Insight Focus

PTA and MEG Futures experienced modest gains this week. A rebound in polyester demand supported raw materials. PET resin export prices remained relatively flat, following the ebb and flow of upstream inputs. Despite the upcoming buying season, futures forward curves continued to show minimal forward premiums.

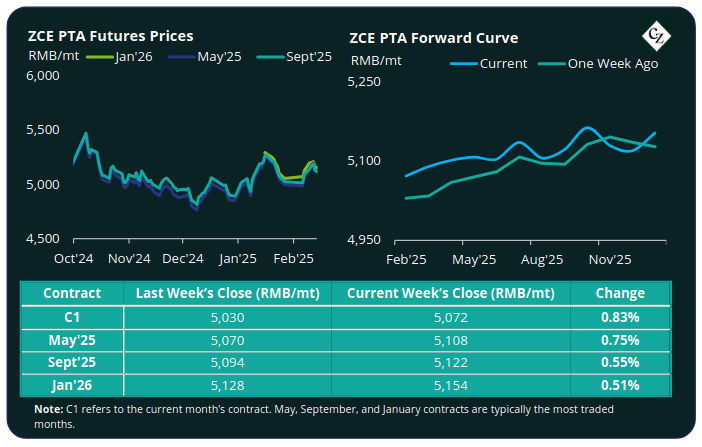

PTA Futures and Forward Curve

PTA Futures moved modestly higher, with main month contracts averaging gains of between 0.5% and 0.75% on the week.

By Friday Brent relatively unchanged around USD 75/bbl, as the market digested bullish signals from US trade tariffs. This was weighed against the prospects of Russian supplies being brought back on the market amid potential Ukraine-Russia peace talks.

Both PX and PTA spreads saw some improvements, with the PX-N CFR average weekly spread increasing to around USD 195/tonne. The PTA-PX CFR spread also improved marginally, increasing to an average of USD 80/tonne last week, up USD 2/tonne on the previous week.

The PTA market saw some plant maintenance last week, leading to a decrease in operating rate; combined with a sharp rebound in downstream polyester production, PTA supply and demand fundamentals improved.

The PTA forward curve remained in slight contango over the next 12 months, with the May’25 contract holding a RMB 36/tonne premium over the current month’s contract. The Sept’25 held a RMB 50/tonne premium.

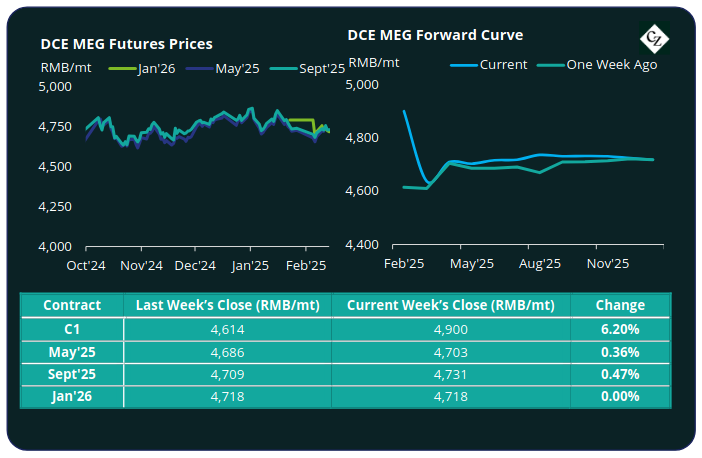

MEG Futures and Forward Curve

The MEG Futures main month contracts of May’25 and Sept’25 eked out marginally gains last week, both rising by less than 0.5%.

East China main port inventories increased a further 17% to around 725,000 tonnes on steady arrivals and slower offtake.

Despite the increase in demand from the polyester sector, inventory buildup is expected to continue through February as imports continue at pace.

Beyond the current month, supply and demand fundamentals are expected to improve in March as the downstream, bottle-grade PET resin manufacturers who will see demand swing into pre-season buying.

Beyond elevated current month’s contract, the MEG Futures forward has flattened with the Sept’25 contract at just a RMB 28/tonne premium over the next main month contract of May’25.

