Opinion Focus

- Retailers have changed strategies to carry higher inventories amid supply chain disruption.

- But the tide is now turning as inflation begins to dampen consumer demand.

- Warehousing excess inventories could cost retailers dearly ahead of the holiday season.

For many retailers, the past few years have been volatile. Faced with procurement difficulties, many began to shun just-in-time delivery in favour of an increase in stockpiling. Now, as demand starts to slow, the balance needs to be struck between reducing inventory and preserving profit margins.

Inventories on the Rise

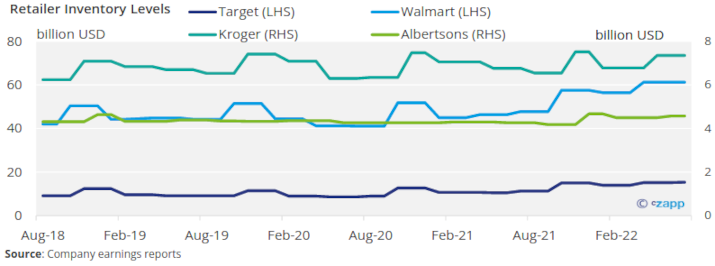

Retailer inventories are up. The issues with the supply chain in the past few years have led companies selling consumer goods to carry more stock.

In response to challenges in sourcing stock, many sellers are now shunning just-in-time solutions and investing more in storing greater levels of inventories.

In an interview with Goldman Sachs, US grocery chain Kroger’s CEO Rodney McMullen discussed the paradigm shift. “If you look at the supply chain before COVID… we might have two or three days of inventory in our supply chain… A warehouse really wasn’t a warehouse, it was just a flow-through facility,” he said.

Post-Covid, however, he noted that the tide has turned. “We are starting to decide part of the volume from Covid will be permanent,” McMullen said. “So, we need to start building a capacity that can handle things at a higher level.”

Holiday Seasonality Weighs

Traditionally, inventories rise approaching the holiday season in the US. In the months leading up to Thanksgiving and Christmas, retailers expect greater demand and therefore stock up.

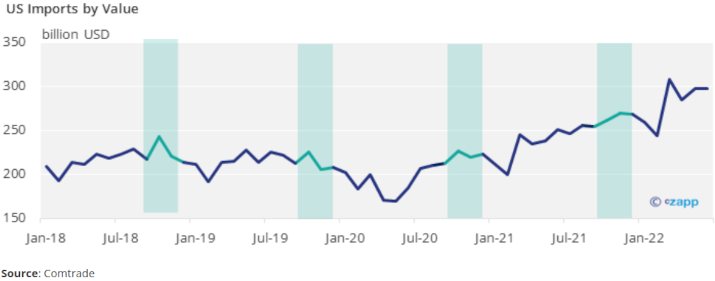

In the US in particular, peaks in imports can be seen in the months from September to December.

Already this year, the value of global imports has been elevated above normal years. Now, given the current levels of inventory, it seems retailers will struggle to find enough space in warehouses to cover the busy demand period.

Slowing Demand Exacerbates Situation

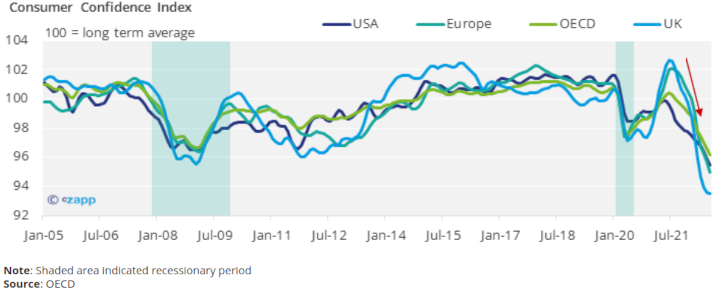

Not only this, but as stocks build up, there are preliminary signs of a dip in demand as the world enters a recession. Consumer confidence has plummeted among OECD countries.

