This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- US Sugar beets 24% planted vs 17% a year ago.

- 5-year average at 38%.

- Cane sugar prices rising.

Sugar beet planted advanced in the week ended May 5, although growers in the Red River Valley were just getting into their fields and were behind schedule. Cane sugar prices were raised for this and next year.

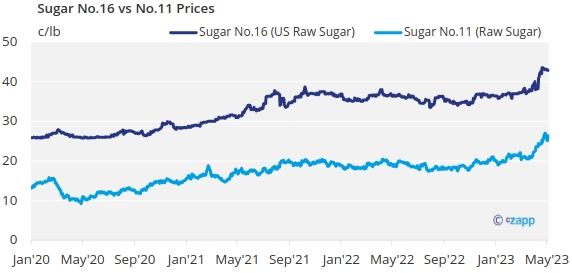

Forecasts for world raw sugar prices from speakers at New York Sugar Week ranged from 20¢ to 30¢ a lb, mainly due to uncertainty about weather over the coming months. Lower-than-expected 2022-23 output in India, Thailand, China, Mexico and other countries boosted raws to nearly 27¢ a lb recently. Should El Niño bring drier weather to Asia, production could be down again in 2023-24. For now, Brazil is “the only game in town,” but early harvest of the 2023-24 cane crop has been slowed by rain.

Because of tight supplies in the United States and the increased pace of high-tier imports, global raw prices have had an outsized impact on US sugar values.

Domestically, traders focused on sugar beet planting. Sugar beets in the four largest producing states were 24% planted as of April 30, ahead of 17% a year ago but well behind 38% as the 2018-22 average for the date, the US Department of Agriculture said. All the planting was in Idaho and Michigan. No beets were yet planted in Minnesota (25% as the five-year average) or in North Dakota (19% as the average). Of the eight reporting states, only Michigan was ahead of average.

Louisiana sugar cane crop condition ratings as of April 30 slipped slightly but were near most ratings for the date over the past 10 years.

Beet sugar sales activity was quiet with most processors comfortable with the amount of sugar they have sold for 2023-24 as the bulk of the growing season lies ahead. One processor remained out of the market, and most others were selling only selectively. Cane refiners still were selling sugar for next year and were ahead of the average pace for the date.

One major refiner raised prices for bulk refined cane sugar for calendar 2024 to 61¢ a lb f.o.b. Northeast and West Coast and to 59¢ a lb f.o.b. Gulf and Southeast, both up 1¢ from a week earlier. Bulk refined beet sugar prices were unchanged in the mid- to upper-50¢ a lb f.o.b. range amid slow sales for next year.

In the spot market, one major cane refiner offered sugar at 68¢ a lb f.o.b. at all locations, up 2¢ from a week earlier and equal to the 2022 high that ran from mid-June through December. Spot beet sugar mostly was unavailable and priced nominally at 62¢ a lb, keeping pace with rising cane sugar prices.

Sugar demand in the current year remained unclear. Several beet processors noted slower-than-expected shipments of contracted sugar in the first quarter and into April, but a couple indicated an uptick in the first week of May. Some food manufacturers also reported slower sales of their sugar-containing products.

The corn sweetener market mostly was quiet. Trade sources noted slow deliveries of regular corn syrup from one refiner.