Insight Focus

- Interest and investment into bioplastics continue to rebound, particularly in Asia.

- PET tray recycling reaching commercial scale, supermarkets move to lightweight films.

- Packaging sustainability in East Africa reaching milestone with Kenyan EPR implemented.

This Month’s Top Trends

1. Bioplastics Resurgence Takes Hold Across Asia

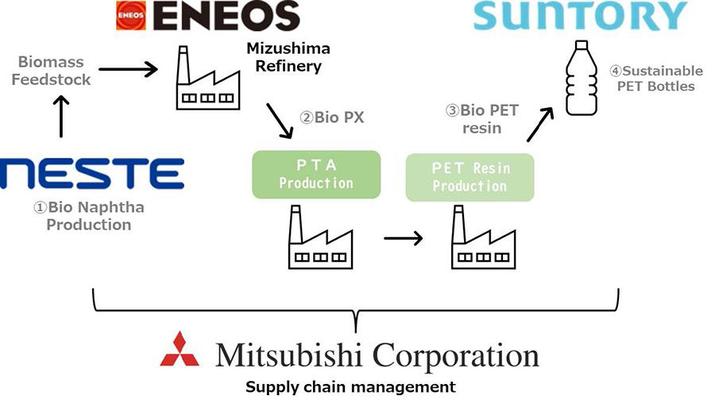

After several hype cycles, bioplastics are once again coming back into favour, driven on by the global drive for sustainable packaging. Several high-profile bioplastics announcements were made last month, including a ground-breaking partnership between Neste, Suntory, ENEOS, and Mitsubishi Corporation.

The partnership aims to produce renewable PET resin on a commercial scale using Neste RE, a renewable feedstock made entirely from bio-based raw materials.

Japanese beverage company Suntory plans to use the resin for bottle production in 2024. Whilst ENEOS will contribute by producing bio-PX (Bio-Paraxylene) using Neste RE-based bio-intermediates; Mitsubishi Corporation will coordinate the partnership.

Source: Mitsubishi Corporation

The project seeks to pioneer an industry first in the commercial-scale, ‘sustainable’ PET bottle production using bio-PX derived from bio-naphtha.

It is anticipated that, by the end of 2023, ENEOS aims to produce the bio-PX equivalent to approximately 35 million PET bottles, which will be used by Suntory to produce PET bottles the following year.

This follows a similar announcement last year when Mitsubishi Corporation partnered with Neste, Idemitsu Kosan, and CHIMEI in the pursuit of another renewable plastics supply chain; in this instance using Neste’s bio-based hydrocarbons to produce styrene monomer and its renewable, mass-balanced derivatives, such as bio-ABS.

Source: SCGC

Another bioplastics announcement related to Braskem and SCG Chemicals entering into a joint venture agreement to establish Braskem Siam Company Limited.

This venture aims to produce bio-ethylene through the dehydration of bioethanol and commercialise ‘I’m green’ bio-based polyethylene (PE) using ‘EtE EverGreen’ technology.

The latter technology is the result of a partnership between Lummus Technology and Braskem and is geared towards developing and licensing sustainable plastic production methods.

I’m green bio-based polyethylene is manufactured from renewable raw materials, specifically ethanol derived from sugarcane, in contrast to conventional fossil feedstocks like naphtha. This approach substantially reduces the plastic’s carbon footprint, aligning with efforts to combat climate change.

The bio-ethylene plant, a pioneering facility outside of Braskem’s Brazilian heartland, will significantly increase the global capacity for I’m green bio-based polyethylene.

This expansion, located in Thailand’s Map Ta Phut, Rayong, will focus on meeting the rising demand for sustainable products in Asia, aligns with Thailand’s Bio-Circular-Green Economy guidelines.

According to Roberto Bischoff, CEO of Braskem, the project forms part of the company’s goal of producing one million tons of green products by 2030, replacing fossil feedstock with renewables to reduce the industry’s carbon footprint.

2. Tray Recycling Gains Traction but Demand Dented by Switch to Shrink Wrap

PET tray and sheet manufacturers face a challenging market at present. Whilst strides continue to be made in tray-to-tray recycling, large supermarket chains across Europe are increasingly adopting alternative packaging solutions in a blow to the thermoform sector.

