Main Point

- With the deadline for meeting the targets approaching, demand for Cbio increased in September.

- As a result, the price of the asset came out of the stagnation and reached a high of 48 BRL/Cbio.

- Even with accelerated purchases, distributors still need to buy 9 million Cbios in just over 3 months.

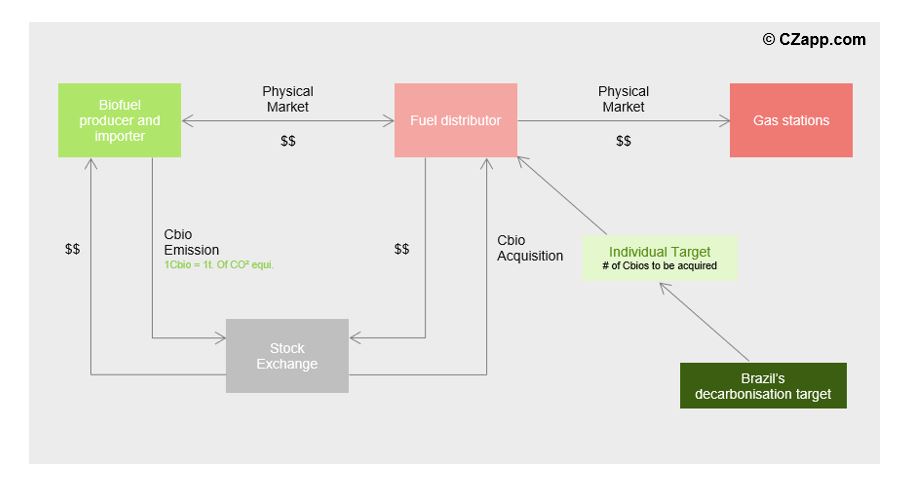

Reminder: Waht is RenovaBio?

- RenovaBio is the Brazilian national biofuels program launched in 2016

- The main instrument of the program, in accordance with the Paris Agreement, is the establishment of annual national decarbonization targets for the fuel sector.

- The national targets will be divided into mandatory individual targets for fuel distributors

- To meet their goal, fuel distributors will need to acquire CBIO certificates on the stock exchange

- Each CBIO emitted by biofuel producers corresponds to a ton of carbon that is not released into the atmosphere.

- Biofuel producers voluntarily issue CBIOs, based on their energy-environmental efficiency rating of the volume of biofuels sold.

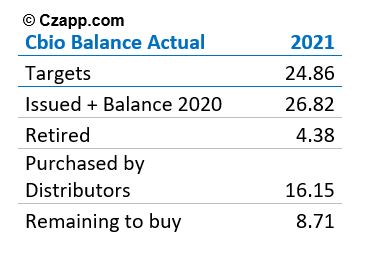

Balance 2021

- For the year 2021, the goal requires that 24.86 mm CBIOs are acquired by 136 distributors:

- So far, the total credits issued by biofuel producers this year have been 23 mm.

- The deficit between emission and demand will be remedied by the remaining balance for 2020.

- Distributors have already purchased 16 mm of Cbios, which represents 64% of their targets.

- There are about 9 mm Cbios left to be purchased by December 31, 2021.

- According to the ANP, some distributors have already proven that they have met the targets set for the year.

- Therefore, everything indicates that the other distributors will reach the goal within the deadline.

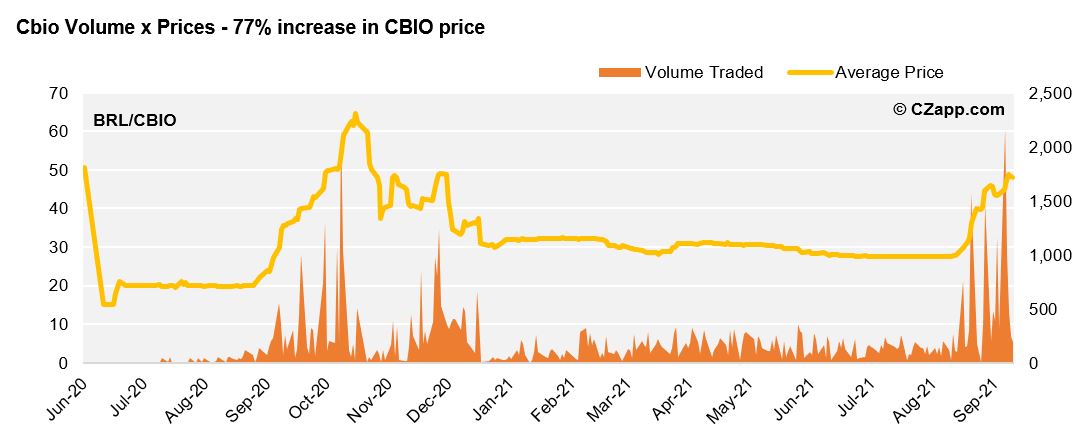

Why are Cbio’s prices soaring?

- Until the month of August, the trading volume of Cbios and its price did not vary much.

- An average of 176,000 Cbios were traded per day, far from the liquidity seen at the end of last year.

- And so the price of Cbio “parked” between 26 and 29 reais.

- However, as of September, demand picked up and the Cbios prices broke with stability, raising 48 BRL/Cbio – an increase of 77% in the month.

- Despite different circumstances, the behavior of the September 2020 and 2021 negotiations was similar.

- As the deadline for achieving the goals approaches, the demand for Cbio has increased.

- Period also when it is less likely that there will be some type of review in the obligations of distributors.

- Another point is the large batches of Cbio purchases, made by distributors with the largest share of the target.

- Like Petrobras, which has a weight of 26% of the decarbonization target.

- This also affected demand, thus raising the price of Cbio.

and how much are mills earning?

- Until now, the volume of Cbios traded on B3 generated a financial value of 548 million reais.

- This all reverts the revenue to the issuers of Cbios, that is, the biofuel mills.

- With the goal not yet met, by the end of the year, issuers can receive around 297 mm reais.

- Remembering that this revenue is free cash for mills, so they can allocate the money wherever they need it.

Dashboard that you might like