Insight Focus

Grains rose due to lower European yields and short covering. The net spec short triggered a rally, driven by bad yields in Europe and worsening US crop conditions. However, ample supply justifies a lower Chicago corn price environment.

Grains in Chicago fell last week, driven by a weaker dollar and favourable conditions for US crops, with wheat declining by 6%. European corn experienced smaller losses, while European wheat remained largely unchanged.

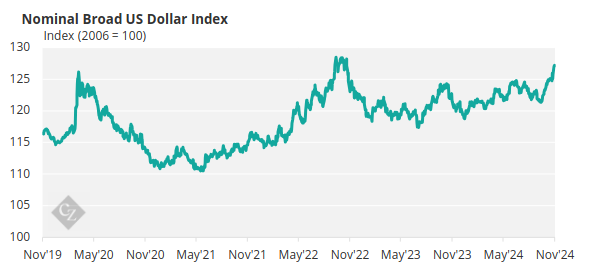

Last week’s price action in Chicago was driven more by adjustments in the dollar’s valuation. The dollar index rallied 1.6% week-on-week, making US FOB values less competitive compared to other origins.

Source: St Louis Fed

Additionally, concerns over delays in France’s corn harvest have eased thanks to substantial progress over the last two weeks, which is expected to continue with favourable weather this week. Currently, weather conditions are optimal across all regions, and Brazil’s drought is easing after several consecutive weeks of rain.

But rumours of Russia reducing its wheat export quota resurfaced last week due to the rapid pace of exports and lower production this year. Some local analysts estimate the export quota for the February to June period could range between 9 to 12 million tonnes, compared to 29 million tonnes last year.

There are no changes to our forecast for Chicago corn for the 2024/25 crop (September/August), which is projected to average USD 3.90/bushel with an upside bias. The average price since September 1 is currently tracking at USD 4.10/bushel.

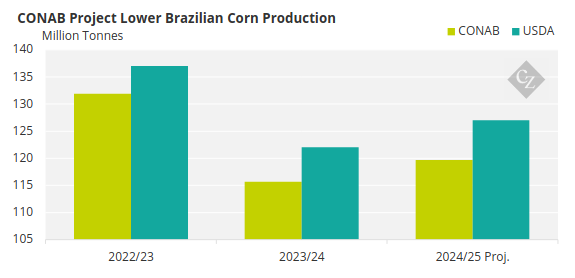

Corn Production Forecasts Rise

The French Ministry of Agriculture increased its forecast for corn production despite the very slow pace of harvesting. The new estimate is 14.6 million tonnes, up from 14.5 million previously. This represents a 12% year-on-year increase.

CONAB in Brazil also increased its corn production forecast for 24/25 to 119.8 million tonnes, though this remains significantly below the 127 million tonnes projected in the latest WASDE report.

US corn is 95% harvested, compared to 86% at the same time last year and the five-year average of 84%. The percentage of corn area under drought conditions fell to 64%, down seven points week-on-week.

In France, 76% of corn is rated good or excellent, unchanged from last week but below 82% at the same time last year. Harvesting in France is 71% complete, up 13 points week-on-week, but progress remains very slow compared to 96% harvested at this point last year and the five-year average of 93%.

Ukrainian corn is 88.5% harvested, with an average yield of 6.27 tonnes/ha compared to 7.42 tonnes/ha last year. Russian corn is 87% harvested, with a yield of 4.92 tonnes/ha, compared to 66% harvested and a yield of 6.8 tonnes/ha last year.

In Brazil, summer corn planting is 48.7% complete, slightly ahead of 46.8% at the same time last year.

US Wheat Exceeds Expectations

US wheat planting exceeded expectations once again, with conditions improving by three points week-on-week, which has pressured Chicago wheat prices since the start of last week, further supported by a stronger dollar.

The French Ministry of Agriculture raised its wheat production estimate to 25.56 million tonnes, up from 25.4 million previously, though this remains one of the smallest crops in recent years.

US winter wheat planting is 91% complete, compared to 92% at the same time last year and the five-year average of 93%. Conditions are rated 44% good or excellent, up 3 points week-on-week, but below 47% last year.

Winter wheat planting in Ukraine is 97% complete, compared to 91% last year, while in France, it is 78% complete, up from 70% last year but below the five-year average of 83%.

Favourable Weather Supports Harvest Pace

Dry and warm conditions are expected again in Eastern Europe, while northwest Europe is forecasted to experience normal temperatures and beneficial rains.

In the US, wheat planting areas are anticipated to receive rains and normal temperatures. The Midwest is expected to remain dry in the north with favourable rains in the south. In Brazil, after several weeks of rain, conditions are expected to be drier this week, although some areas in the Centre-South will still receive rain.

We expect weather to remain a key driver of price movements, though any upward price potential should be limited. The only mid-term upside risk is a potential reduction in Russia’s export quota, which is increasingly anticipated.