Insight Focus

- rPET prices face downward pressure as demand falters and oversupply builds.

- Brands focus on packaging redesign and removal of plastics to achieve sustainability objectives.

- Revision of EU regulations will push for greater use of reusable packaging.

This Month’s Top Trends

1. Could European rPET Flake Spot Prices Reach Virgin Parity by YE 2022?

Recycled PET prices have surged in 2022, driven higher by MNCs in a frantic bid to reach regulatory and sustainability targets, and opportunistic price gouging by some recyclers.

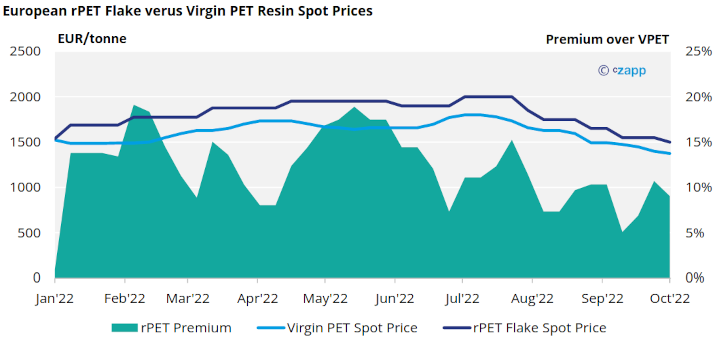

European RPET flake prices reached record levels in the first part of this summer, with European colourless flake prices averaging EUR 1950/tonne in May, 19% higher than virgin resin prices.

High premiums have led buyers to substitute away from rPET flake to cheaper virgin resin. Manufacturers of films and sheet, who traditionally have used a high percentage content of rPET, have switched en-masse to cheaper virgin alternatives.

Whilst increasing demand from the bottle market has absorbed some of this additional volume, even within the beverage space, higher rPET prices have repulsed some buyers leading to greater availability of flake in the market.

As a result, rPET flake prices have fallen sharply over the last couple of months, dragged down by a combination of falling virgin and bale prices, as well as weaker flake demand.

Actual colourless flake prices averaged EUR 1500-1600/tonne in September, with the premium over virgin narrowed to just 5%.

Both bales and rPET flake markets are now facing oversupply.

Recyclers are hoping October and November sees some restocking, as buyers whittle down existing supplies, helping to elevate the market’s excess.

However, outside of the UK, there is currently no regulatory pressure or minimum recycle content that manufacturers are required to use until 2025. (Italian and Spanish Plastic taxes may face further postponement beyond Jan 2023).

For regional or discount brands without the exposure or commitments of larger multinationals, there is little financial incentive to stock build in the off-season using expensive European flake amid an uncertain 2023 demand outlook.

The mantra from buyers is consistent, rPET flake should be cheaper than virgin.

Virgin PET resin prices are expected to continue to weaken through Q4’22 and Q1’23, with rPET flakes set to follow, and indexes expected to correct sharply.

European colourless flake prices in the mid-1300s (EUR/tonne) could well be achievable. If the oversupply sustains the premium could also come under increased pressure.

Could parity with virgin prices, or even a discount in 2022 eventually be seen?

2. Packaging Design Changes Boost Sustainability

The summer has seen a flurry of packaging design changes driven by sustainability objectives within the food and beverage space. Plastic replacement, particularly with paper-based alternatives, or simply elimination has been high on the agenda.

In July, Kellogg’s Australia announced that it was ditching the plastic lid from its iconic 53g Pringles crisp tubes. Kellogg’s anticipates, “this will result in the removal of 26 tonnes of plastic waste per year in AU and a 48% reduction in plastic on each 53g can”. Similar lid removals have been seen by other brands within Europe, including several yogurt and diary brands, such as Yeo Valley and The Collective dairy company.

Procter & Gamble (P&G) brand Gillette has recently introduced at a recyclable, plant-based inner tray for its GilletteLabs Razor. The new inner tray, believed to be one of the first of its kind to be produced on this scale, was designed in collaboration with Footprint, a Gilbert, Arizona-based materials company. This is not the first time P&G has sought to innovate its Gillet Razor packaging. P&G has a rich history of packaging innovation using bio-based materials, having previously trialled paper, bamboo, and other natural fibre packaging.

In September, several major Japanese snack makers moved to reduce plastic packaging. Calbee and Koike-ya brands will switch to new paper-based packaging for some potato-chip products. Whilst Lotte will focus on light-weighting its chewing gum containers and chocolate packaging.

And this month, Nestlé have announced plans to scrap plastic packaging from Quality Street chocolates. The move will see plastic wrappers eliminated from nine out of the 11 Quality Street chocolates, replaced with new paper wrappers. The move makes Quality Street the second Nestlé brand to move into paper packs, after Smarties moved its entire range into paper packs in 2021.

3. Will Europe Embrace Reusable Packaging?

The EU commission are expected to publish revision of the Packaging and Packaging Waste Directive (PPWD) in 2022, anticipated in November.

The PPWD revision is likely to include measures to tackle the growing levels of packaging waste within the EU and current barriers to packaging circularity.

Not only will the revised directive likely include new recycled content targets for 2030 and 2040, going beyond the 2025 and 2029 targets in the existing Single-Use Packaging Directive, but also focus in on reusable and refillable packaging.

Since 2000, there has been a significant decrease in the market share of refillable packaging across Europe. Share of refillable packaging has decline between 52-80% in a range of countries, such as Denmark, Finland, Romania, Bulgaria, and Hungary.

According to Werner Bosman at the EU Commission, current proposals that are expected to make the revision, include a pan-European target for refillable bottles, with bottlers required to have a minimum share of refillable packaging across their European portfolio.

This moves also aligns with previous commitments for major beverage brands, including Coca-Cola, which earlier this year announced that 25% of all its beverages globally will be delivered in returnable/refillable containers by 2030, up from 16% in 2020.

Another prospect is the requirement for all European countries to introduce deposit return schemes.

The revision of the PPWD comes at a critical time for the recycling industry, improved standards in packaging design and collection systems, could help raise bale quality and bolster bottle circularity. (See also RPET Trends: Will Refillable Bottles Go Mainstream?)