- A series of unplanned production outages have crippled PET supply across the Americas.

- Within South America, just 640kmt of capacity is currently operational versus nearly 1.3mmt of demand.

- With demand building ahead of peak season, what’s the outlook for South American converters?

Americas’ PET Production Constrained by Power Outages

PET resin producers across the Americas are stumbling from one crisis to the next.

Although production at Alpek’s Pearl River (Mississippi, USA – 450kmt) is now fully restored, M&G (Altamira, MEX – 560kmt) was forced to close its facility on the 15th October.

According to the official letter sent from M&G to customers, the shutdown was as result of an equipment malfunction, with the damage requiring “a major repair or replacement of the affected equipment”.

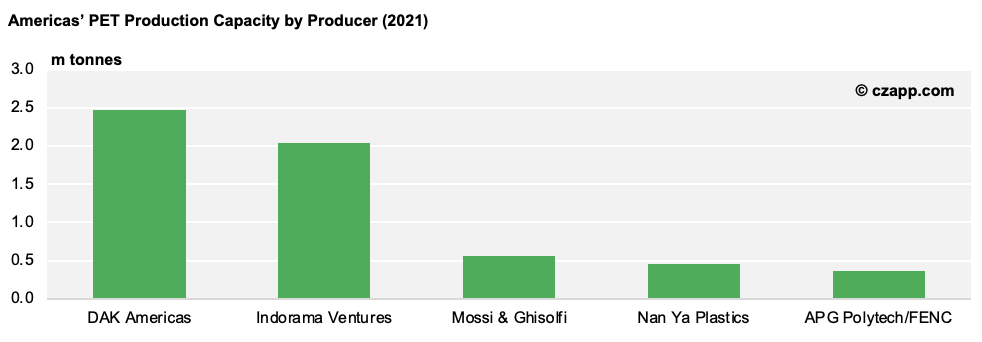

M&G’s plant represents around 12% of total North American PET production capacity, so resin supply across the Americas remains stretched as a result.

The plant currently operates under a tolling agreement with Alpek, as its main PTA supplier and guaranteed creditor, following M&G’s restructuring process back in 2018.

Further South, Indorama’s plant (Port of Suape, Brazil – 500kmt) has been closed since mid-August following a major fire at the facility.

According to Indorama, operations should resume by the end of November, but there’s still a certain degree of scepticism amongst converters around this timeframe.

Some are also worried that contracts won’t be fulfilled once production returns, with volumes closed for some customers until June 2022.

The combined impact of the M&G and Indorama outages is loss of just over 1.1mmt or around 25% of the combined Mexican and Latin American PET production capacity.

US PET Imports Rise in August

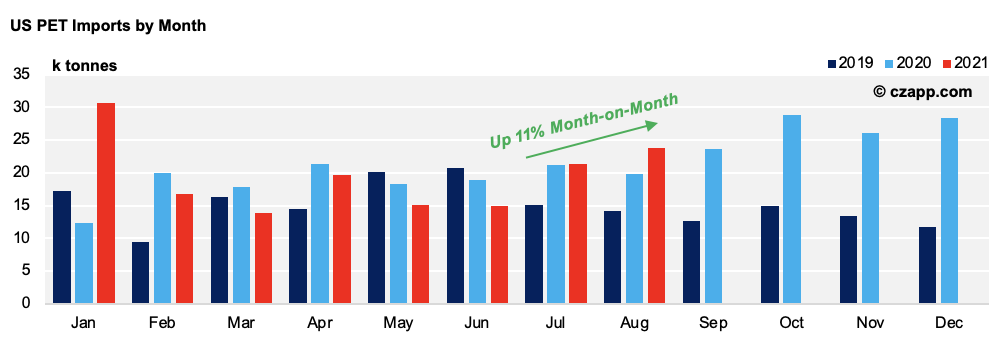

Although North American PET resin demand is starting to ease with the return of a more traditional seasonal trend, US supply remains constrained, and imports are high.

The latest US trade data shows that PET imports were in August were the highest they’d been since February. Overall, US imports are up by just over 4% year-to-date.

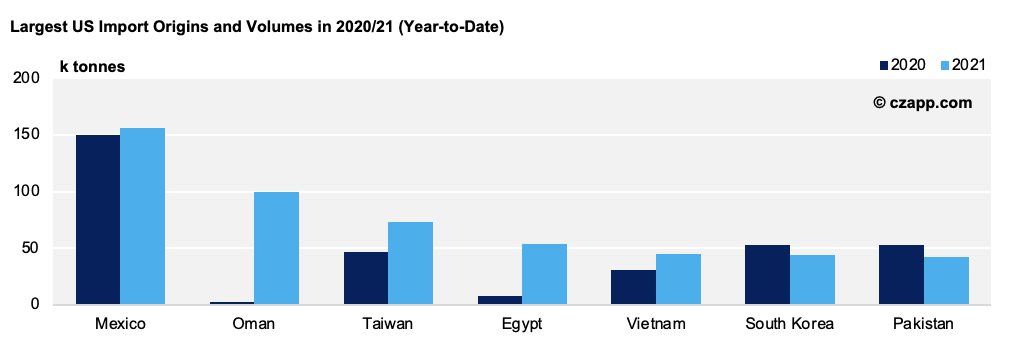

So far this year, Mexico has accounted for around 26% of the US’ PET resin imports, with volumes up 4.4% year-on-year. Imports from Oman (290%), Taiwan (59%), Egypt (617%), and Vietnam (47%) have also surged.

