994 words / 5 minute reading time

- The coronavirus could impact the EU’s Skimmed Milk Powder (SMP) trade the most severely.

- Drought has arrived early in New Zealand meaning some dairy farmers have already run out of grass feedstock.

- SMP demand from China is expected to drop.

The Coronavirus Could Impact EU SMP Trade the Most

Following a recent trip to New Zealand in which I excperienced both major risks first hand I thought I should share some thoughts. My recent flights transited through Hong Kong, where I experienced temperature scans to be allowed through transfer gates and a flight with only 103 people on it (capacity ~300).

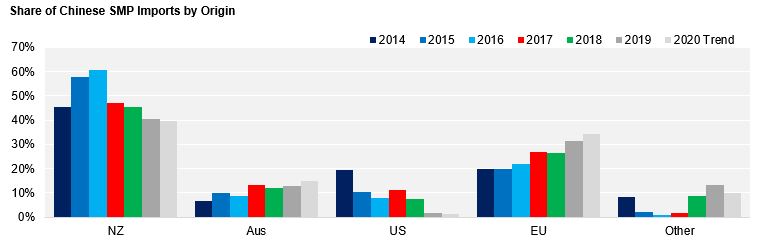

China is of course at the heart of the COVID-19 epidemic. China is also very important in the trade of SMP having imported a record 344k tonnes of SMP in 2019, up 23% from 2018. The compound annual growth rate in Chinese SMP imports has been 6.3% since 2014. As you can see below, the EU has gained a significant market share over this time – if the six-year trend were allowed to continue unabated, this would lead to the EU having 34% share of an expected 365k tonnes of Chinese SMP imports this year.

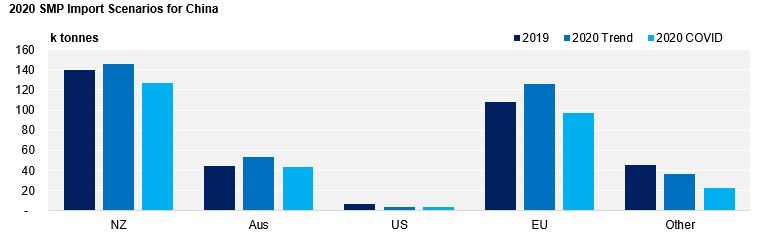

However, if we take the average drop in imports seen between 2015 and 2016 as a “bad” case, due to extended COVID-19 impacts, then Chinese imports could fall 14% in 2020. If we then make some more granular assumptions:

- Applying the fall in Chinese SMP imports experienced by Australian, US and EU origins over 2015 and 2016.

- As NZ was not as impacted over this time, let us assume imports from NZ return to 2018 levels.

We can then see that the EU stand to lose the most in absolute terms relative to trend, a swing of ~28k tonnes. Relative to trend NZ could stand to lose ~18k tonnes and Australia ~10k tonnes.

- Europe is reporting increasing numbers of confirmed COVID-19 cases, these appear to be largely connected to northern Italy. Eleven Italian towns in this area have now been quarantined.

- Northern Italy is the main dairy region of this country. The lockdown will undoubtedly affect milk collections here at an important time where Easter production runs will be underway; short term exports could also be impacted. This will obviously be magnified if COVID-19 spreads across the continent.

- Expect local demand for dairy products to also be impacted by these developments.

- The net impact could be a wash – but traditional markets served by European supply such as the Middle East and North Africa could also see shipments delayed or products being shorted.

- Near term this could be bearish prices from Europe as suppliers try to clear stocks while they can, following which we may see prices for other markets being bid up as buyers search for alternate supply options.

Drought Arrives Early in New Zealand

Below is an aerial photo of the Waikato, New Zealand’s largest dairying region, courtesy of the NZX. It is visibly dry and gives a more tangible lens to the severe dry which NIWA’s soil moisture charts have been showing for some time. Speaking to some farmers in the region, I am told that some have “run out of grass” and are already feeding out silage – this is incredibly early for this sort of situation to arise.

- Of the NZ-based processors, Fonterra (representing 81% of NZ collections) are likely to be the most impacted by drought given the location of their assets.

- Combining data from the Fonterra Global Dairy Update and DCANZ we can see that while total NZ collections were flat season-to-date through December, Fonterra’s collections were down 0.7% and other NZ processors were actually up 3.7% over the same period.

- Given the dry conditions would have only really started to bite after the New Year, I would expect national collections to be negative now YTD (approx. -0.1%); Fonterra to be down >1% YTD and other NZ processors to still be up over 2% YTD.

- This has two implications:

- Smaller players in NZ make relatively less commodity products, so total commodity availability will be down ex-NZ assuming a flat or lower milk pool.

- Even though SMP/Butter will currently be the higher value stream, Fonterra are likely to be making as much WMP as possible to manage their COGS.

- The combined result is that of a material tightening for NZ SMP availability in the short term.

What Does This Mean?

Given the above two major risks, it would seem the EU will be most impacted by a slowdown in Chinese SMP consumption due to the Coronavirus. The possible reduction in NZ exports may be taken care of by its own drought situation.

Other Things to Consider

A few points on the US:

- After bottoming in October, Non-Fat Dried Milk (NFDM) stocks have started to increase again to 113k tonnes as of December 2019, which is still relatively low.

- US cold storage released earlier this week showed large gains in butter stocks (+28% MoM to 110k tonnes).

- Growing stocks of both NFDM and Butter should weigh on prices short-term and impact the value of the NFDM/butter stream. The few producers able to swing production toward cheese are likely to do so, tempering price falls in the medium term.

- Given lesser reliance on Chinese demand and current lesser COVID-19 impact, the US could be well placed to gain from the current fundamental picture for dairy.

A Technical Point:

I have mentioned cross-commodity spreads and Fibo levels in previous reports (covering WMP and SMP), but another useful tool in the technical space is mean reversion. I have modelled a price forecast for NZ SMP based on its calculated long run mean, calculated mean-reversion, currently exhibited volatility and included a random error term. Using an Ornstein-Uhlenbeck process this average forecast price is just under $2,600 USD/mt for the May contract in a month’s time, with a common range of $2450-2850, though observations can exist outside of this.

Sources: NZX, CLAL, Bloomberg, Sky News, Fonterra GDU, DCANZ, USDA, BBC