Insight Focus

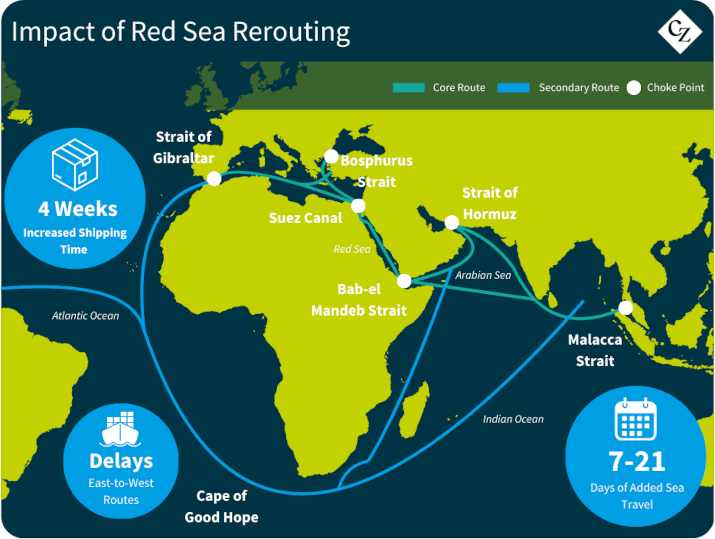

The Red Sea remains restricted due to the Israel-Hamas conflict. Shipping companies are rerouting around the Cape of Good Hope to avoid the region. Despite Suez Canal expansion efforts, the conflict continues to prevent normal operations. As a result, shipping costs remain high, and uncertainty persists in the industry.

The Red Sea remains a “restricted zone” for most major ocean carriers, as the safety and security of commercial vessels cannot yet be assured. While the shipping industry had hoped for a return to normal operations following the agreement between Hamas and Israel around January 20 to halt hostilities, the official end of the ceasefire on March 18 dashed those expectations.

Container Lines Persist with Cape of Good Hope Detour

With Israel resuming military operations in the Gaza Strip, maritime security concerns across the Middle East are once again escalating. Shipping stakeholders find themselves in a “déjà vu” situation, facing prolonged transit times and increased operational costs due to continuing rerouting around the Cape of Good Hope.

“We do not prefer navigating around the Cape of Good Hope, and we are waiting for the situation to stabilize to return to transit through the Suez Canal,” said Soren Toft, CEO of MSC, the world’s largest ocean carrier, in a discussion with the chairman of the Suez Canal Authority (SCA) Adm. Ossama Rabiee.

Toft explained that the Cape of Good Hope is not the preferred route for container lines due to its lack of navigational services, requiring heightened caution during transit.

Suez Canal Set for Expansion

In response to these concerns, Rabiee reaffirmed the Authority’s commitment to expanding and improving the canal, despite the current decline in traffic. He highlighted the completion and operational status of the Southern Sector Development Project, a key upgrade designed to improve navigational safety for larger vessels transiting the Suez Canal.

The expansion project adds a 10km stretch of two-way traffic at the Canal’s southern end, in a development that will enable the Suez Canal to accommodate an additional six to eight ships per day, once vessel owners and operators return to the Red Sea and the vital global trade artery.

Traffic on the Suez Canal, Egypt

While the Suez Canal Authority’s expansion and upgrade projects may seem paradoxical amid the ongoing crisis that has halted the traffic through the gateway, they reflect SCA’s strategic commitment to regaining lost ground once the situation stabilises. Rather than retreating, Suez Canal leadership is pressing ahead with improvements to ensure the Canal will be even stronger and better equipped to support global supply chains.

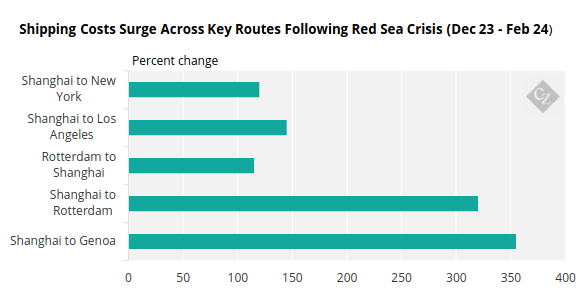

Rising Risks Drive Up Shipping Costs

According to maritime security firm Ambrey Analytics, the ceasefire between Hamas and Israel ended after unsuccessful negotiations to advance beyond ‘Phase 1’, leading Israel to halt humanitarian aid and electricity to Gaza.

In response, Iran-backed Houthis have reinstated their ban on Israeli-owned and Israeli-flagged vessels. Although the “official restriction” applies only to Israeli-related ships, the broader security risks mean that major box lines and container shipping alliances will continue rerouting via the Cape of Good Hope, as the Red Sea and the Suez Canal remain under persistent threat of attacks.

Meanwhile, shipping costs for goods passing through the Red Sea are expected to remain elevated. While most shipping companies continue to avoid the region, some vessels still choose to transit through the Red Sea—but at a higher cost to shippers.

Source: JP Morgan

According to a Reuters report, war risk premiums briefly eased to around 0.5% of the value of a ship after the January announcement from over 0.7% in December, before moving higher in February to 0.7% for some voyage rates. Industry sources noted that for some US and UK linked ships, premiums have recently surged to as high as 2% for those still opting to navigate the waterway.

While various discounts are regularly applied, this still results in hundreds of thousands of dollars in additional costs for the shippers’ side. It is no secret that these increased costs for shippers often lead to a chain reaction of higher prices for the final products, which consumers ultimately have to pay.

Continuing Uncertainty

The Red Sea crisis has developed into an ongoing situation which, despite causing significant disruptions in the global shipping industry, has become a relatively normality. We saw that despite the positive signs in the first weeks of the year, the involved parties ultimately failed to find common ground for more than two months, leading to an abrupt end to the ceasefire.

The involvement of the Trump-led US adds further complexity to the situation, making the outlook highly uncertain, while the shipping industry continues to operate under the same motto that has defined it for the past several years: “Abnormal is the new normal”.