- Refillable PET bottles are growing more popular across Latin America and developing regions.

- Usage is still limited in Europe and the US, but refillables are staging a comeback.

- Could new initiatives lead to greater plastics circularity within Europe?

Refillable Bottles Are an Established Option in Latin America

Refillable items have a long history in the developing world. They’re generally more cost-effective and enable brands to develop a wider consumer base due to a more affordable price point.

Across Latin America, returnable glass and PET bottles are established packaging options for a wide range of big beverage brands, covering everything from Coca-Cola to Guinness.

In Mexico, refillable glass bottles hold between 75% and 80% of the market share in Mexico’s beer market. Refillable soft drink containers also remain popular.

In Argentina, while higher-income households tend to use single-use PET bottles, lower-income families prefer refillable bottles due to cost savings. Mercosur legislation means countries aren’t allowed to reuse food grade plastic, except for carbonated non-alcoholic beverages.

In 2018, Coca-Cola Brazil invested $25 million in designing a new reusable PET bottles and $400 million in expanding their reuse infrastructure (bottle cleaning and refilling facilities) as part of their aspiration to significantly scale up reusable packaging by 2030.

Refillable initiatives have also long existed on both the large and small scale in India. Mumbai-based packaging firm, Restore, partners with well-known skincare and cleaning product companies to offer a bottle exchange program. Customers can order their preferred products through the Restore app and exchange the empty bottles for full ones.

Similarly, in Indonesia, the Siklus app provides refills for shampoo, detergent, and cooking oil to homes in Jakarta at prices of 10% to 20% below retail price. The initiative means consumers no longer need to use small disposable sachets to buy products in small quantities.

And more recently, Coca-Cola Beverages South Africa has expanded the roll-out of 2LK returnable PET bottles across several South African states after a successful pilot scheme in the Eastern Cape region in 2019. Depending on where the customer purchases their bottle, the new 2L returnable bottles retail at a significant discount to traditional packaging formats.

Returning to the Mainstream Within Developed Markets

Although the refillable market used to be extremely popular in Northern Europe and the US, most bottle return schemes largely died out through the 1980s and 1990s as cheaper cans and PET bottles began to gain greater traction.

According to Reloop, a plastic waste initiative, at the turn of the century, the share of the total beverage market for drinks sold in refillable containers across European countries was 41%. By 2015, this had decreased to just 21% of the European beverage market. According to Coca-Cola, in 2020, refillable PET bottles represented 13% of the PET bottles it placed on the market.

Although use is still limited across much of Europe and the US, refillables look to be staging something of a comeback. Consumer concerns around plastic waste has already resulted in a large uptake in refillable personal water bottles within these regions. This trend highlights that there is potentially no hard and fast link between income and consumer preference towards refillables.

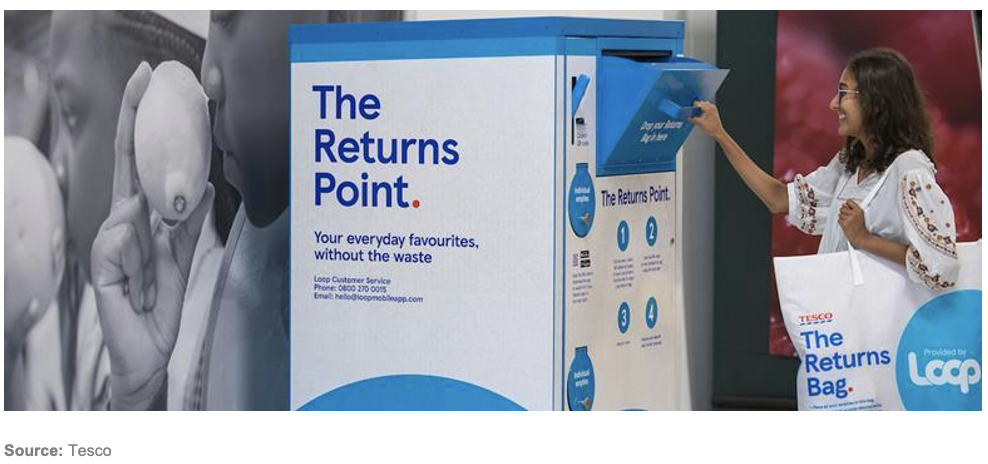

Loop, an initiative launched by US-based Terracycle, is among those spearheading this refillable comeback, and allows consumers to return plastic packaging to stores. The initiative is currently working with food and retail chains around the world, including Kroger and Walgreen’s in the US, Tesco in the UK and Woolworths in Australia.

