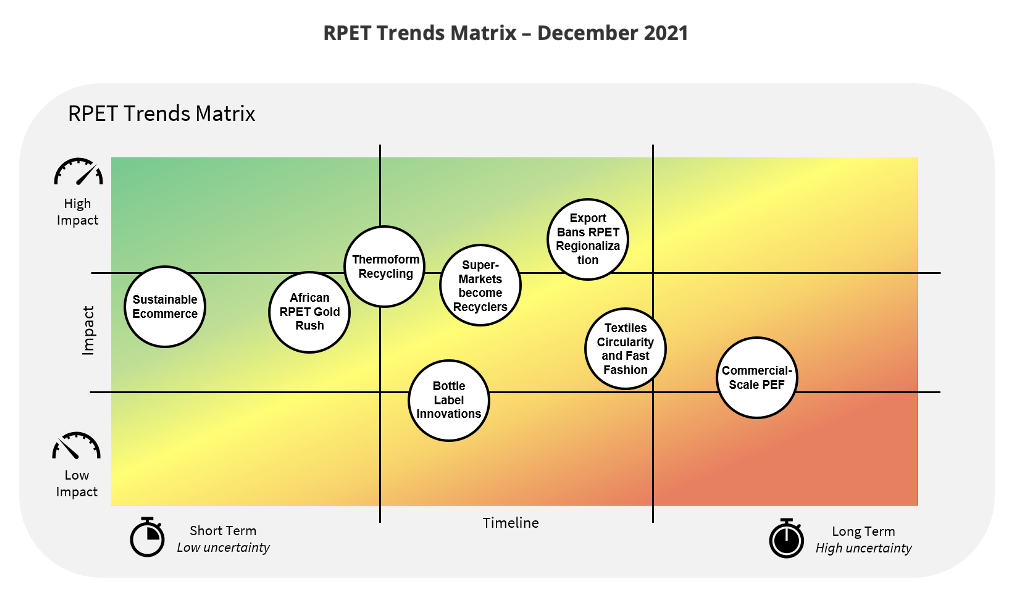

- In a world overloaded with data and information, it’s difficult to identify industry trends.

- This process allows you to spot disruptions or opportunities ahead of time and prepare for shifts in industry dynamics.

- Every month, we’ll filter and analyse the latest recycling market information and reveal interesting trends and patterns.

The Trends Matrix below shows those market changes that we believe deserve greater attention. Full articles covering some of the key trends will follow through the month.

This Month’s Top Trends

1. Ecommerce Tackles Sustainable Packaging

COVID-19 has accelerated the adoption of ecommerce at an incredible rate, fuelling concerns around sustainability.

Ecommerce typically uses more packaging than traditional retail, and consumers increasingly expect online retailers and brands to use sustainable options.

With a 40% market share in North America, and accounting for 9% of the entire global ecommerce market, Amazon is central to change and trends within this sector.

In November, Amazon announced plans to replace all single-use plastic packages with paper-based bags or cardboard boxes in Germany by the end of 2021. This follows the elimination of all single-use plastic packaging across more than 50 of Amazon’s national fulfilment centres in India.

Within France, the national postal service, La Poste, is also turning to new reusable and recyclable packaging solutions for ecommerce.

Implications

You may have noticed changes in your latest Amazon order; plastic bubble wraps, plastic air pillows, and thin films are being increasingly replaced with paper-based solutions.

The types of packaging being targeted are flexible plastic films, largely due to the difficulty in collection and recycling. Demand for these types of items and materials within the commerce space should decline within certain key markets, particularly North America and Europe.

La Poste’s interest in reusable packaging, however, may support the growth of new plastic-based packaging solutions and mean polymers, such as PET and polypropylene (that are easier to recycle), see greater use.

Click here to read related article.

2. Creating Circularity in Textiles

The packaging industry isn’t alone in facing a sustainability crisis. According to a June 2021 report from London’s Royal Society for Arts, as much as 88% of new clothing items from fashion retailers contain virgin plastics, with little to no way of recycling end products.

Although around 60% of global post-consumer bottles are recycled into the fibre and textiles, just 15% of consumer-used clothing is itself recycled. Therefore, despite the advances in collection and recycling of bottles, the vast majority is still only one stop away from ending up in landfill.

The fashion industry is under increasing pressure to improve its sustainability credentials, but new initiatives and technologies are emerging to support greater circularity within the industry.

Ambercycle is one such technology, which separates blended polyester from textile waste and produces a purified polyester pellet that can be turned back into clothing.

And on the 2nd November, Northern Europe’s first recycling centre for discarded textiles officially opened its doors in Paimio, Finland.

Implications

Many fashion brands will continue to target greater use of recycled content, primarily from PET bottles. However, increased demand for the same bottle pool from the food and beverage industry will ultimately constrain supply for textiles.

Unlike many plastics, infrastructure for the collection of clothing is widespread. The bottleneck is therefore on the efficient recycling of end-of-use clothing and investment in the sector.

Truly improving sustainability with fashion brands and fibre manufacturers will require investment in new recycling capacity in the same manner as the beverage brands. However, will fast fashion consumers be willing to stomach the additional cost?

Click here to read related article.

3. Could Thermoforms Help Balance Future RPET Demand in the Americas?

According to the National Association for PET Container Resources (NAPCOR), the amount of RPET used by end markets in the US and Canada increased by 10% in 2020.

Higher market demand outpaced collection, with US PET bottle recycling rates dropping to 26.6% in 2020, down 1.3% year-on-year.

Demand should continue grow across North America in the coming years as post-consumer recycled (PCR) content commitments and mandates do too.

Mexican legislators have recently endorsed a proposed law that’ll require numerous plastic products to contain 20% recycled materials by 2025.

