Insight Focus

- Demand for veg oils from the US renewable diesel industry will overwhelm nearby supply.

- The Dec/Jul soybean oil futures spread is strengthening rapidly.

- US soybean export sales are slower than last year’s.

Returning briefly to 2 themes I have focused on frequently over the last 3 months:

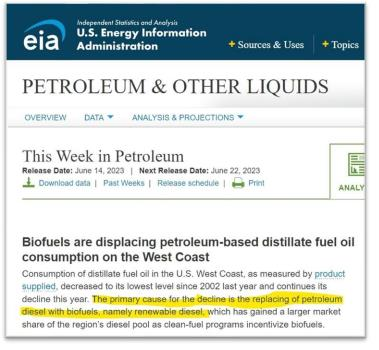

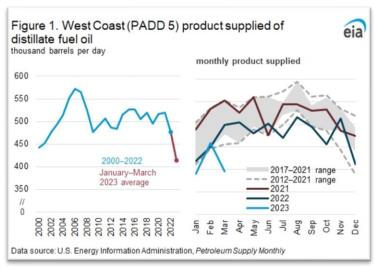

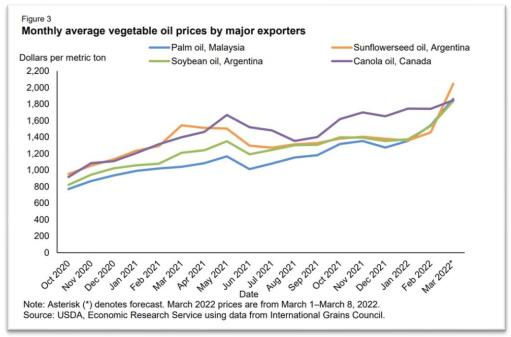

1. Unprecedented demand expansion for vegetable oils from the US renewable diesel refining industry has recently overwhelmed nearby supply and will likely do so again in 2023, a topic I have identified as RD 2.0. My essays have featured the observations of senior management from two US vegetable oil feedstock producers, Archer Daniels Midland (NYSE:ADM) and Bunge Limited (NYSE:BG), during recent earnings calls and the typical Q and A sessions with analysts that follow, as well recent industry conferences. The management teams’ “heads up” to consumers went like this: “wait until the public statistics come out and you can see how busy our vegetable oil trading desks have been; you will be shocked.” And so we have this yesterday from the EIA: https://www.eia.gov/petroleum/weekly/

The middle part of the soybean oil futures curve is where I have been watching for a SIGN that supplies are tightening and it is clear something (bullish) is changing the shape of the curve (the first place where we fundamentally oriented discretionary traders look for evidence of a change). Below features the December 2023/July 2024 calendar spread, the middle, with Fibonacci analysis (which I have mentioned before I like to use for spread analysis and trading).

Source: Refinitiv Eikon

Suffice it to say this part of the curve is motoring higher and pushing through RESISTANCE. Traders know what this means: higher probability that the bulls are about to take over. Need help to understand this?

I have featured this chart many times in my essays: here is RD 1.0.

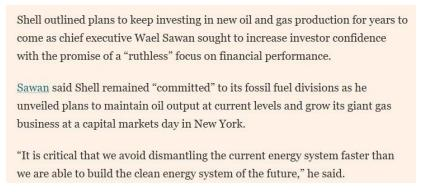

2. I recently wrote this essay on a different group of CEO’s providing a “heads up” about a change: https://tinyurl.com/3pmneztr The petroleum industry management leadership is now no longer afraid (of their boards, of their investors especially pension funds, and of the “no petroleum ever” crowd) to say the quiet part out loud. This manifested itself yesterday when one of the majors travelled from Europe to NYC to say that “the transition takes longer than you think” quiet part out loud. The FT summarized it this way:

Other very brief macro thoughts:

- The bearish trend following funds maintain short positions across agriculture (except for soybean meal) and the bulls are stirring and starting to trot

- The EPA delayed the final RVO for another week but bulls run over everyone, including apparatchiks

- US export sales for corn and soybeans remain well below a year ago (especially for soybeans) due the long tail of the record Brazilian production of both crops (the primary export oriented second corn harvest just getting under way) moving into traditional US export windows and destinations

- US soybean meal sales remain robust for this and next year but the USDA economists are slow walking their recognition of that

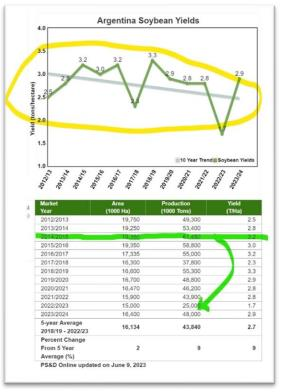

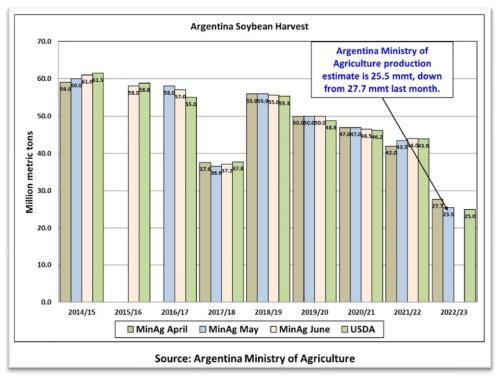

- The bears and their trend following compatriots may have forgotten this: 9 year trends are hard to break and USDA early forecasts for this year’s Argentine soybean production predicted 51 million metric tons of production that ended up at 25, so recovery to 48 next year, maybe (or not):

Or: 25.5 from a different source.

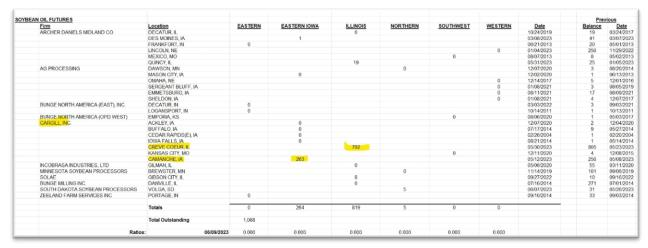

The CME’s soybean oil delivery window: the highlighted will likely not be there for long, IMHO.