Insight Focus

- Brands fall behind on global commitments to recycled plastics, switch to cheap virgin resin.

- US PET bottle collection rates improves, momentum gaining at policy level.

- More brands trial reusable packaging in bid to cut plastics use.

This Month’s Top Trends

1. Could Cheap Virgin Resin Further Derail Global Commitments to Recycled Content in 2023?

Latest progress reports on brand commitments towards plastics use, from the Ellen MacArthur Foundation (EMF) and the World Wildlife Fund, were released this month.

Brands showed progress on increasing their use of reusable, compostable and recyclable packaging, as well as recycled content. Although in both cases steep increases are still needed to reach 2025 targets.

However, use of virgin plastic headed in the wrong direction, with overall volumes of virgin plastics increasing back to 2018 levels.

Many of the largest global packaging users registered an increase in virgin resin, in part due to a post-pandemic rise in total plastic packing use, according to the EMF report.

Lack of investment in recycling and collection infrastructure, particularly for more difficult to recycle flexible packaging is partly to blame.

However, another key reason is the disparity between recycled and virgin resin prices, previously highlighted here.

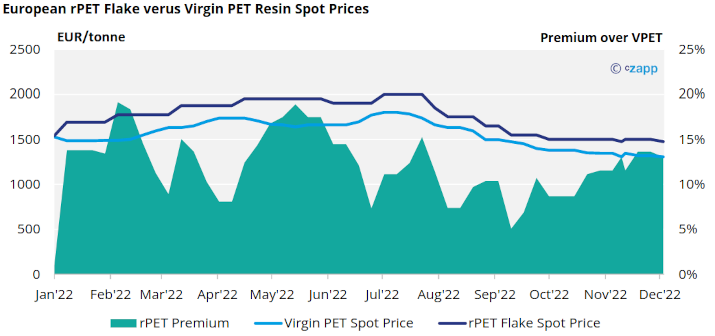

Since the oil price crash in early 2020, colourless rPET flake resin in Europe have been trading at large premium to virgin PET resin.

Price trends in 2022 have continued this trend, with domestic rPET flake prices averaging around a 13% premium to domestic virgin in Dec’22, and a shocking 40% premium to cheaper imported virgin resin.

The switch to virgin resin has gained momentum through 2022, thermoform tray and sheet manufacturers have been joined by large global and regional brands in doing so.

Whilst some in the industry are hoping for some price stability in 2023, H1 is likely to remain a challenging pricing environment for rPET in Europe.

Virgin prices are expected to move lower, attempting to close the gap with imports, whilst facing weaker demand in the face of recession. In turn if rPET flake prices are to remain competitive with virgin resin, particularly for any increase of consumption within the sheet market, flake prices need to follow suit.

2. Bottle Bills and Collection Initiatives Boosting US PET Return Rates

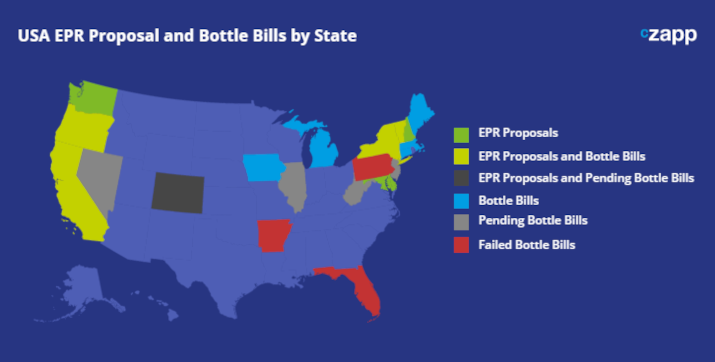

The US recycling industry is in-the-midst of a post-COVID resurgence, driven by increasing legislation and brand commitments (see also US Plastics Regulations Gain Momentum).

