Insight Focus

- US share of Chinese dairy imports at 4 year high.

- But shipments from New Zealand decline.

- Europe loses market share into Southeast Asia due to competitive pricing from the US.

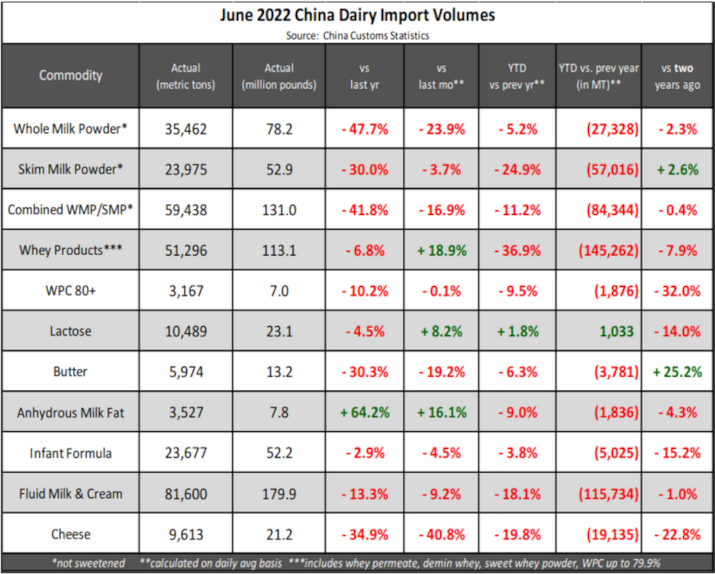

China

US market share increased to four-year highs of 17.2% (versus 10% last year) with whey (28,766MT, +9,481MT YoY) and lactose (8,661MT, +2,084MT YoY) volumes aiding the jump. Whey imports from the US were the highest since July 2021. Skim milk powder imports from the US also improved slightly and reached eight-month highs (4,382MT, +201MT YoY). June cheese imports were the lowest for the month since 2018 with the steepest month-over-month drop observed since October 2021. The consumption of cheese has declined at the restaurant and QSR level; the Yum China Holdings, Inc. (KFC, Pizza Hut, Taco Bell, Little Sheep, Huang Ji Huang, and Lavazza) stock value has dropped nearly 30% over the last year, when the country was opening back up. Imports from Australia were strong due to an uptick in fluid milk & cream demand from the country. China imported 11,319MT, UP 88% from prior year. SMP from Australia was also notable with China importing 5,167MT in May, UP 9% from prior year. Of the top ten dairy commodity suppliers in June, seven reported losses. After the US and Australia, imports from the UK also increased due to an increase in whey flowing in.

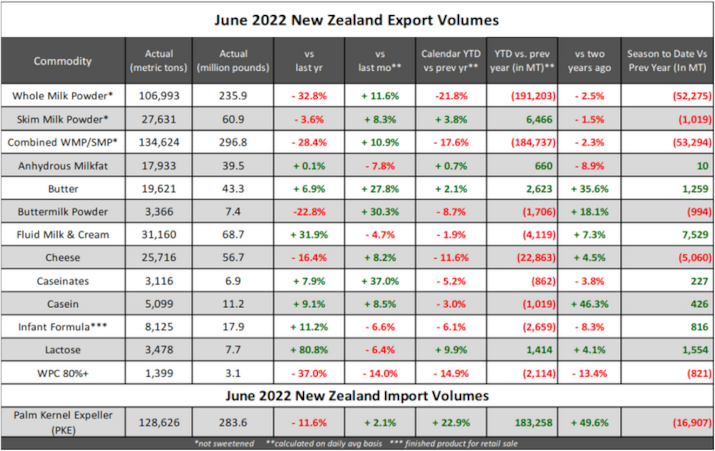

New Zealand

New Zealand: Total shipments to China continue to falter, DOWN 35% from prior year, driven by the slowdown in WMP volumes against a record prior year. Q2 exports were the lowest to the country since 2018. China’s milk production was strong in H1 (+8.4% YoY) and they are rumored to be sitting on higher inventories following their COVID-19 lockdowns in Q2. Trade with Indonesia was strong in June, as well as during the second quarter; New Zealand shipped record Q2 dairy volumes to Indonesia and primarily due to strong milk powder exports, but butter exports have been notable as well. Q2 exports to Algeria were the highest since Q1 2019, led by the country’s demand for WMP (30,387MT, +15,704MT YoY). June shipments to the country were the highest since March 2020. Quarterly AMF exports were the highest in two years from Apr-Jun due to a strong rise in volume to the EU and China, as buyers take advantage of the competitively priced fat. Fluid milk and cream exports marked the strongest June volume on record, even as total shipments were DOWN slightly versus the past three months. Q2 shipments were UP 4.4% from prior year with the largest jump in the quarter to the Philippines, though China remained the top destination.

