Insight Focus

- A flurry of new rPET projects were announced in January.

- European Parliament votes for a ban on plastic waste exports.

- More US States seek EPR programs and content mandates.

This Month’s Top Trends

1. New rPET Projects Get the Go-Ahead

Veolia, through its regional subsidiary Repeet, has signed an agreement with Beeah, a UAE-based sustainability initiatives company, and food and beverage company Agthia to set up the first food-grade plastic recycling plant in UAE.

The proposed facility will be based in Abu Dhabi and have a total capacity of 12,000 tonnes per annum of food-grade resin.

Revalyu, a German recycling company, announced plans to develop a new $50 million PET recycling plant in Georgia, US.

The facility will undergo two development phases, the first of which will enable more than 225,000lb of PET waste to be converted into polyester resins and rPET flake per day. Once the plant is fully completed, input capacity is expected to be doubled to around 450,000lb/day.

Reciclar, the leading PET recycling company in Argentina, has expanded its capacity to produce food-grade rPET recyclates from post-consumer PET bottles using the latest TOMRA Recycling Sorting equipment.

Using TOMRA AUTOSORT™ and AUTOSORT™ FLAKE equipment and technology, the Argentinean company has expanded its processing capacity to 600 million plastic bottles, producing around 18,000 tons of rPET and rHDPE food-grade pellets per year.

2. Tighter Controls on EU Waste Shipments, including Plastics

The European Parliament has voted in favour of a new law that would introduce stricter controls and procedures around the shipment of all waste destined for disposal.

The revised legislation is aimed at incentivising countries to push towards the EU’s goals of a circular and zero-pollution economy.

This includes, “banning shipments of all wastes destined for disposal within the EU, except if authorised in limited and well-justified cases”. As well as prohibiting the export of hazardous waste to non-OECD countries.

The export of non-hazardous waste to non-OECD countries for recycling and recovery purposes would only be allowed if consent from those countries was granted, and the EU deemed those countries had the ability to process the waste sustainably.

The export of plastic waste is included, with the European Parliament wanting to ban the export of plastic waste to non-OECD countries and to phase out its export to OECD countries within four years.

The proposed legislation will likely have little to no impact on the flow of post-consumer PET waste but will curtail the shipment of hard to recycle plastics, such as films and flexible packaging.

Within the EU, this may curtail some flows of material currently stoking industrial incinerators in Eastern Europe. Whilst the eventual banning of plastic waste exports will undoubtably be a positive step towards creating greater packaging circularity within Europe.

Having voted in favour of the propels, the European Parliament is set to begin negotiations with EU member states later this year to finalise the text.

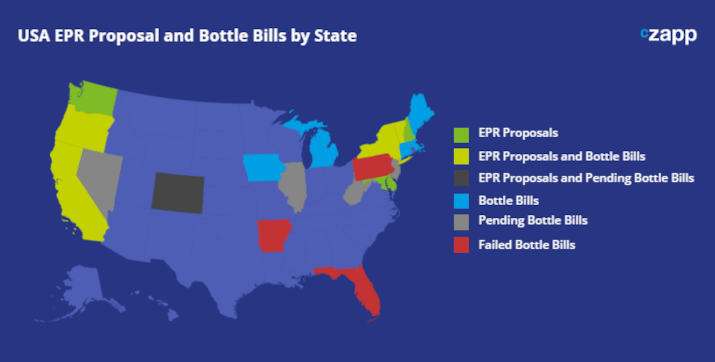

3. More US States Seek EPR Proposals and Content Mandates

Washington state legislators have introduced a new bill aimed at improving recycling and reducing waste production in the state.

The Washington Recycle and Packaging (WRAP) Act would require producers, manufacturers, and companies to fund residential recycling services and manage packaging waste programs, as well as create a bottle deposit system.

A similar extended producer responsibility (EPR) bill was previously introduced in January 2022 but failed in the state senate. With a longer legislative session this year, chances of that the WRAP Act will pass are improved.

The state also previously passed a recycled content mandate in 2021, requiring all plastic beverage containers to have 15% recycled plastic from 2023, rising to 50% in 2031.

California is set to enforce its own recycled content mandate for plastic bottles.

California passed a law in 2020 that requires beverage containers that are covered by the state’s bottle bill, to have a minimum recycled content, starting at 15% in 2023, increasing to 25% on 2025, and to 50% on 2030.

Beginning January 1, 2023, the recycled content mandate will now be enforced, with beverage manufacturers that do not meet the minimum content requirements subject to penalties.

Penalties will be calculated at a rate of $0.20 per pound based on the shortfall of recycled content used compared to the minimum content requirement.

Connecticut may also seek to bring in a similar recycled content mandate, mirroring California’s rules.

This month Connecticut Gov. Ned Lamont threw his support behind a potential state recycled-content mandate for plastic beverage containers, as well as the introduction of EPR legislation for packaging.

Like California, Connecticut is one of 10 US states with a bottle bill. As of January 2023, Connecticut’s bottle bill was extended to cover more types of beverage containers.