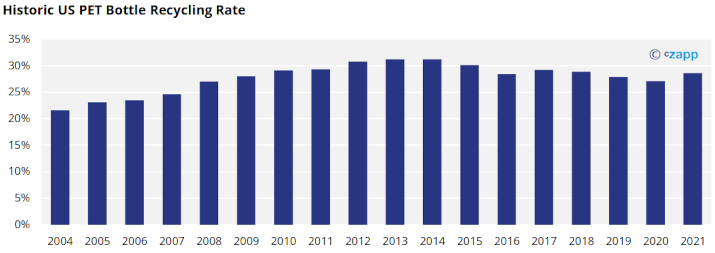

The US PET bottle recycling rate increased to 28.6% in 2021, up from 27.1% in 2020, according to the latest 2021 NAPCOR PET Recycling Report.

The rebound snaps the losing streak in US recycling rates, which have steadily fallen since 2017.

In 2021 NAPCOR also documented the largest amount of postconsumer PET ever collected, “bottle collection in the US exceeded 1.9 billion pounds for the first time”. Thermoforms collected in the U.S./Canada also reached its highest-ever of 142 million pounds, as tray-to-tray circularity was greatly improved.

Other key trends noted within the data included, a significant rebound in the volume of PET collected via deposit return schemes, increasing 46% compared to deposit returns in 2020.

Schemes such as the beverage-industry led ‘Every Bottle Back’ initiative, backed by Coca-Cola Company, Keurig Dr Pepper, and PepsiCo, have also contributed to the rebound in collection.

Earlier this month, the American Beverage association announced a fifth community in Michigan will received funding from Every Bottle Back to expand residential recycling access by providing larger curbside carts.

For a second year in a row, rPET used within Food/Beverage took the largest share of RPET consumption, surpassing fibre, traditionally the largest sink for PET bottles within the US market.

Future growth in rPET end-use share within Food/Beverage is being underpinned by mandatory recycled content legislation. Presently, four states (California, Washington, New Jersey and Maine) have mandated recycled plastic content in both food and beverage packaging as well as other plastic items such as bags.

Whilst the US recycling sector has much to celebrate from these figures, future consumption still faces challenges; the recent price crash in virgin PET resin has already led to buyers switching away from rPET.

Potential plastic bans and/or curbs on virgin plastic production, e.g., ‘Protecting Communities From Plastics Act’, could also disrupt collection efforts and future plastics circularity.

3. More Brands Trial Reusable Packaging to Slash Plastics Use

Whilst the use of refillable bottles has primarily been spearheaded by global beverage brands, the trend in reusable packaging has broadened over the last year to include many supermarkets and food service companies (see also ‘Will Refillable Bottles Go Mainstream?’).

Early December, PepsiCo pledged to double reusable packaging, from 10% to 20% by 2030, following a similar commitment earlier this year from Coca-Cola.

Whilst PepsiCo’s latest sustainability drive includes a focus on refillable/returnable PET and glass beverage bottles. The company also aims to reach target by expanding its SodaStream business and finding ways to ensure more fountain drinks are served in reusable cups.

Over the last year UK shoppers may have noticed the disappearance of lids from yoghurts, dips, and other products. Whilst the removal of the additional plastic lid has enabled brands and supermarket-retailers to cut plastic use, the lack of lids to many of these products has lessened the consumer experience and increased food-wastage.

One major UK supermarket chain, Sainsbury’s has now launched its own reusable silicone lids, which shoppers can purchase for £1.25 at stores. The lids can be washed and reused multiple times.

Another interesting development was seen in France this month, McDonald’s began to trail reusable containers in its French restaurants (Burger King UK also trailed a range of reusable and returnable packaging for its burgers, sides, and drinks across a small number of its restaurants earlier this year).

Unlike anti-plastic movements, reusable packaging predominately favours durable plastic containers. Many of the trailed changes at the fast-food restaurants mentioned are in fact replacing paper-packaging, to boost packaging sustainability.