In a bid to create tray-to-tray circularity and support the EU target to have all packaging recyclable at scale by 2035, Indorama Ventures and AMB have joined forces.

Source: Indorama

The partnership will allow Indorama Ventures to supply recycled PET flakes from post-consumer trays for AMB to use in making food-grade transparent film, increasing the recycled content sourced from trays in AMB’s end-products.

As a result, AMB aims to divert more than 150 million post-consumer PET trays away from landfill or incineration by the end of 2025.

As a precursor to the partnership, in 2022, AMB launched its tray-to-tray recycling brand ‘AMB TrayRevive’ to develop infrastructure supporting recyclable packaging.

However, whilst Indorama and other consortiums are creating circularity for PET trays, major supermarket chains are increasingly turning away from thermoformed trays to lighter plastic wraps.

In August, Aldi became the latest major European supermarket chain to announce a trial of ‘tray-less’, vacuum and flow-wrap packaging for its meat products, following in the footsteps of Lidl, Sainsbury’s, and Tesco.

Source: Aldi

The trial will involve a thorough evaluation of these alternative packaging methods, focusing on their ability to maintain product freshness, quality, and shelf life while also being more environmentally sustainable.

Whilst Aldi estimate that ditching its existing mince packaging may reduce the amount of plastic packaging by 73%, the quality of the product is undoubtably impacted and the packaging remaining unrecyclable.

This approach is now also becoming common practice amongst other global branded food manufacturers, no longer confined to just own-brand supermarket products, as they prioritise weight reduction of true sustainability.

3. Kenya Leads the Way in Plastics Circularity in East Africa

Previous Czapp reports have touched on the progress of plastics and packaging sustainability in Africa, from new collection programs to the use of blockchain and digital solutions.

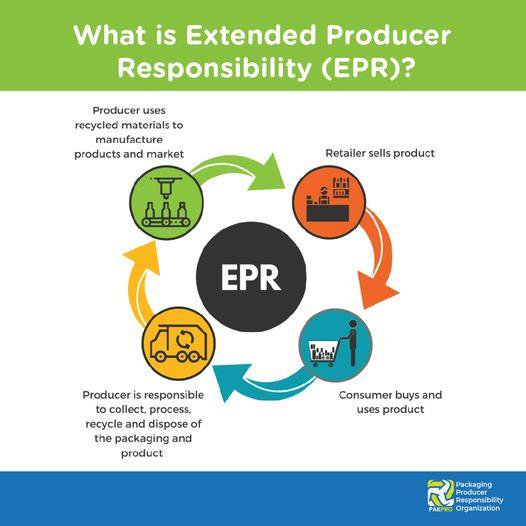

August marked a significant milestone for sustainability within East Africa following the implementation of new Extended Producer Responsibility (EPR) regulations.

Source: PAKPRO

Kenya Kenya’s National Environment Management Authority (NEMA) has given all packaging manufacturers 60 days, from the public notice dated 30th August 2023, to comply with new EPR Regulations.

The EPR Regulations require producers to bear mandatory responsibility for the post-consumer stage in their products’ lifecycle, prioritising re-use, increasing recycling rates for technical material, and safe disposal in a temporary, controlled landfill.

The EPR Regulations are based on the Polluter-Pays Principle, which means that producers are responsible for the environmental impacts of their products, even after they have been sold. This is a proactive measure that seeks to minimise the environmental footprint of products from inception to disposal.

By holding producers accountable, the EPR Regulations aim to foster innovation in eco-friendly design, recycling, and waste management. They also aim to reduce pollution and environmental impacts of the products that producers introduce into the Kenyan market.

Producers now have 60 days to submit their EPR plans individually or collectively in a compliance scheme under a Producer Responsibility Organisation (PRO).

Their plans must include the list of products introduced into the Kenyan market, the estimated annual volume of products introduced into the market, mechanisms put in place for identification and tracking of products, and the list and location of drop off or collection points per county.

The EPR Regulations are a significant step forward in Kenya’s efforts to reduce waste and protect the environment. They are expected to have a positive impact on the economy by creating jobs in the recycling sector and by reducing the cost of waste disposal.