Insight Focus

The Red Sea crisis continues to disrupt global shipping. This disruption has driven up freight rates and created volatility amid additional factors like Panama Canal restrictions and growing geopolitical tensions. The shipping industry must adapt to ongoing disruptions, higher costs and uncertain demand in 2025.

Preparing for the New Normal

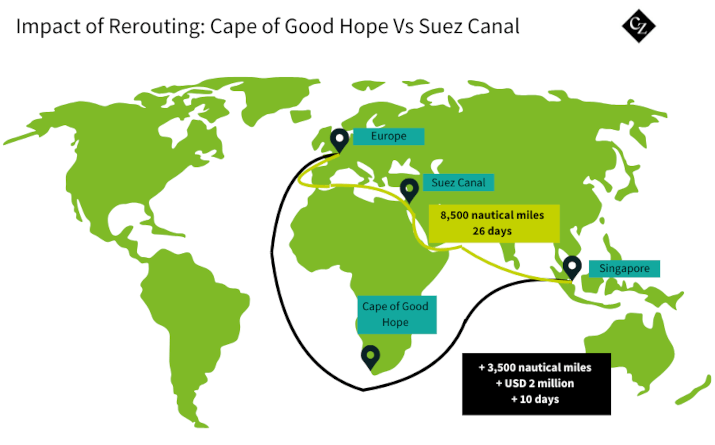

The ongoing Red Sea crisis has disrupted global shipping for over a year, prompting most cargo vessels to bypass the Red Sea and the Suez Canal. Instead, they are opting for the longer route around the Cape of Good Hope. This re-routing has significant implications for the industry, raising critical questions about the outlook for 2025 and the anticipated changes in the coming months.

Preparing for the next anomaly has become the “new normal” for the shipping stakeholders. The crisis has magnified the ripple effects of other challenges across the industry, such as port strikes or congestion, turning what was once considered an exception into an everyday reality for the market.

The global shipping industry must adapt to a landscape where prolonged disruptions, elevated costs and evolving geopolitical risks are part of the operational norm. For shippers, this means proactively planning for volatility, monitoring rates and building flexibility into supply chains to navigate an increasingly uncertain environment.

Freight Rates Surge Amid Disruption

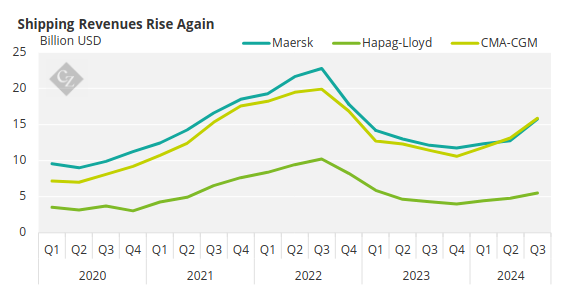

The diversion around Africa has driven a sharp increase in freight rates, with many container shipping companies reporting exceptional financial results—second only to the record earnings during the Covid-19 pandemic period. The global ocean freight market shows no signs of slowing down, underscoring the sustained pressures on shipping costs.

Source: Hapag-Lloyd, CMA CGM, Maersk

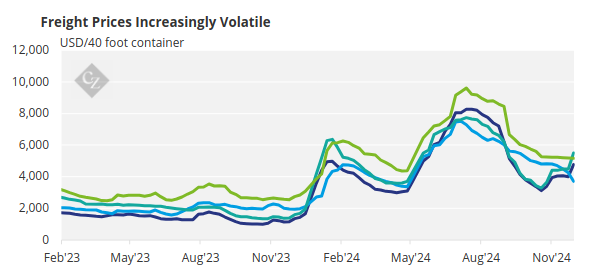

However, the Red Sea crisis is not the sole factor influencing container rates. Additional challenges, such as the Panama Canal’s drought-induced restrictions, broader geopolitical tensions, shifting global trade patterns, and the potential new US tariffs on Chinese—and other—goods, are contributing to a volatile pricing environment. These factors collectively create a complex landscape that could sustain or even escalate freight rates in the months ahead.

Freight rates have become significantly more unpredictable compared to previous years. Shippers must brace for another volatile year, with high rates likely remaining the norm.

