dominated by China. It’s by far and away the largest importer of resins and is an industrial powerhouse of all plastic production, including some not in our remit here, such as PVC.

Geopolitics and Other Global Issues

We discussed this as a risk factor here. As an industry (both resins and plastics), there are significant geopolitical risks.

Flashpoints could include disruption to oil supplies in the Gulf, to weather events or economic manoeuvres.

It also partly explains China’swillingness to sign a long-term deal with Russia for pipeline natural gas and China’s great interest in the untapped oil and gas resources of the South China Sea and beyond. China, surely, is also watching the Rest of Asia for areas where it could be usurped.

A case in point, is an economic manoeuvre. The Trump era tariffs, still continued today, were imposed on many Chinese products including plastics. Tariffs of 10% on a proposed wide range of finished plastics from China ranged from headline plastic elements in smart phones and laptops to a sundry category. It’s just not credible that the US can

suddenly start producing these sundry items, such as plastic toilet seats, plastic sauce bottles and dishes and trays, or that another country could suddenly ramp up production to compensate. Most serious economists believe this was a self-inflicted wound by the US, which hurt its consumers and did not increase tax revenues.

Another event, COVID-19, also had a dramatic effect on the global plastics market. This did not so much affect the food and beverage sector, but had major negative effects in other key sectors.

Plastics Supply

Unsurprisingly by now, with Chinese resin production and importing, it’s the dominant player in the finished plastic market.

Not only is China the largest producer of plastics, but new capacity is being added at a rapid rate.

Growth in Chinese production is taking place in all sectors, especially in the industrial and automotive sectors, but also in packaging. In just the second half of 2019, China added 900k tonnes of capacity although, as a result of COVID-19, some 2020/21 production has been put on hold.

In 2018, China imported some 6.86m tonnes of HDPE and 4.46m tonnes of LLDPE, according to Chinese Customs data. This data does not provide a breakdown for different grades of each polymer.

These imports had a combined total value of about $14 billion, according to Reuters calculations, based on the delivered cost for these two products.

Conclusion

Knowing a little about plastics supply and demand in general, and the specific price volatility for each grade, as well as the ability to substitute products, is a useful exercise in risk management.

Other Opinions You Might Be Interested In…