Insight Focus

- PTA futures surged on stronger PX and supply issues resulting from lockdowns.

- PTA forward curve reached new highs, with future contracts heavily discounted.

- PET resin exports are expected to move higher on tighter PET supply availability.

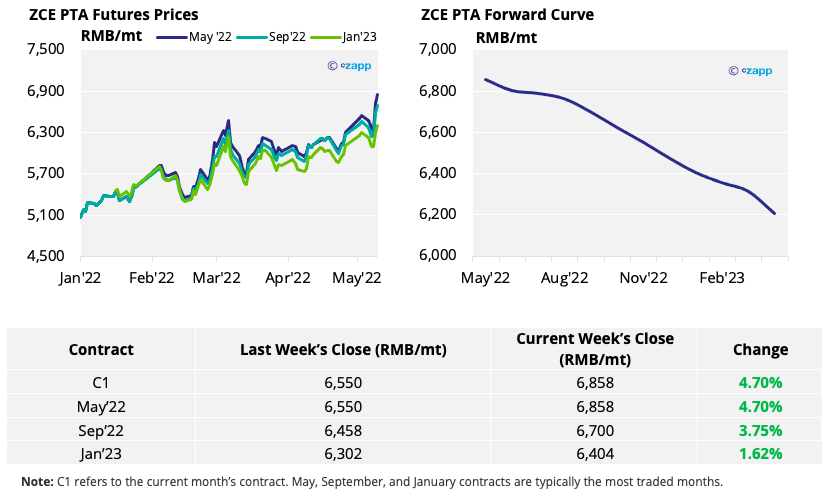

PTA Futures and Forward Curve

- PTA Futures leapt mid-week, trading limit up on Wednesday, and ended the week with strong gains.

- Prices were driven higher by a strengthening PX market, as well as PTA producers announcing further production cuts due to COVID restrictions and a deterioration in logistics.

- PTA 12-month forward curve has hit its highest since February 2019; remains backwardated falling away into 2023.

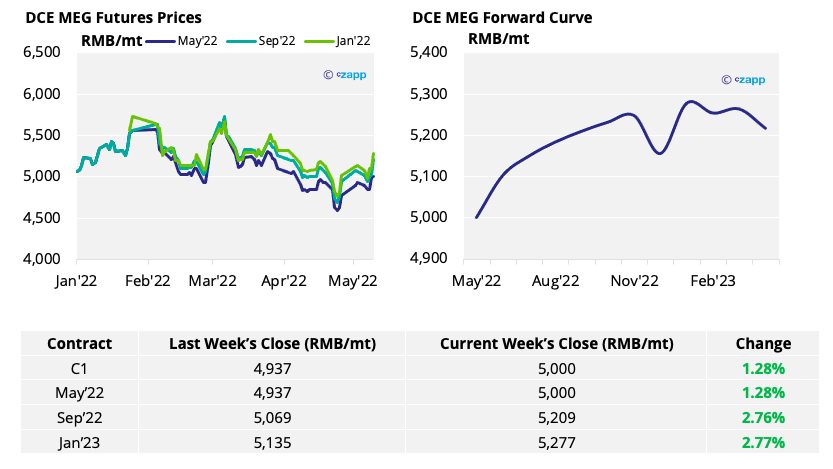

MEG Futures and Forward Curve

- MEG futures prices increased modestly on the week, although market fundamentals remained weak.

- Port inventories remain high, having increased over the last month. However, sizable production cuts and the expected arrival of less cargo in 1H May could help improve the supply/demand balance.

- MEG forward curve remains in contango, with future contracts trading at a premium to current levels. Although futures prices for the first part of 2023 have now eased.

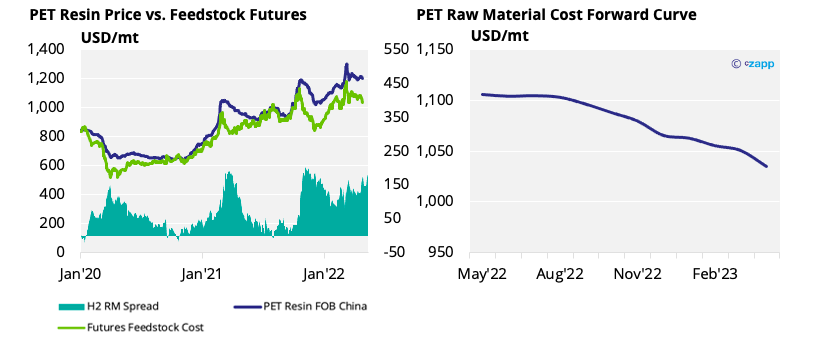

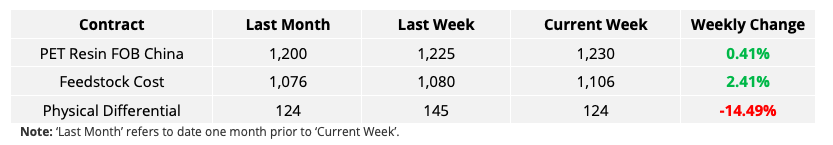

PET Resin Export – Raw Material Spread and Forward Curve

- Export prices for Chinese PET resin stayed relatively flat, ending the week at 1230 USD/mt.

- However, upward pressure from rising feedstock costs saw the physical differential slide through the week to just 124 USD/mt.

- The PET export-raw material forward curve over the next 12 months became more backwardated, primarily because of a steep fall in the PTA forward curve.

Concluding Thoughts

- PTA and PET production continues to be reduced by COVID controls, with Sanfame in Jiangyin under lockdown and Yisheng Dailan entering a maintenance period.

- As a result, Chinese PET Resin exports FOB values are expected to follow raw materials higher over the next week recovering the physical differential on lower PET supply.

- Whilst the availability and movement of containers remains challenging, demand for large volume breakbulk orders helps keep a strong order flow for producers.

- At present, major exporters are increasingly sold-out through June and July, offering availability for August shipment.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

China’s zero-COVID Approach Hampers PET Resin Exports

China’s Zero-COVID Policy Hits Domestic PET Resin Demand

European Buyers Under Pressure as PET Prices Hit New Highs

PET Resin Trade Flows: China’s COVID Response Slows Exports

Explainers That May Be of Interest…