Insight Focus

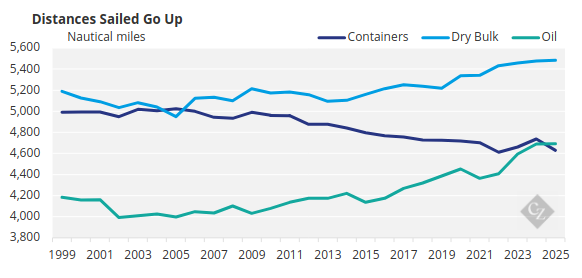

The ongoing Houthi attacks in the Red Sea area are severely disrupting the cargo shipping industry. The instability in the region is forcing shippers, vessel owners and operators to reroute their vessels around the Cape of Good Hope, leading to longer journeys and increased emissions.

Carbon Emissions on the Rise in 2024

Shipping’s carbon emissions surged by 23 million tonnes in the first half of this year, marking a 6% increase from the previous year and bringing the industry’s total emissions to approximately 450 million tonnes, according to Bloomberg.

The container shipping sector experienced the sharpest rise, with boxships emitting around 15% more during the first six months of 2024.

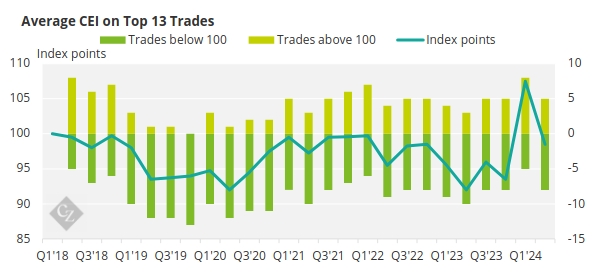

A Xeneta analysis reveals that carbon emissions in ocean container shipping were extremely high in the first half of the year, though there was a slight improvement in the second quarter compared to the first three months.

Xeneta’s Carbon Emission Index (CEI), which measures container shipping emissions across the world’s top 13 trades, reached a record-high 107.5 points in Q1 2024 but dropped to 98.6 points in Q2.

Source: Xeneta, Marine Benchmark

The Red Sea conflict notably impacted three major long-haul trades – Far East to North Europe, Far East to the Mediterranean, and Far East to the US East Coast – all of which saw quarter-to-quarter increases in carbon emissions, according to the Xeneta report.

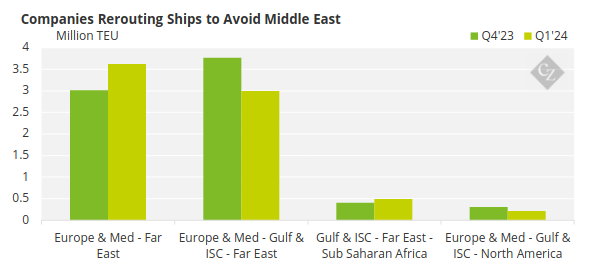

Source: UNCTAD

“It is important to note that, while emissions per tonne of cargo have fallen across Xeneta’s top 13 trades [in the second quarter], this hides an increase in total emissions across the global container shipping fleet,” said Emily Stausbøll, Market Analyst at Xeneta. “2024 has seen record levels of demand for ocean container shipping globally, meaning more cargo is being transported and higher total CO2 emissions.”

These figures underscore the significant challenges facing the shipping industry as it strives to meet emissions targets set by the International Maritime Organization (IMO). Despite the industry’s commitment to reducing its environmental impact, the recent surge in emissions continues a long-term upward trend, driven in part by external factors.

Higher Speed Drives Up Vessel Emissions

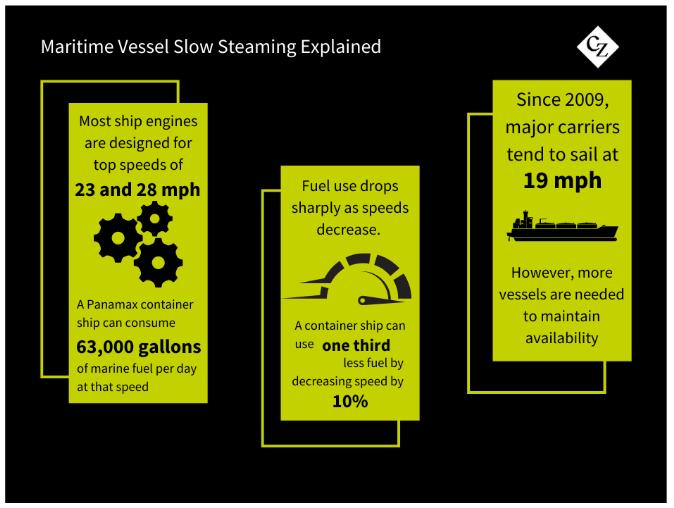

A crucial factor for a vessel’s carbon emissions is speed. Especially in the first weeks of the Red Sea crisis, several ocean carriers decided to increase the speed of their ships aiming to mitigate the impact of re-routing on voyage times. This decision, as expected, led to a significant rise in the ships’ carbon emissions.

In December 2023, when ships started rerouting, average transit times increased by around 50%, leading to a similar increase in carbon emissions.

“The disruption in the Red Sea and Suez Canal, combined with factors linked to the Panama Canal and the Black Sea, could erode the environmental gains achieved through “slow steaming”, as rerouted vessels increase speeds to cover longer distances,” noted UNCTAD in a report.

This is particularly evident among container vessels, where a 1% increase in speed typically leads to a 2.2% rise in fuel consumption. For example, accelerating from 14 to 16 knots increases fuel use per mile by 31%.

“As a result, the longer distances caused by rerouting from the Suez Canal to the Cape of Good Hope imply a 70% increase in greenhouse gas emissions for a round trip from Singapore to Northern Europe,” pointed out UNCTAD.

According to a Reuters report citing LSEG data, a large container ship traveling from China’s port of Shanghai to Germany’s port of Hamburg emits 38% more CO2, equivalent to 4.32 million kilograms, when rerouted around Africa instead of passing through the Suez Canal.

Looking Ahead

As of now, there are no signs of improvement in the Red Sea region, with Houthi forces continuing to target ships using drones and missile attacks. Consequently, shipping companies are unlikely to return to the Suez Canal in the near future.

Source: UNCTAD

However, there is optimism for a reduction in shipping-related carbon emissions for two key reasons. First, as time progresses, shipping companies are adapting to the situation by finding more efficient alternatives, such as deploying larger vessels or introducing additional routes. This approach helps them avoid the need to increase vessel speed, which would negatively impact voyage times and emissions.

Additionally, most ocean carriers are engaged in a continuous newbuilding campaign, with the first of the more carbon-efficient and environmentally friendly ships already delivered. As these new, greener vessels are deployed into the shipping line’s services, carbon emission levels are expected to decrease further.