- Different types of wheat often have unrelated end uses.

- Prices can therefore vary widely from one type of wheat to another.

- Understanding what drives the wild price movements can steer proactive business decision.

The World Has a Multitude of Wheats

As we’ve discussed in previous editions, wheat is not just wheat.

Winter, Spring, Hard or Soft, and all the varieties within each category. Each variety has its own individuality setting it apart from the others.

Price Premiums Based on Quality and End Uses

Looking at a few types of wheat and end uses will enable us to grasp the basis of price premiums and discounts.

Assuming a year of averages with regards plantings, weather, yields, etc, here are the highest to lowest priced wheats:

1. Premium Hard Milling Wheats (MW): used by millers to create the best bread flours, requiring high levels of protein, Hagberg, gluten, specific weight, and other qualities.

2. Lower Grade Hard Wheats (HW): found in the lower priced breads, some biscuits, etc.

3. Soft Wheat (SW): generally lower protein, with less gluten, less coarse and thus finer flour than the hard wheats. SW are good for cakes, cookies, crackers, and many pastries.

4. Feed Wheats (FW): mostly winter varieties, hard or soft, these basic quality wheats have lower specific weights, with no need for stipulated protein, gluten or Hagberg levels. Blended into compound livestock feeds, these are the lowest value wheats or failed MW, HW or SF.

The Price Driver: Elasticity of Supply and Demand

There are many factors that impact supply and demand. Political actions, such as national or international disputes, subsidies, taxes, as well as political stability and instability. Consumer preferences and demand changes may be altered by many social and economic influences.

Despite all the above, the one that is a constant threat is weather.

Demand is generally possible to predict with a reasonable amount of confidence under normal socio-economic conditions.

Supply can be greatly enhanced or devasted by weather.

Planting conditions, disease, pests, timely growth stages, harvests, conditioning, and quality issues are all reliant upon a helping hand from the weather.

Elasticity of supply and demand then become important factors in determining price variations between wheat types.

- Premium Hard Milling Wheats (MW) are the most obviously impacted by weather. The high-quality requirements of these wheats can be shattered by just a few days of the wrong weather at critical times. There are often few available replacements.

- Hard Wheats (HW) are more easily substituted by blending the better MW with slightly substandard HW to fulfil needs where supply is insufficient.

- Soft Wheats (SF), although more robust with lower quality requirements than MW, cannot readily be exchanged for other wheats in some processes where the unique SW characteristics are required.

