The cocoa market has tripled in the past 7 months and has now hit all-time highs. This has followed a drop in production in West Africa, caused by disease, high tree age and low fertiliser application. Yet many farmers are still not seeing the benefits of high prices.

What Is Happening in Cocoa?

Daily movements in the cocoa market are more volatile than any monthly and, in some years, even annual movements we have ever seen.

The spot position on the London market has tripled in price since October 2023, hitting a recent all-time high of GBP 9,312/tonne in London on a day that saw a GBP 135/tonne rally before closing at GBP 531/tonne. This was down on a single day trading range of GBP 712/tonne.

This makes a roller coaster look like a smooth ride!

Source: World Bank

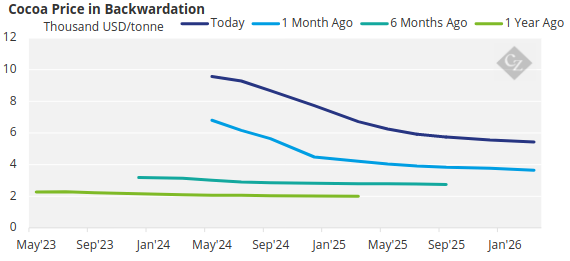

The market is in severe backwardation with the twelve-month forward positions trading over GBP 3,000/tonne lower than the spot position.

So, what has happened and what has led to this carnage?

Setting the Scene

Cocoa is a tropical crop with around 75% of global production coming from West Africa and 65% coming from Ivory Coast and Ghana alone. Over 95% is grown on smallholder farms by farmers who are significantly challenged by high poverty levels, human rights issues and major levels of deforestation.

Both Ivory Coast and Ghana are government-run systems with farm gate prices set by the authorities at the beginning of each season. The prices are established by selling the crop forward during the year prior to the harvest period. The remaining origins are free markets.

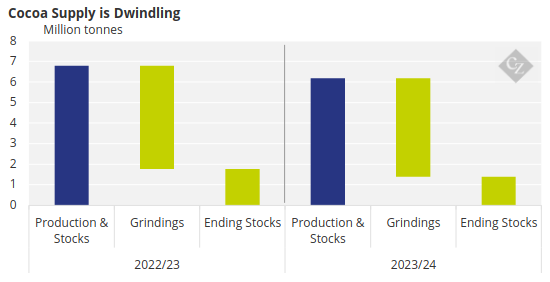

There has been a huge drop in production leading to a global crop deficit estimated to be 400,000 tonnes, which is nearly 10% of production.

Source: International Cocoa Organization

The stock-to-consumption ratio is now at a level that has stimulated an extension of buying cover by cocoa purchasers. Speculators are also jumping in ahead and driving prices to these record highs.

Production Decline Explained

The question is, why is there such a sharp decline in production globally?

The argument that climate change has affected cocoa production is far from convincing. To some extent, weather has had an influence on cocoa production through El Niño, which has contributed to a reduction of the Ecuador crop. However, this cannot be blamed for anywhere near the entire deficit.

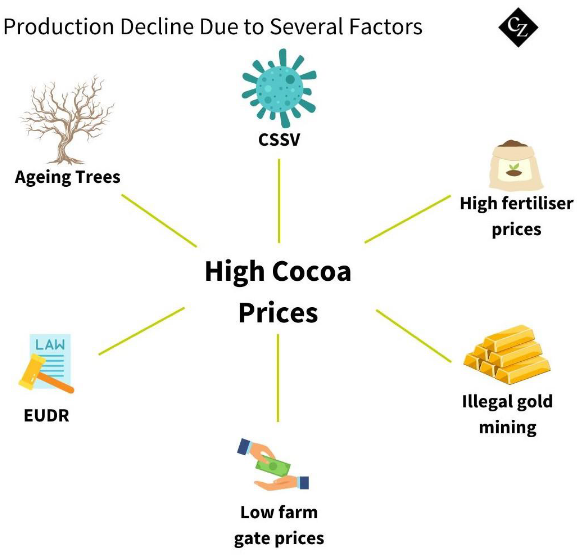

In fact, there are many contributing factors, including the age of the trees and diseases such as cocoa swollen shoot virus (CSSV), particularly in Ivory Coast and Ghana. Another contributory factor is high fertilizer prices after the Ukraine war, which has led to virtually non-existent application by cocoa producers.

More factors to consider are illegal gold mining on cocoa fields in Ghana and overall low farm gate prices over the last five years, resulting in lower levels of husbandry. Added together, these issues provide a clearer picture as to why we find ourselves with such a significant deficit.

The Situation Today

The volatility and record prices have created an operating environment that is extremely difficult for all the players. There is enormous pressure on the cash flow of market participants coming from the significant increase in the initial margins on the futures market and also the dramatic outright increased valuation of physicals.

There is talk of a material level of outstanding contracts from Ghana and Ivory Coast, which are going to have to be rolled into the 2024/25 season. This means that Ghana and Ivory Coast will have sold their next crop 2024/25 at levels well below the current market levels.

The cocoa farmers of Ivory Coast and Ghana will therefore not be likely to see farm gate prices for the 2024/25 season that reflect the current market level. While they have seen a more than 50% increase in price for their mid crops, this is only the small crop amounting to around 20% of the total that starts around June. It should also be noted that this 50% increase is from a very low level of around USD 1,550/tonne to around USD 2,450/tonne. This represents a huge step, but will momentum be maintained for the 2024/25 main crop?

High Prices Here to Stay

It is too early to predict the size of next season’s crop or changes in supply and demand, but some have released forecasts for deficits of around 150,000 tonnes. This would suggest that the market will remain strong and volatile.

The cocoa market trades in five- to 10-year cycles with high prices stimulating better husbandry and then more planting, which in turn drives up production and pushes the supply and demand into surplus — eventually exerting downward pressure on the market.

The effect of more investment and better husbandry on existing farms will only be felt when better prices begin reaching the farmers.

About 65% of the world’s farmers are not seeing better prices and may not see them for another 18 months. Therefore, this means that the normally expected production increases only apply to 35-40% of the global crop. This may well mean that the current price levels will remain for longer than the historical cycles would suggest.

The other unknown for the industry to digest is whether the cocoa crops from Ghana and Ivory Coast are in terminal decline. The reasons expressed earlier in this article indicate that there is a real possibility due to tree age, disease and historical low farm gate prices.

The final challenge that cocoa faces is the European Union Deforestation Regulation (EUDR) entering into application on December 30, 2024. Around 60% of the world’s global crop crosses the EU border annually. The requirement to be compliant for the 2024/25 crop will only add another volatile element to the cocoa price formula.