Insight Focus

The rains have arrived in Brazil’s main producing regions. Despite early-season challenges, the outlook is now optimistic. Initial data from the National Supply Company, Brazil’s agricultural agency, is encouraging for corn, with potential for a new production record in soybeans.

Record Soybean Production Projected

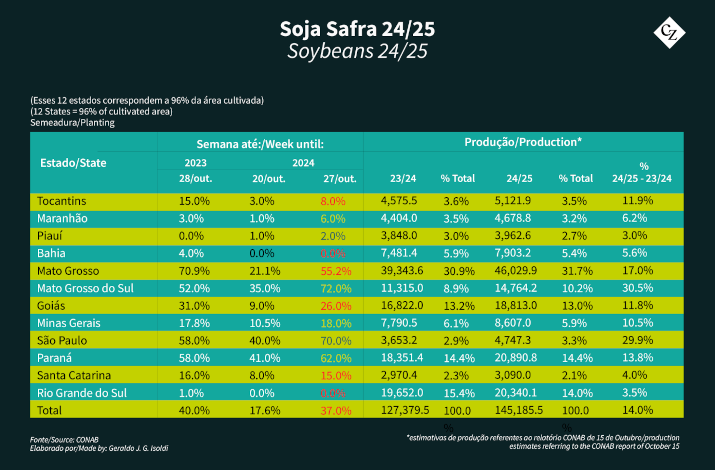

Despite a slow start to planting caused by delayed rains, field activities have picked up momentum recently. Rainfall has finally arrived, improving prospects for normalcy in the coming weeks and supporting CONAB’s projections for the summer soybean and corn crops.

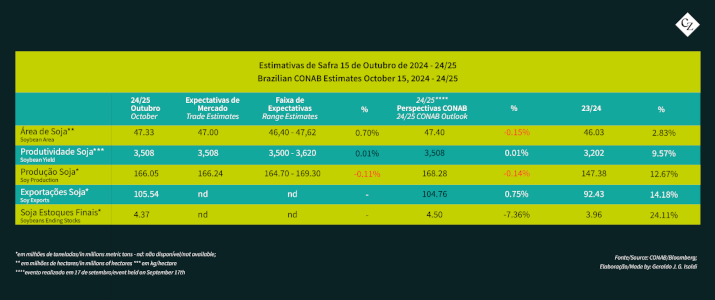

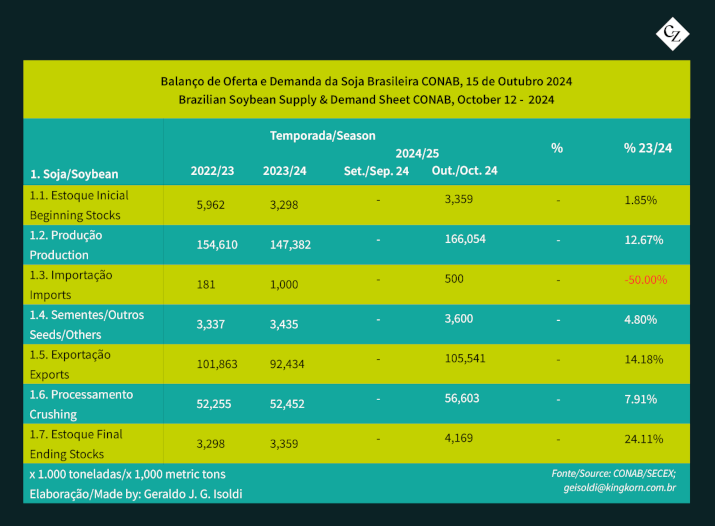

The initial estimate for the new soybean crop points to a record volume of 166 million tonnes, marking a 7.4% increase over the previous high of 154.6 million tonnes achieved in the 22/23 season.

The new estimate results from a 2.8% increase in planted area. This rose from 46.03 million hectares (ha) last season to 47.33 million ha this season. Yield has also shown growth, now projected at 3,508 kg/ha, a 9.6% increase compared to 3,302 kg/ha in the previous season.

