Insight Focus

- New materials and recycling technologies offer glimpse into possible future.

- Is the prevented Ocean plastic capable of scaling-up?

- Textile industry aims to increase recycled content, less than 1% of clothing recycled.

This Month’s Top Trends

1. New Technologies Push for Greater Plastics Circularity

New technologies are a great shaper of future marketplaces, and the plastics and recycling industry is no exception. Only a handful of emerging technologies will make the transition into commercial reality but keeping an active radar is essential.

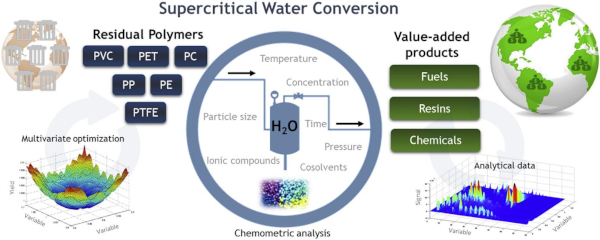

University of Birmingham, UK and Stopford, an engineering firm, have been awarded a further £300k in funding from Innovate UK to develop a novel plastics recycling technology. The technology in question uses supercritical water, under high pressure and temperature, to dissolve and depolymerise waste plastics.

Similar processes can produce shorter polymer chains, or intermediate chemicals, such as BHET, that can be isolated and repolymerised back into virgin grade polymer. The technology also creates fewer emissions and using supercritical water as the solvent, produces no solvent residues.

Material scientists at Boise State University, Idaho are researching a new type of plastic based on PECA, a chemical found in Superglue. Due to the materials ease of recycling, the new polymer could replace other less desirable plastics, which is not currently accepted in most US collection programs e.g. polystyrene used in plastic cutlery. Unlike other polymers, PECA can be thermally cracked back into its monomers to be used once again.

Similarly, a group of researchers at Shinshu University, Japan are developing a new highly recyclable material based on polymer microparticles. The polymer microparticles are used to create a thin polymer film, whose physical and optical properties can be tuned by using different fillers and pigments. Crucially the polymer film is also highly recyclable.

Another trend we’ve been tracking here on Czapp is the use of enzymes in plastic recycling technologies. A hot topic that continues to garner investment.

Researchers at the National Renewable Energy Laboratory (NREL) in Golden, Colorado, as well as Protein Evolution in New Haven, Connecticut were both separately highlighted in March as making advancing in this field.

Protein Evolution is using artificial intelligence to screen and design custom enzymes to breakdown PET and polyester fibre back into their original raw materials MEG and PTA.

The process under investigation uses minimal energy and can be carried out at room temperature. Protein Evolution has lofty ambitions to further scale their enzyme production to eventually build a plant capable of processing around 50k tonnes of polyesters annually.

2. Don’t Dismiss Ocean Prevented Plastic, Industry has the Momentum

A recent study, published in the journal PLOS, has estimated the total weight of the plastic pollution detected in the ocean today to be around 2.3 million tonnes; plastic use will nearly double from 2019 across G20 countries by 2050.

Last year, 175 nations signed a draft resolution focused on tackling plastic waste; a dedicated UN Committee will seek to produce a draft treaty by the end of 2024 (see report).

However, future timeframes for change will likely run into the 2030s and beyond. Even then the impact and enforceability of any treaty is questionable.

Dumping of waste from fishing vessels continues to be the largest global source of plastic pollution by weight, yet the MARPOL treaty, a legally binding agreement among 154 countries to end the discharge of plastics from naval, fishing and shipping fleets, has been in place since 1988.

Although volumes of plastic waste recovered from the ocean and coastal communities are comparatively small, the Ocean plastic movement has gathered pace in recent years, becoming more sophisticated as an industry.

Whilst many are dismissive of the ability of collection programs to combat the sheer weight of plastic pollution, major brands continue to seek out Ocean prevented plastic for select product ranges. Over the next decade, this demand pull is expected to create a virtuous cycle of investment, and a potential supply boom.

This month Plastic Bank Indonesia celebrated having stopped 40 million kilograms of plastic from entering the ocean since 2019, equivalent to 2 billion single-use 500ml PET bottles.

The social enterprise enables ethical plastic collection in communities within 50km of coastlines and waterways; provides collectors with cash and life-improving benefits, including health, work and life insurance, digital connectivity, social and fintech services.

Bluewater, a Swedish beverage solutions provider, in partnership with Empower, a Norwegian plastic recycling organisation, also hit the news having helped clean 85,000 kilograms of plastic waste over the last three years from coastal areas across sub-Saharan Africa and Southeast Asia.

3. The Battle Between Bottle and Fibre for rPET Intensifies

The Asian fashion industry is increasing its use of rPET in clothing, driving prices higher, despite the sharp increase in bottle collection.

Late March, the Korea Environment Corporation reported that the price of compressed PET bottles had soared by more than 14% since the beginning of the year. Whilst bottle collection had surged to 267,991 tons in 2021, up from 160,000 tons 10 years ago.

Clothing brands are successfully marketing apparel made using recycled PET bottles to young, environmentally conscious consumers.

Last month, the European Commission (EC) rejected calls from the bottled water industry to prioritise recovered PET bottles for recycling into new food-grade plastics.

Priority access, or right to first refusal, was argued would support development of bottle-to-bottle circular supply chains rather than downcycling into textiles.

With the beverage industry failing in the one market that would have offered the highest chance of success, it’s now clear the open market rules.

The question is, will the textile industry now also be held to account on recycling and recyclability of its products?

According to the Textile Exchange, “Less than 1% of the global fiber market was from recycled textiles in 2021”. Despite calls within the textile industry to target significantly higher recycled content in items.

One potential solution is “chemical sorting”.

A research team from the Korea Research Institute of Chemical Technology (KRICT) has developed a chemical sorting process that separates polyester from mixed and contaminated waste textiles.

Most clothes recycling relies on labour-intensive process, the Korean researchers have developed a chemical recycling technology that selectively converts polyester fibre back into valuable intermediates, such as BHET, and ultimately back into clean, recycled polyester fibre. For previous articles on textile-to-textile recycling click here.