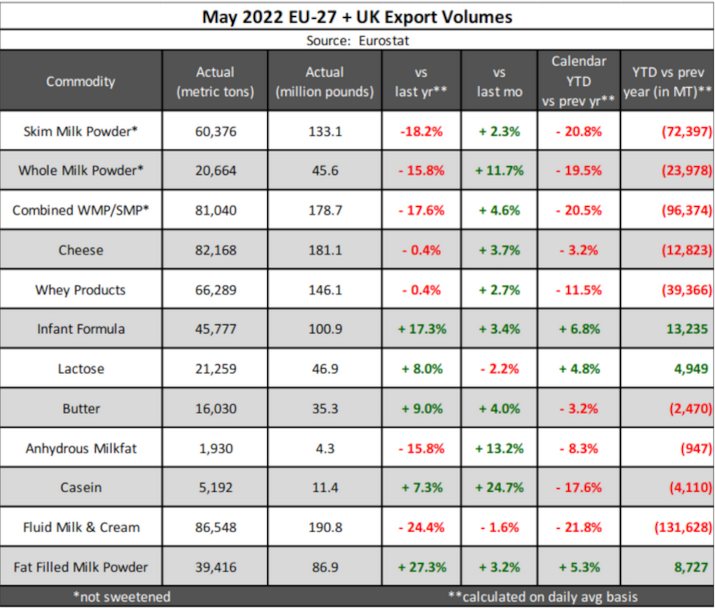

EU + UK

Skim milk powder (SMP) shipments were the weakest for May in six years with a drastic fall noted in volume to Asia. The largest drop was into China as exports dropped 47% or 7,218MT from prior year to 8,201MT; the U.S. and New Zealand also reported weaker SMP shipments to China during May due to the widespread lockdown to control the spread of COVID-19. Europe lost market share to the U.S. into Southeast Asia due to competitive pricing across the pond and as a result, exports to Southeast Asia fell 33% or 8,006MT from prior year from the EU. Conversely, May was a fresh record high for EU fat-filled milk powder (FFMP) exports as emerging markets become more sensitive to price, most notably with whole milk powder heading north of $4,000/MT during the month. The key destination markets were, as usual, into Sub-Saharan Africa with Nigeria the top importer. The EU shipped 7,888MT into the country, an increase of 32% or 1,899MT YoY. Senegal was the second strongest market with exports UP 23% or 1,269MT from prior year to 6,849MT. Growth was notable into nine of the top ten destination markets in May. Casein exports reached five-month highs with the U.S. becoming the No. 1 buyer again into May (Mexico’s demand outpaced the U.S. last month).

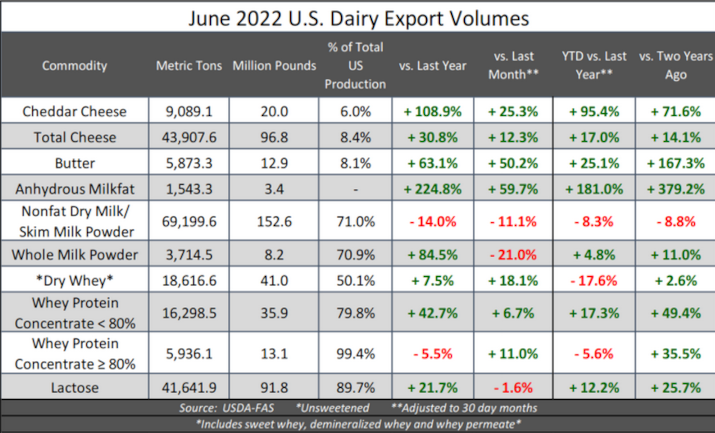

USA

Despite negative headlines about China’s economy, June was a record month for dairy shipments from the US into the country, led by demand for ingredients. WPC<80% exports to China reached an all-time high of 9,514MT (+61% YoY), though lactose increases were also notable (10,650MT, +38% YoY). Total cheese exports climbed to a new all-time record high, surpassing the prior monthly record set in March. Shipments were higher to each of the top ten destination countries in the month. South Korea saw the largest volume gain of any country, with shipments UP 2,104MT or 43% versus last June. For the seventh consecutive month, US nonfat dry milk shipments fell below firm prior year levels and dropped to four-month lows. June exports were below both prior year as well as two years ago, with the biggest losses observed into Indonesia. Demand for butter remains robust, with volume exceeding prior year levels yet again after two months of weakness in April and May. Canada remained the top destination in the month with 51% market share; it also marked the steepest year over year gain of any country, UP 1,650MT or 124% versus last June. Remarkably, the top 17 export destinations each saw higher volume versus one year ago.

For additional dairy market analysis, request a free trial at highgrounddairy.com/free-trial.