To supplement RPET supply, there’s significant interest in the collection and processing of PET thermoforms.

Implications

Collection rates will unlikely be able to meet future demand growth. Therefore, to keep pace with PCR mandates and brand commitments, other recyclate pools must be tapped into.

Although challenges exist in the processing and mechanical performance of thermoform flake, new initiatives and technologies are under development to recover PET trays and overcome quality and technical challenges.

Further advances could give access to a sector that represents around 20% of post-consumer PET packaging. Development of a tray-to-tray market would free up additional bottle supply for the food beverage sector.

Click here to read related article.

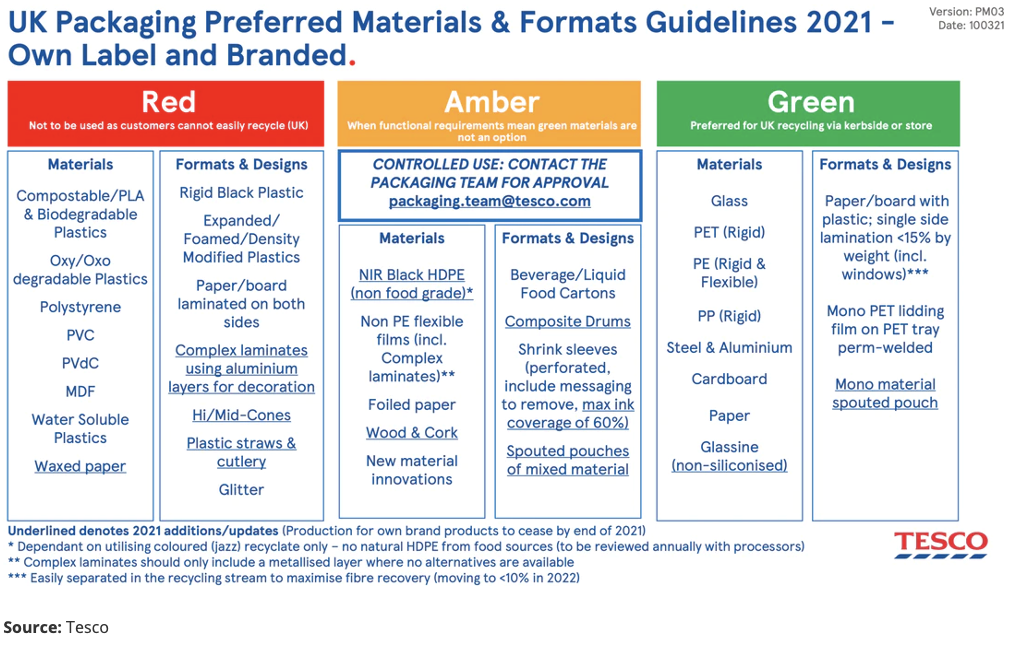

4. Will Supermarkets Become a Driving Force in the Recycling Sector?

In November, the UK Supermarket chain, Morrisons, became the first supermarket to acquire its own recycling operations, having taken a significant stake in a recycling site in Scotland.

In recent years, supermarket chains, particularly across Europe, have become leaders within packaging sustainability, setting the agenda for much of plastics industry.

Tesco has recently set out a traffic light system for sustainable packaging materials for UK suppliers. Brands that want a space in one of Tesco’s stores must comply with preferred packaging material and format suggestions, driven largely by material recyclability.

Other supermarket chains have also recently launched a range of other recycling initiatives and have become focal points for the aggregation and sorting of packaging materials.

Implications

Whilst supermarkets are championing the use of easier-to-recycle packaging, supermarket-own brands represent over half of the value share in the grocery market, according to retail analyst, Kantar.

In many ways, challenges facing supermarkets around packaging sustainability and the supply of recyclable materials dwarf those of many individual beverage brands, so a greater number of major supermarkets are likely to follow Morrisions’ lead in directly investing within the recycling space.

Owning future supply security is a critical issue within the beverage sector. With the sheer volume of packaging consumed by supermarkets and the footprint available at many sites, supermarkets are ideally suited to become centre points for future waste management.

Click here to read related article.

5. Recycling Gold Rush in Africa

Last month, Nestlé Waters launched Egypt’s first water bottles made of 100% recycled plastic (RPET). Not only was this a first in Egypt but also one of the first from a major brand outside of South Africa. This is a strong indication that multinational commitments may now spread rapidly across the continent.

To keep pace with any future demand, regional recyclers are tapping into the readily available waste supplies, with Africa fast becoming a hot bed for recycling activity.

Coca-Cola Beverages Africa (Kenya) has recently reported efforts to boost recycling in collaboration with PETCO Kenya. Collection rates have doubled in recent years, reaching 72% in 2020.

Recycle Up Ghana, sponsored by DOW, are spearheading collection and waste recovery in Ghana and within West Africa.

Petco South Africa is also rolling out new mobile technologies to recycling buy-back centres to “revolutionise” how recyclable materials are traded, tracked, and traced in South Africa.

Implications

The majority of PET collected and recycled outside of South Africa is typically destined for export, either to Europe or Asian fibre manufacturers.

Many beverage companies within Africa use little to no recycled content, largely due to the premium over virgin resin, but also due to the perceived requisite to do so.

Multinational brands are increasingly shifting focus onto their African markets with many sustainability commitments needing to be met across all sales regions.

To meet 2025 targets on recycled content, rapid investment and supply chain development needs to be actioned.

Local recyclers are springing up almost overnight in what’s rapidly becoming something of a gold rush across many African countries.

Creating formalised structures including cooperatives may be challenging.

Click here to read related article.

Other Insights That May Interest You…

Explainers That May Interest You…