With Mexican imports averaging about 20k tonnes per month, M&G’s shutdown will likely have an immediate short-term impact on trade flows.

South American PET Demand Starts to Heat Up

Consumption within South America is ramping up ahead of the summer, and converters are scrambling to secure resin.

With domestic supplies cut, most converters have turned their attention to imports, but high container rates and rising Asian resin prices are still causing concern.

Disruption to Brazil’s internal logistics caused by recent fuel shortages and truck driver strikes has also delayed domestic deliveries.

The existing anti-dumping duties on PET resin imports from China, India, Indonesia, and Taiwan are another challenge those trying to source supply outside of Brazil are facing.

Brazil’s antidumping duties vary by country and producer; the current set should expire on the 28th November 2021.

Despite the supply crisis in Brazil, many of the larger converters would like to see the duties renewed as they don’t see them as a limiting factor to securing supply and would like to protect market share.

If the market were completely open to Chinese imports, many small/medium converters would have greater availability and bargaining power with buyers, meaning they could compete with the larger players.

However, final decisions on any renewal will depend on a combination of critical factors, including the return of Indorama’s production and resin availability in the domestic market.

Asian PET Export Prices Begin to Stabilise After Sharp Rise

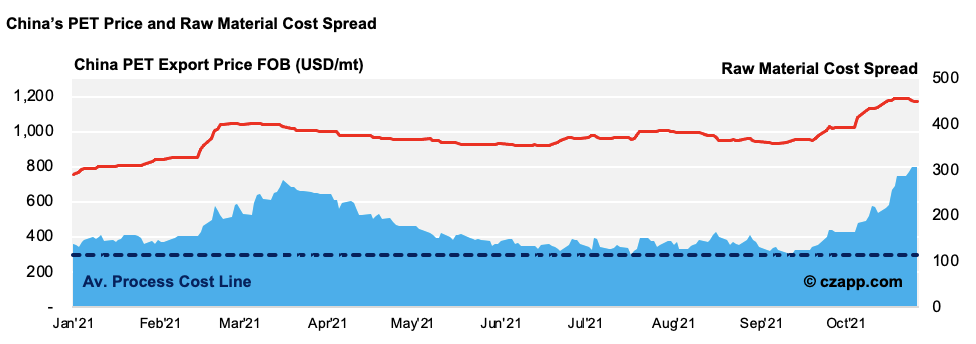

Latin American PET prices are still tracking the trend in Asian markets, with sharp rises in offers through September and October.

After rising by over 200 USD/mt since mid-September, China’s FOB prices started to stabilise towards the end of October at around the 1,170 USD/mt mark.

Although Chinese domestic demand has slowed in the off-season, export demand has remained robust with producers enjoying strong export margins. This is quite a turnaround, given many were in loss making positions in early September.

Due to strong export demand, as well as constraints on operating rates due to energy curbs, most Chinese producers are now sold out for 2021, and any downside correction to current price levels should be limited.

Corpus Christi Project Update

Given the current supply challenges across the Americas, the Corpus Christi Polymers (CCP) project in Texas has perhaps gained greater relevance, in a world that is otherwise transitioning towards recycle.

The CCP project is an integrated PTA-PET complex currently under development which, when completed, will have 1.1m and 1.3m tonnes PET and PTA capacity per year, respectively.

The complex will be the largest production unit of PTA-PET integrated single-line in the world and the largest PTA plant in the Americas.

According to Alpek in its Q3 earnings call, the company remains committed to CCP, with the project’s other joint venture partners, Indorama Ventures and Far Eastern New Century, also eager to move ahead with the project and in the process of finalising costings.

Project partners plan to finalise engineering and construction contracts and announce a decision on resuming construction on the US PET mega-project within the next two to three months.

Market Outlook

Even if Indorama returns to full production by the end of November, order backlogs and inventory builds will take time to resolve, meaning supply will remain squeezed through the rest of 2021 and into the beginning of 2022.

Although Asian export prices should stabilise in the near-term, low global inventory could create a volatile H1’22 price environment.

In the absence of any new capacity, and a likely rebound in post-COVID global demand in 2022, the North American supply/demand balance should remain tight, with pricing power on the side of the producer, until Corpus Christi becomes reality.

Import levels and opportunities should remain strong through to 2024 if additional anti-dumping duties can be avoided.

Other Opinions You Might Be Interested In…

- Changing Regulations Trigger RPET Boom in Asia

- Europe’s Energy Crunch Causes Chaos for PET

- China’s Energy Crisis Shakes PET Market

Explainers You Might Be Interested In…