Source: Drewry

Vessel Route Shifts and Risks

With conditions in the Red Sea showing little improvement and Houthi attacks continuing unabated, there is no expectation of liner operators resuming routes through the Red Sea anytime soon. Several reports indicate that Suez Canal diversions will likely persist throughout 2025.

While some niche regional carriers have recently increased their usage of the Suez Canal, this does not suggest a broader shift in industry trends.

Major container shipping lines continue to favour the Cape of Good Hope, prioritising the safety of their crew, vessels and cargo over shorter transit times.

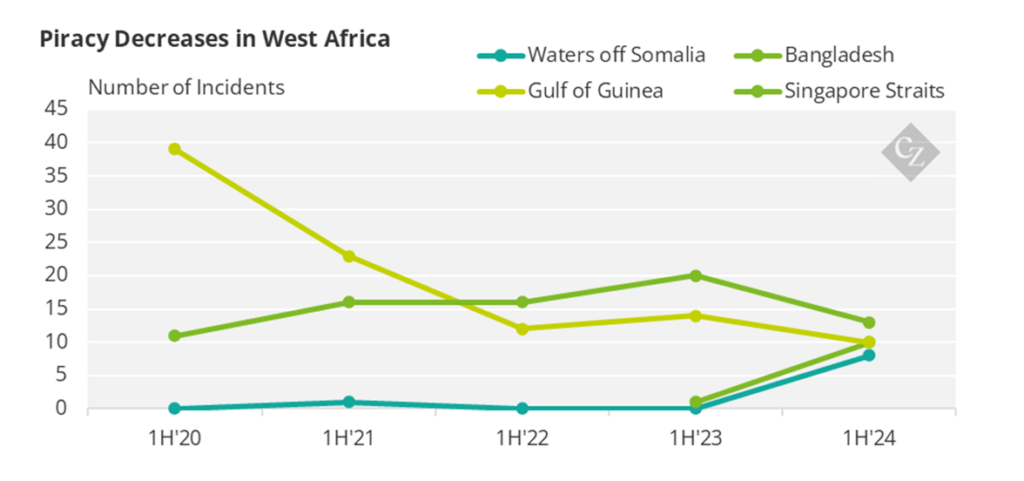

Source: International Maritime Bureau

This is further underscored by the announcements from new container shipping alliances, which will launch operations in February 2025.

These alliances have developed dual service networks—a standard route and an alternative—and have decided to start with the Cape of Good Hope network in the first months of the next year. This decision signals that longer transit times, higher operational costs and elevated freight rates are likely to persist well into 2025.

Demand-Supply Balance

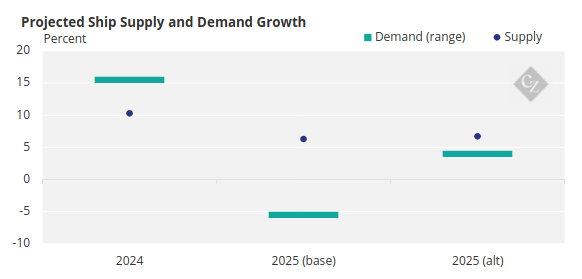

A recent forecast by BIMCO highlights the Red Sea crisis as a major factor driving growth in container shipping demand. In 2024, vessel capacity demand is projected to rise at a rate three times faster than the increase in cargo volumes.

Specifically, container shipping capacity demand is expected to grow by 15.5% in 2024, while cargo volumes are anticipated to increase by a more moderate 4% to 5%. However, BIMCO cautions that a return to the Suez Canal route could lead to a 5.5% drop in capacity demand by 2025, as shorter routes would reduce overall tonne-miles.

Source: BIMCO

Cargo volume growth is also forecast to slow in 2025, with estimates ranging between 3% and 4%, compared to the higher growth rates seen in 2024. Conversely, if vessels continue to avoid the Suez Canal, container ship demand is expected to grow between 3.4% and 4.5% in 2025 compared to the previous year.

“At this point, it is difficult to determine which scenario is more likely, but with the Israel-Gaza conflict escalating to include Hezbollah in Lebanon, it seems increasingly probable that rerouting will have at least a partial impact on 2025 shipping patterns,” commented BIMCO.