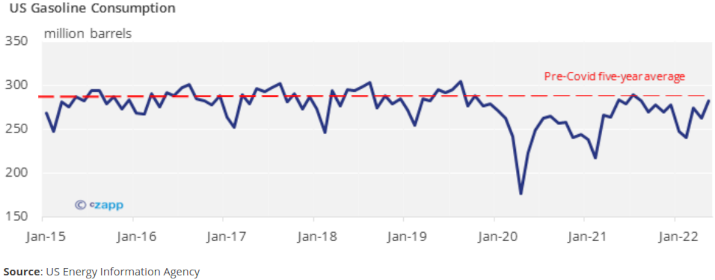

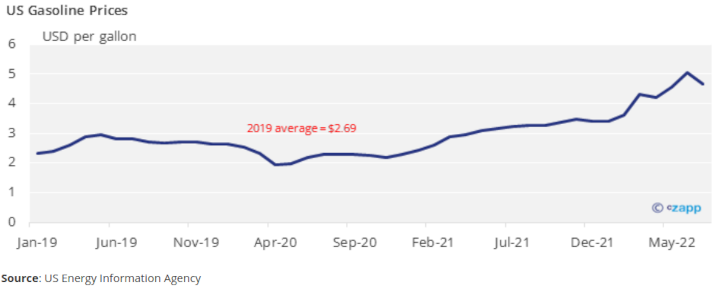

Already, there is evidence of a reduction in fuel demand among consumers. Since the dramatic Covid-related fall in early 2020, gasoline consumption has struggled to pick back up to previous levels.

Experts widely expect a lacklustre summer season – usually the peak demand season for US gasoline due to the prevalence of summer road trips. But extremely high prices exacerbated by the war in Ukraine put a dampener on demand this year.

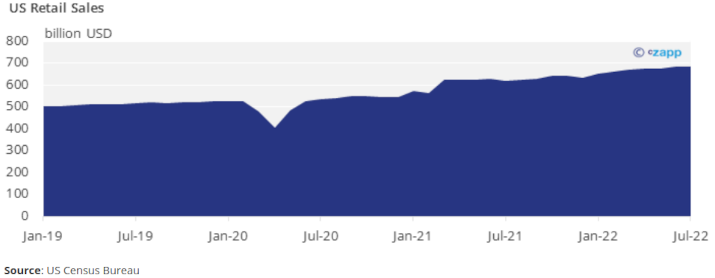

And while retail sales are continuing to climb, this is widely expected to drop off soon.

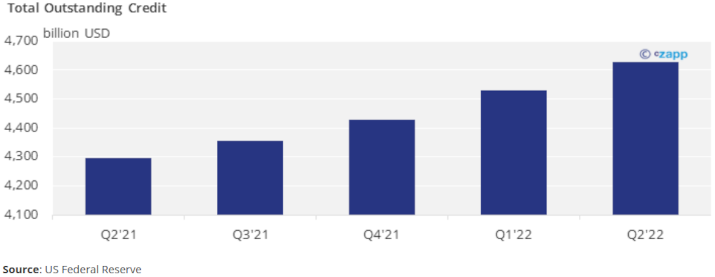

Rather than reducing spending mid the rising cost of living, the data suggests consumers are instead turning to credit.

This of course is not sustainable in the long term and spending is likely to drop off soon.

Retailers Heading for Mass Discounting?

With warehouses packed and consumer spending tailing off, the supply chain blockages are moving further downstream. This suggests that retailers may have to get creative in order to alleviate the logjams and free up cash flow, especially as warehouse space becomes more valuable during the holiday period.

This could mean significant discounting to alleviate high inventory costs. However, these price reductions are likely to be made on non-essential items rather than food.

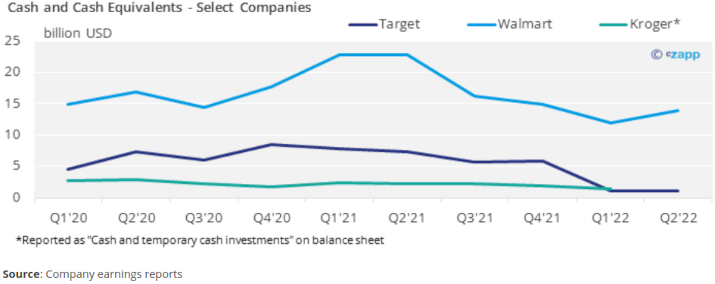

Walmart has already begun reducing inventory through markdowns. President and CEO C. Douglas McMillon said in the company’s third quarter earnings call that its previous stockpiling was “aggressive” and “put pressure on margins overall”.

For Target, efforts to reduce excess inventory have resulted in “gross margin pressure”, according to its latest second quarter earnings report. “This year’s gross margin rate reflected higher markdown rates, driven primarily by inventory impairments and actions taken to address lower-than-expected sales in discretionary categories,” the company said.

Concluding Thoughts

- Efforts to increase inventories toward the end of 2021 have resulted in excess warehouse stock for retailers.

- Now, faced with the prospect of a recession-related slowdown, retailers may need to turn to markdowns.

- These markdowns are likely to be focused on discretionary items rather than essentials.

- But if inventory gluts persist, retailers may find themselves with a lack of food warehousing space.

- There is a risk that space may not be available for high-demand holiday items.

- Any drop in food supply threatens to fuel the current inflationary flames.