Insight Focus

Worse-than-expected juice yields and low Brix levels could substantially limit supply in Brazil and further boost prices. Price risk management strategies can help producers and buyers limit losses.

Global Orange Stocks Slide

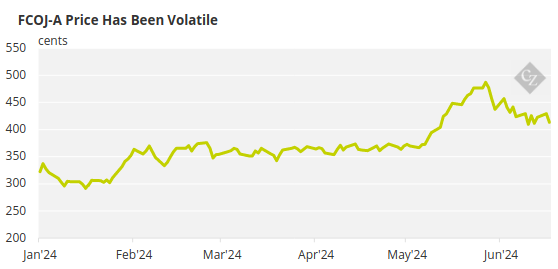

Over the past few years, the price of Frozen Orange Juice Concentrate (FCOJ) has slowly ticked up. It went from about 150c/lb in the middle of 2022 to around 410c/lb in June 2024. A record high of 487c/lb was reached on May 28.

Source: ICE

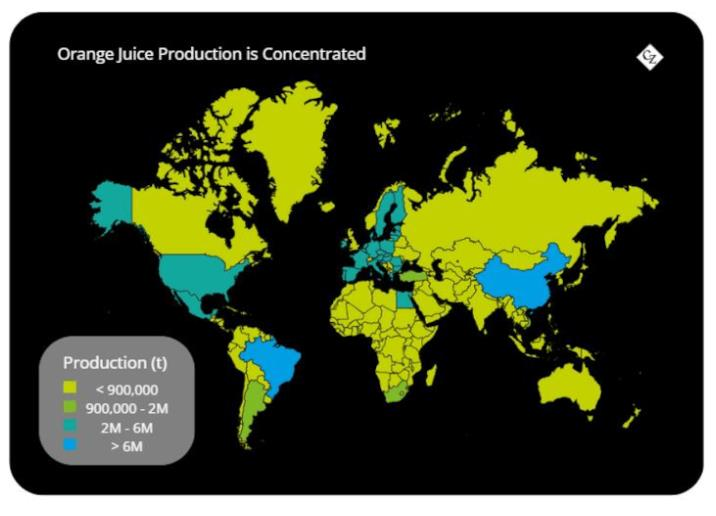

The steady price increases have been caused by lower supply and chronic long-term structural issues in the market. Because orange production is largely concentrated in two countries – the US and Brazil – any supply constraints have huge knock-on effects.

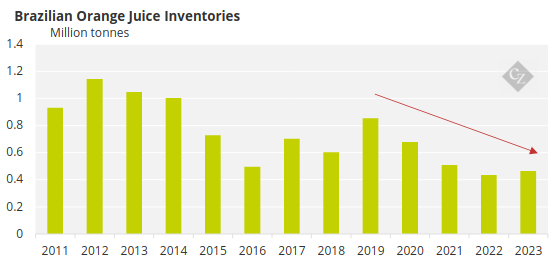

Unfortunately, both the US and Brazil have experienced issues. The forecast for the forthcoming crop in Brazil is alarmingly low at 232.38 million boxes (40.8 lbs each), representing a 24.36% decrease compared to the 2023/24 crop.

Source: Citrus BR

According to Fundecitrus, the 2024/25 orange crop is likely to be significantly impacted by weather. This, as well as the impact from borers and fruit flies, will lead to premature fruit drop. Worse-than-expected juice yields and low Brix levels could substantially limit supply in Brazil and further boost prices.

The predicted poor crop in Brazil, which accounts for 70% of all orange juice exports, marks the third consecutive challenging global harvest. Alongside Brazil’s issues, Florida faces hurricanes and greening disease, limiting manufacturers’ ability to blend new crop with frozen juice, typically viable for two years.

The situation is so bad that the International Fruit and Vegetable Juice Association (IFU) is considering lobbying for a rewrite of UN food regulations to allow other citrus fruits in orange juice.

The market is now characterised by increased volatility and uncertainty in pricing. The price of the fruit is currently being traded for BRL80-85/box (USD 14.84-15.77/box). Due to rising producer costs for juice companies, there are limited discounts for buyers.

Price Risk Management Strategies

Despite such volatility, there are some strategies that can be employed to combat price risk.

1. Long-term contracts

Although long-term contracts can provide pricing certainty for buyers, producers are hesitant to enter long-term contracts. This is because they cannot guarantee future supply levels, nor can they predict processing capabilities.

2. Alternative suppliers

Distributors have begun sourcing from alternative suppliers. A diversified supply chain helps during times of volatility, but the problem is that production is so concentrated that there are not enough suppliers to sufficiently counter the risk.

3. Investment

Since many of the issues with orange supply have been caused by weather and pest, producers investing in technological advancements to improve crop resilience. However, this requires heavy investment and time – which means this strategy likely won’t help during the next few crops.

4. Monitor Prices

Timely pricing information is vital in times of volatility.

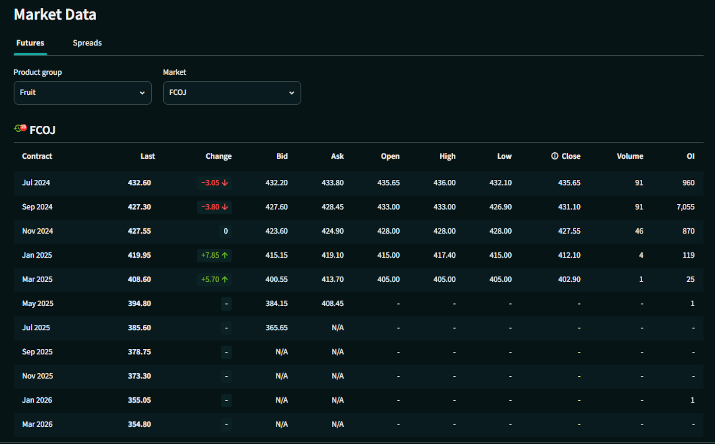

The Cz App now provides live pricing data on the FCOJ futures contract.

5. Derivatives

FCOJ derivatives offer both producers and consumers the ability to manage their price risk independently of the physical supply chain. The price level for delivery in future months can be locked in using futures.

With the market in backwardation, buyers of FCOJ can lock in a discount for future delivery compared to the spot market price. A defined risk management policy in the FCOJ market can allow participants to avoid much of the price volatility that we have seen over the past few years.

This practice is commonplace across other commodities and is gaining popularity within the juice market.

Cz offers a comprehensive and tailored price risk management strategy for orange juice.

Concluding Thoughts

- The FCOJ market is experiencing huge structural challenges that are limiting supply.

- As a result, prices have been skyrocketing.

- As stakeholders navigate these challenges, the importance of adaptive strategies and forward-looking risk management becomes ever more critical to maintaining market stability and ensuring the long-term sustainability of FCOJ supply chains.

- This is where price risk management support can come in.

If you’d like to learn more about how you can manage your FCOJ risk with derivatives, please get in touch.