This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- The American beet harvest is now mostly complete.

- Cane sugar prices remain strong due to exceptional drought in Louisiana.

- The growth of weight loss drugs could be slowing contracted deliveries of bulk sugar.

Cash sugar prices were unchanged during the week ended November 24 amid typically slow trading during a holiday week. Most traders were out of their offices from Thursday forward, with some out all week.

Surplus Beet Stems Cane Shortage

US bulk refined beet sugar offers for spot delivery were in the range of USD 0.59/lb to USD 0.62/lb FOB. For 2024, offers were between USD 0.57/lb and USD 0.59/lb FOB Midwest, all unchanged. Traders indicated beet sugar could be purchased for 2024 well below list in the mid-USD 0.50 range depending on volume and other factors.

All beet processors were in the market, while also maintaining they were in well-sold positions. Beet sugar production has been forecast by the USDA to be at a record high in 2023-24, over which there is little disagreement. The large beet supplies will help offset lower cane sugar production in Louisiana and potentially lower imports from Mexico. It could also increase export opportunities to Mexico due to a second year of drought in that country.

Spot refined cane sugar was offered at USD 0.68/lb nationwide through December 31 and was offered for calendar 2024 at USD 0.63/lb FOB Northeast and West Coast and at between USD 0.59/lb to USD 0.61/lb FOB Gulf and Southeast, all unchanged.

Weight Loss Drugs Weigh on Deliveries

Some sugar sellers continued to express concerns about slow contracted deliveries of bulk sugar to large food manufacturers and of 50lb bags to foodservice, while shipments to small and mid-size buyers were on track. Shipments to the retail sector were as expected or even stronger. Sugar deliveries for food use in 2022-23 were flat on the prior year per USDA data. Some see that trend continuing or even declining due to ongoing reformulation away from sugar and the growing impact of Ozempic for weight loss.

Inquiries about 2024-25 continued with beet sugar pricing said to be in the low- to mid- USD0.50/lb range FOB Midwest, flat to modestly below current 2024 price levels. There has been some contracting for 2024-25 and more will follow as some buyers seek some coverage on the books before the end of 2023 or early in 2024. But most expect contracting will move slower than it did for 2023-24 when sales mostly were wrapped up in March 2023 on the heels of the International Sweetener Colloquium.

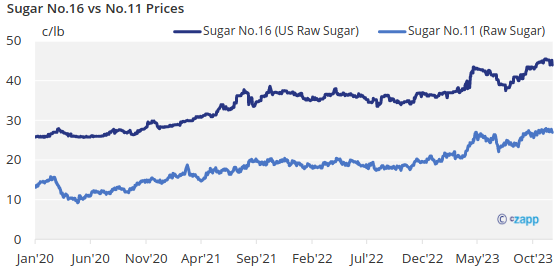

With forward raw sugar futures prices at discounts to nearby values and forecasts of easing global sugar tightness later in 2024, some buyers are willing to delay contracting at least for now. At the same time, some buyers may go ahead and book early because they can lock in supplies and prices below 2023-24 levels that reflect favourably on budgets.

The sugar beet harvest was complete with only Michigan and Montana trailing at 96% and 95%, respectively, still with beets in the field as of November 19, according to USDA state office reports. The harvest in both states was expected to be wrapped up by Thanksgiving.

The sugar cane harvest in Louisiana was more than a week behind average at 41% complete compared with 52% as the 2018-22 average amid exceptional drought conditions.

Corn Sweetener Contracting Flat

Corn sweetener contracting for 2024 advanced as buyers and sellers were intent to wrap up business ahead of Thanksgiving and avoid the year-end holiday period, although some business remained. Most contracting appeared to be getting done about flat with 2023, when prices were up sharply from 2022.

Buyers cited record-high corn production and sharply lower corn prices from last year as reasons for lower corn sweetener values, while sellers noted higher labour costs, high sugar prices and good demand from Mexico due to record-high sugar prices there.