322 words / 1.5 minute reading time

- The No.11 is vulnerable to further selling pressure.

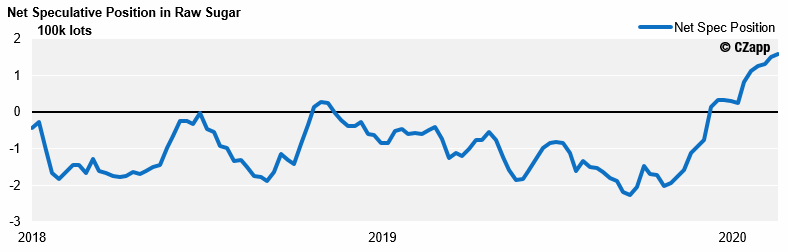

- Speculators are now probably neutrally positioned and could go short with recent BRL and crude weakness.

- Brazilian mills are unlikely to buy back shorts and have more to sugar to sell.

More Selling to Come…

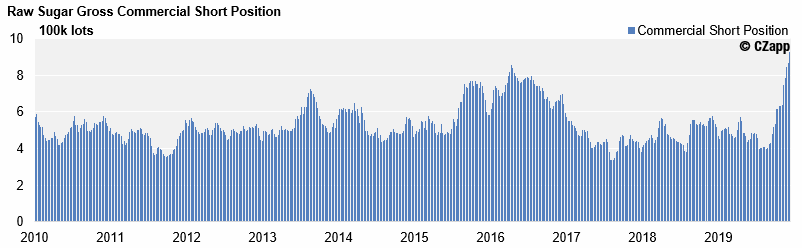

- Producers are currently very short in the sugar market, having been at a record in the last two weeks.

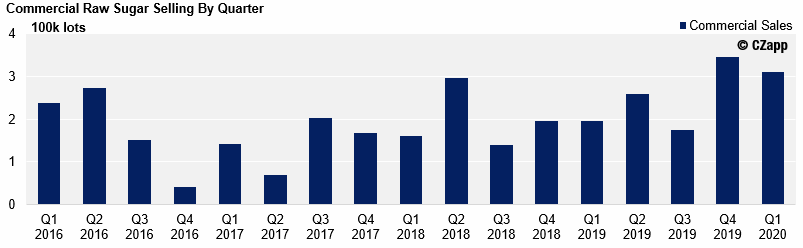

- In the previous two quarters we’ve seen record selling by producers.

- This selling was induced by the price rally in late 2019.

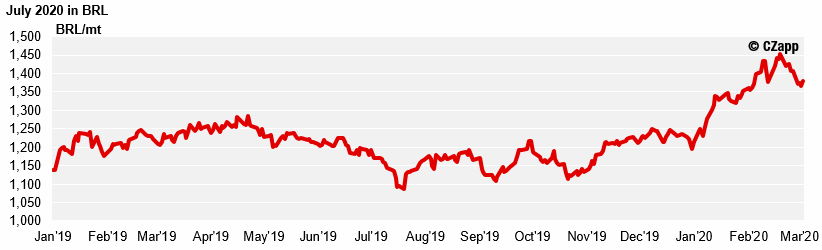

- The weak BRL gave Brazilian mills the opportunity to price at levels not seen since 2016.

- We estimate that Brazilian mills have priced around 70% of their sugar for next season.

- There is still more to be hedged, and they could increase their sugar production further if the market approaches BRL1500/mt.

- This is 14.50 c/lb in the N20 using forward FX.

- Brazilian mills are unlikely to buy back their hedges even if the No.11 reduces as crude prices are too weak.

- We expect specs to be neutral after the recent No.11 weakness.

- They could move shorter still, pushing the market lower, especially if the BRL and Brent Crude Oil continue to weaken.

Who Will Be There to Buy the Market?

- Consumers should be well-covered for 2020.

- The trade is probably long and could therefore be vulnerable.

- How do we know the trade is long? They helpfully told us at the Dubai conference that they were all bullish.

- The trade clearly underestimated the risk from coronavirus; they actually attended the Dubai conference a month ago.

- Seeing how things have escalated, going to a conference today would be considered

madness… - Of course, the sugar market will rebound higher at some point.

- But we think the order flow risk is heavily to the downside in the short to medium term.