Insight Focus

- Mexico is a major producer of sugar and corn but lags in ethanol adoption.

- The country could also take advantage of nearshoring to boost ethanol production.

- Regulations need to be updated before it can ramp up ethanol use.

Mexico Lags in Ethanol Blending

As a producer of two of the primary sources for ethanol, sugarcane and corn, Mexico currently has the potential to be a significant producer of biofuel. But a range of obstacles, both regulatory and cultural, slow the development of what could be an important contribution in the global effort to reduce carbon emissions and slow the pace of accelerating climate change.

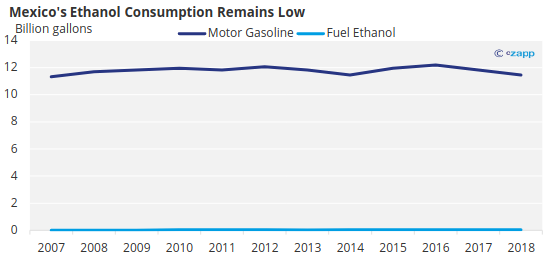

According to recently available data, Mexico’s fuel ethanol consumption was at a level of 3,380 barrels per day in 2021, up from 3,220 barrels per day the previous year. Fuel ethanol production was 920 barrels per day in 2021, unchanged from the previous year.

Source: USDA

The Inter-American Institute for Cooperation on Agriculture (IICA) based in Costa Rica states that Mexico is one of the few nations in the Americas that has not imposed specific mandatory quotas of ethanol for their fuels.

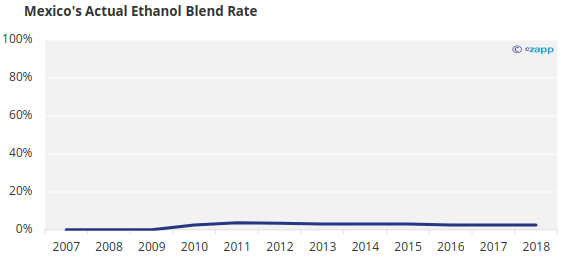

Mexican authorities, the IICA said, have refused to review fuel quality specifications as established by local standards since 2018 and have left unchanged an obsolete regulation that allows an ethanol content in fuel of only 5.8%.

Source: USDA

In 2020, Mexico’s Supreme Court ruled against a regulatory amendment that would have allowed the share of ethanol in gasoline to be increased to 10%. In 2021, Mexico’s Energy Regulatory Commission (CRE), responsible for modifying fuel standards, decided against addressing the issue. As of January 2024, CRE has yet to take any action.

Cultural Concerns Pose Barrier

While Mexico is the sixth largest producer of sugarcane in the world, and the seventh largest producer of sugar, the approximately 10.5 million gallons of ethanol produced from this source is mostly consumed by the alcoholic beverage industry. This means corn is the most viable source of ethanol.

However, in addition to regulatory restrictions on ethanol production, cultural obstacles concerning the use of corn for anything other than food or animal feed are extremely important to the Mexican population.

“In the mosaic of Mexican culture, maize, or corn, isn’t just a staple crop; it is a symbol of history and a cornerstone of a rich culinary heritage,” writes author David Santaniello. “Beyond its culinary uses, corn holds significant cultural and ceremonial importance. Corn is not just consumed; it is celebrated, a tradition reflecting the profound connection between the Mexican people and their land.”

Santaniello adds that corn’s influence extends into art and storytelling, where it symbolizes fertility, life and sustenance. “Artists and storytellers often use corn as a motif to convey deep cultural and historical narratives, embedding this humble grain in the collective consciousness of Mexico.”

In Mexico, using corn to produce something as banal as a fuel additive does not garner much public support, as reflected by the lack of attention given to ethanol by the nation’s regulatory authorities.

The Pieces of the Puzzle

Rodrigo Cardenal, CEO of Panama’s national sugarcane industry association, said Mexico could leverage the nearshoring trend and the growth of its automotive sector to adopt higher ethanol percentages in fuel blends.

Cardenal has also stressed the importance of Mexico accommodating a regulatory framework to facilitate investments in higher ethanol standards given the availability of funding, financing, expertise, and equipment, with knowledgeable partners ready to offer guidance.

“Mexico has a unique advantage,” Cardenal said, “as it already produces two of the primary sources for ethanol: sugarcane and corn. That is a significant asset.”

Source: iStock

In June this year, Mexico will elect a new president to replace Andres Manuel Lopez Obrador whose focus during his six-year term has been the improvement of life for the nation’s working class. One of the two candidates running to replace him, both women, could usher in a new administration that may be more concerned about how Mexico prepares for an uncertain future. There may be an opportunity for the nation to modernize its outdated management and regulation of biofuels.