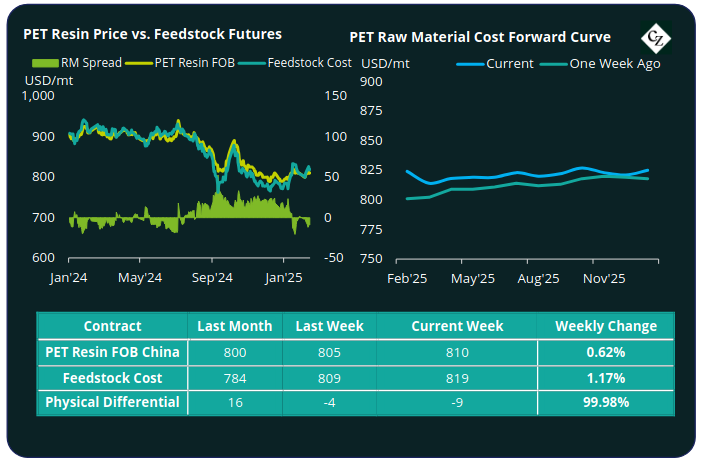

PET Resin Export – Raw Material Spread and Forward Curve

Chinese PET resin export prices kept relatively flat last week, increasing just USD 5/tonne to average USD 810/tonne by Friday.

The average weekly PET resin physical differential against raw material future costs reversed back down to a weekly average of negative USD 10/tonne last week, down around USD 6/tonne. By Friday, the daily differential was negative USD 9/tonne.

The raw material cost forward curve continued to flatten, with May’25 holding just a USD 5/tonne premium over Mar’25, and Sept’25 holding a USD 8/tonne premium.

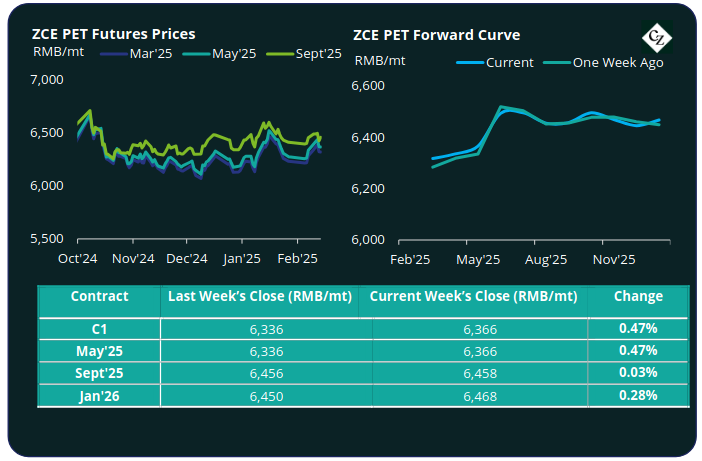

PET Resin Futures and Forward Curve

PET Resin Futures saw near-term contracts gained around 0.5%, although the Sept’25 contract kept flat.

The Mar’25 contract, the first contract month of these new futures, increased to RMB 6,366/tonne (USD 878/tonne), equating to an FX adjusted increase of USD 11/tonne versus last week.

The average weekly premium of the Mar’25 PET futures over Mar’25 raw material futures decreased to just USD 16/tonne, down USD 7/tonne. By Friday, the daily premium was USD 18/tonne.

The PET resin futures forward curve kept relatively unchanged across the main contract months. May’25 held just a RMB 48/tonne (USD 6/tonne) premium over the main Mar’25 contract, and Sept’25 held a RMB 140/tonne (USD 29/tonne) premium.

Concluding Thoughts

Although there was a notable increase in overall polyester operating rates last week, bottle-grade production still languishes. Several major plants already entered maintenance before CNY, and with others due to follow suit in the coming weeks, operating rates are expected to deteriorate further.

However, producer margins are likely to remain under pressure because of inventory build-up over CNY, with factory stock averaging nearly 20 days, combined with the fact that many buyers restocked ahead of the holidays and are in now immediate need to rush purchases.

Overshadowing all of this is that maintenance at many of these plants will be short-lived. New capacity has also already been added this year, whilst other plants, including 1.1 million tonnes of CRC capacity are due to restart.

As a result, Chinese PET resin producer margins are expected to remain constrained into the coming pre-season, with minimal carry through both the PTA and PET Futures to May’25 (<USD 10/tonne).

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.