The “Fuel of the Future” bill, approved in early October, mandates a gradual increase in biodiesel blending into diesel. Alongside the high volume of Brazilian exports of soybean oil and meal and the growing demand for meal in animal protein production, this law is expected to boost domestic consumption from 52.4 million tonnes to 56.6 million tonnes.

Exports are also projected to hit a record 105.5 million tonnes, solidifying Brazil’s status as the world’s largest exporter.

Price Challenges Reduce Safrinha Corn Crop Area

However, the upcoming safrinha corn crop requires careful monitoring. Delays in planting may arise from recent droughts affecting soybean sowing, and crops could also encounter increased climate risks.

Models suggest that the La Niña phenomenon, anticipated to affect Brazil from mid-November, is likely to be short-lived, weakening between February and March. This may disrupt rainfall in early April, potentially impacting plant development and lowering yields.

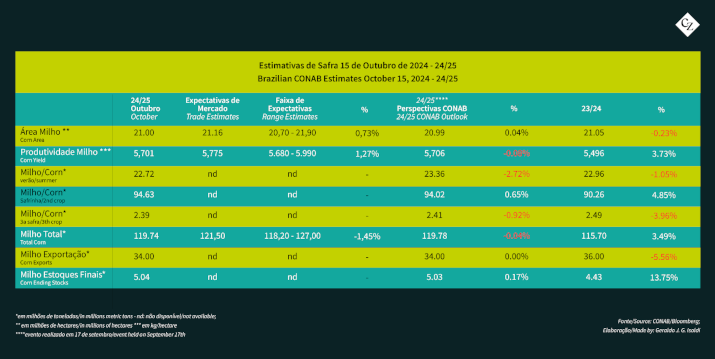

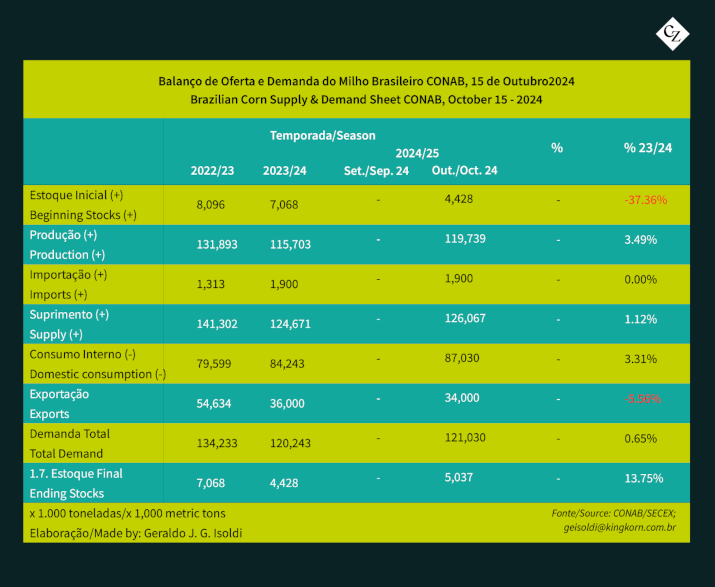

CONAB projects corn production to increase by 4 million tonnes, reaching 119.74 million tonnes, up from last year’s 115.7 million tonnes. This growth is attributed solely to improved yields, which have risen from 5,496 kg/ha to 5,701 kg/ha, while the cultivated area has remained steady at approximately 21 million ha.

Since the end of the pandemic, corn prices have dropped sharply both domestically and internationally, making current and projected prices less appealing for producers, particularly compared to more profitable crops like soybeans.

Corn exports are losing momentum, with production projections decreasing from 36 million tonnes this crop year to 34 million tonnes in 2024/25. This drop is expected to be offset by an increase in domestic consumption, rising from 84 million tonnes to 87 million tonnes.

The growth is driven by rising animal protein production and, notably, a 17% increase in demand for ethanol and Dried Distillers Grains (DDG) production compared to last season.

Despite these projections, it should be noted that summer crops, such as the first corn crop and soybean, are still in the planting phase. The second corn crop (safrinha), which accounts for 76% of total production, only begins at the end of December in the states of Mato Grosso and Paraná and continues until mid-March in other regions.

Therefore, the area and yield calculations are based on field surveys and market data, with substantial support from statistical models.