The Wild Price Movements

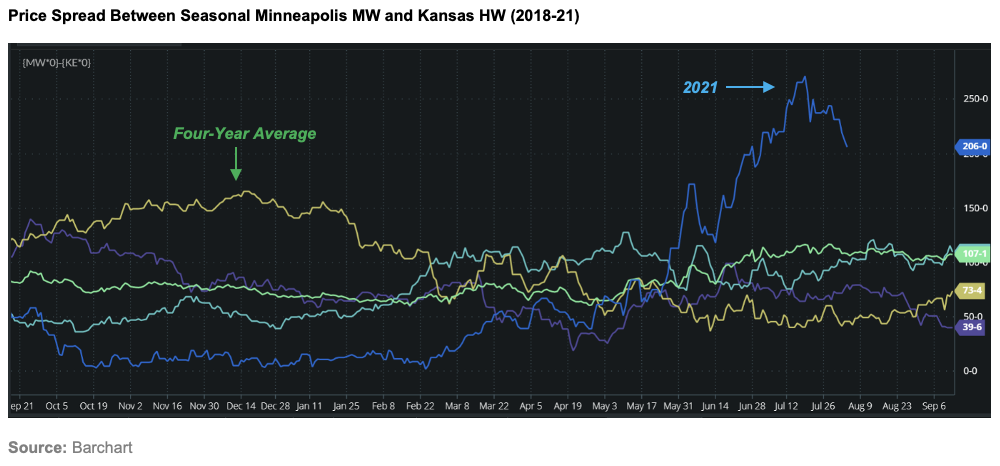

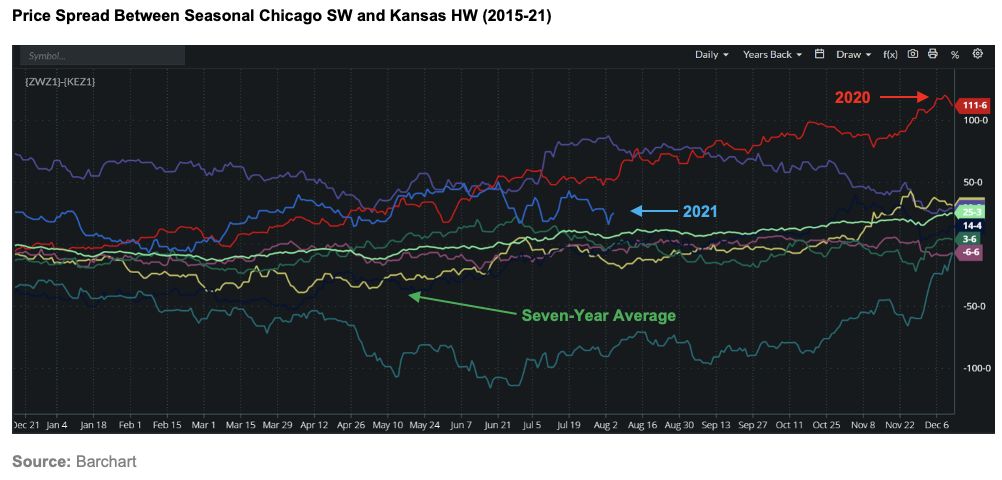

The graphs below show good examples of premiums or price spreads between MW and HW (Graph 1), as well as SW and HW (Graph 2).

Where supply has become a concern for MW or SW, demand has demonstrated its inelasticity, with little option for other wheat types suitable as replacements.

The futures price graphs below relate to crops in the United States. However, the principles apply equally elsewhere around the world. As a UK based farmer and then trader all my life, the correlations to the UK wheat market principles are very similar.

Here, we have a wonderful example of the current year increase in premium for MW over HW as North America bakes in extreme heat with drought covering over 90% of the MW acres.

Harvest, in a year of drought, is much more likely to produce reduced yields of MW with lower specific weights, higher screenings and a less useable commodity.

With harvest under way but not yet completed, it’ll be interesting to see the final production results and whether the premium continues the very recent drop back or ramps back up in the event harvest is worse than current thoughts.

Although a slightly less dramatic graph than above, the 2020 harvest saw a noticeable drop in SW supplies in the US, with a percentage of demand proving itself inelastic. The result was a big swing in the usual SW versus HW spread, as buyers scrambled to buy the available SW, which led to a huge increase in SW premiums.

As the significantly larger 2021 SW harvest completes, it’s logical that, assuming good SW quality, the price spread (blue line) falls more in sync with the norm of past years.

Conclusions

Where supply suffers, often due to weather, and where demand is inelastic, most notably with MW and SF, premiums from wheat to wheat can explode with wild movements.

In most years, the price anomaly will return to the norm for the subsequent harvest, take note and understand the fundamentals behind the extremes.

A poor crop is often followed by a good crop, as farmers plant more acres and chase last year’s price premiums.

Assess the impact on your business and don’t immediately fall into the herd mentality chasing last harvest’s premium or discount.

Understand the premium and hit the peak or trough, whichever gives your business the edge over its competitors!

Other Opinions You Might Be Interested In…

- Czapp Explains: Winter Wheat vs. Spring Wheat

- Czapp Explains: Hard Wheat vs. Soft Wheat

- The World’s Largest Wheat Producers and Exporters

- The World’s Largest Wheat Users and Importers