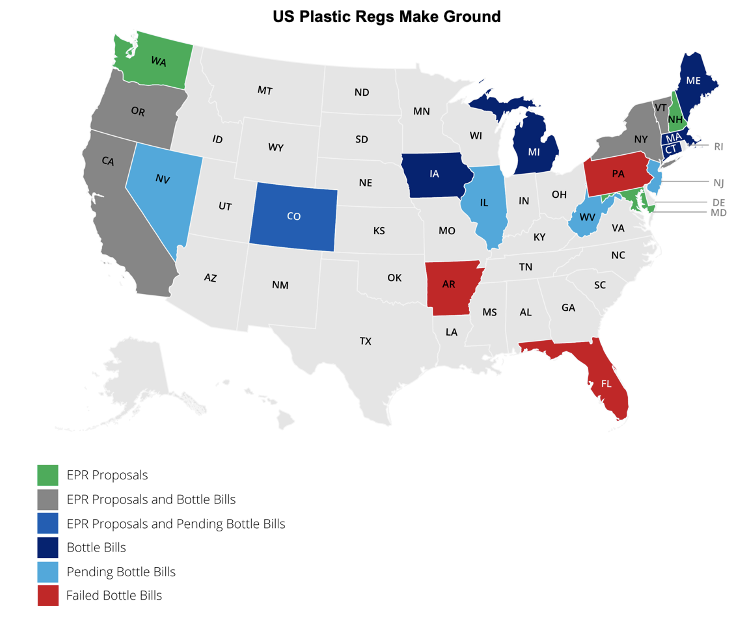

- US plastic taxes and regulations are gaining momentum as more states attempt to adopt new recycling regimes.

- Several states have passed extended producer responsibility laws, others are proposing virgin plastic taxes.

- After many years of pushback, has the dam finally burst on recycling regulations in the US?

US Plastic Regulations Gain Momentum

New US plastic regulations have gained momentum in recent months, after being side-lined by COVID for much of the last year. Previous US regulations have solely been implemented on a state level, confined to California and smaller North-Eastern states.

REDUCE and RECYCLE Acts

Last month, the $550 million Infrastructure Investment & Jobs Act passed Senate. The bill incorporated the Recycling Enhancements to Collection and Yield through Consumer Learning and Education (RECYCLE) Act, which creates a federal grant program for recycling outreach and education.

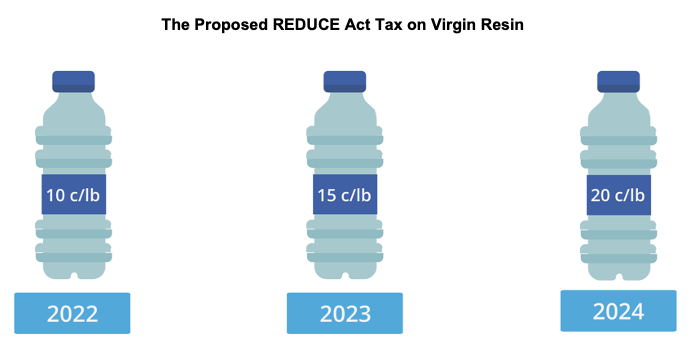

The Rewarding Efforts to Decrease Unrecycled Contaminants in Ecosystems (REDUCE) Act is another impactful new piece of federal legislation that was referred to the Senate Finance committee in August. REDUCE has recently been elevated in Washington, and Senate democrats are now considering the tax as part of their $3.5 trillion budget plan.

The bill proposes a flat tax on virgin resin that increases with time. In 2022, the tax would start at 10 c/lb, moving up to 15 c/lb in 2023 and 20 c/lb in 2024.

Thereafter, the tax would increase based on cost-of-living adjustments.

Extended Producer Responsibility Legislation

Since July, both Maine and Oregon have adopted legislation that would require producers of packaging products to take responsibility for their products after the point of sale.

In Maine, the legislation requires producers to pay into a state fund that’ll be allocated to municipalities to reimburse recycling and waste management costs.

In Oregon, manufacturers must set up a non-profit that’ll develop a recycling plan for packaging materials.

Other states are ready to follow the leads of Maine and Oregon. Large states, New York and California, also have similar legislation in the pipeline, which would be highly impactful for plastic producers.

Minimum Recycled Content Requirements

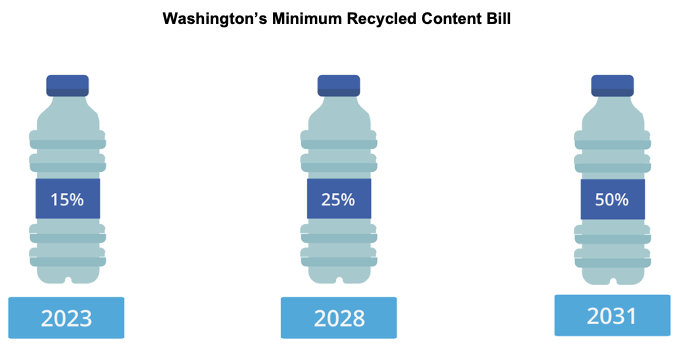

In Washington (state), legislators have implemented minimum recycled content requirements for plastic beverage containers, trash bags, and household cleaning and personal care product containers.

Washington’s minimum recycled content bill includes a staggered ramp-up in requirements over the next decade, starting at 15% postconsumer content within beverage containers from January 2023, before increasing to 25% in 2028, and 50% recycled content by 2031.

Rates will be reviewed on an annual basis starting in January 2024. The legislation also outlaws certain expanded polystyrene products.

In June 2021, Connecticut joined Washington and other states in passing legislation to boost plastic recycling and recycling infrastructure. The bill requires the Connecticut Commissioner of Energy and Environmental Protection to develop recycled content requirements for “products sold in the state” by December 2022.

Break Free from Plastic Pollution Bill Resurges

This month, the California legislature passed a bill aimed at reducing plastic waste that’s exported to other countries. The bill mandates that each city, county, or authority must make a 50% reduction in solid waste by recycling, reducing, and composting. Plastics that are exported for recycling are exempt from the legislation.

The American Chemistry Council (ACC) applauded the move, saying that the reporting criteria will create a more accurate baseline of recycling rates that’ll allow further action to be taken.

Concluding Thoughts

- With the US lagging behind other countries in terms of bottle collection rates, one of the major challenges to the implementation of any future minimum recycled content legislation is going to be supply.

- Legislation in some US states even goes beyond the EU’s Single Use Plastic directive, whilst collection rates in the US are only around half that of Europe’s.

- As the US plastics industry braces for a new wave of legislation, greater investment in domestic collection and recycling infrastructure is needed now, more than ever, with collection economics favouring recovery over landfill.

Other Opinions You Might Be Interested In…

- RPET Trends in September 2021

- RPET Trends: Recycling’s Digital Revolution

Explainers You Might Be Interested In…