In September 2021, Tesco, in partnership with Loop, launched refillable aisles in ten large Tesco stores in the UK where customers will be able to buy products in reusable packaging that can be returned to store when finished so it can be cleaned, refilled, and used again.

Tesco’s new reusable range of 88 products will include some of the UK’s biggest and most popular brands, from homecare products to, soft drinks and beer, as well as 35 own brand essentials, such as pasta, rice, oil, and sugar.

Like the Loop initiative, Unilever has also partnered with supermarkets Asda and Co-Op to provide refillable options for seven of its tea, beauty, and cleaning brands. Following a successful trial at Asda’s sustainability store in Leeds (UK) last year, Unilever has now expanded its refillable trial to include an additional seven stores in the UK. Customers visiting these stores can pick up pre-filled stainless-steel bottles containing some of Unilever’s best-known home and health care brands and, on their next visit, simply return the empty bottle or ‘refill on-the-go’ using a standalone refill station.

Others are also getting in on the act. European supermarket chain, Morrison’s, has also implemented a program to refill customer containers at its Market Street food counters.

A New Generation of PET Water Bottle

Within Europe, Germany is one of the few countries where refillable bottles, especially for mineral water, are still available. Elsewhere, the use of refillable beverage bottles has all but disappeared.

Over the last few years, leading packaging companies, including Alpla (Austria), Sipa (Italy) and Petainer (UK), have partnered with beverage brands and bottlers to design a new generation of refillable bottle for European markets.

Last December, Alpla produced a new PET returnable bottle for a German bottled water and soft drinks cooperative, Genossenschaft Deutscher Brunnen. In June 2021, Alpla also partnered with the Austrian mineral water company Vöslauer to develop a similar reusable PET bottle.

Whilst in April 2021, Petainer supported the German Wells Cooperative in providing a refillable bottle with 30% recycled content.

Lifecycle Analysis

What would a switch to a refillable water bottle mean for carbon footprint?

Life Cycle Assessments carried separately out by Coca-Cola, Alpla and Petainer, have shown that high RPET content and a lower weight can significantly lower a bottle’s environmental impact.

Returnable bottles are typically required to last at least 15 trips, with a figure of 25 trips being a realistic lifespan. ALPLA’s reusable 1L PET bottle was also around 90% lighter compared to glass alternatives, weighing just 55 grams, helping to lower the carbon footprint by nearly 30%. And even when a bottle is withdrawn at the end of its life cycle, it can be recycled back into the RPET stream.

Another key finding was that the carbon footprint from refillable PET bottles is around 80%; less when compared to returnable glass bottles over the same use cycle.

Concluding Thoughts

- In a world targeting a reduction in plastic waste and lower carbon footprints, will reusables regain market share within Europe?

- High RPET content refillable bottles could have a profound impact on the environment and plastic demand.

- In conjunction with a Europe-wide rollout of new deposit return schemes, the introduction of more refillable bottles could create much greater bottle-to-bottle circularity.

- One of the major challenges, particularly in the wake of COVID, will be health and safety perceptions within European and US consumers; although multiple consumer surveys point to consistently high support of refillable options, refillable dedicated aisles may not be the right approach to win over the masses.

- Part of the reason refillable market penetration is so high across Latin America is because returnable bottles aren’t marketed as such, they’re simply part of the mainstream and in some cases the only option for consumers.

- Do refillables simply have an over-engineered marketing problem within Europe?

Other Opinions You Might Be Interested In…

- RPET Trends: Growth in Compostable Packaging

- RPET Trends: Tackling Hard-to-Recycle Plastics

- RPET Trends: Investors Double Down on Recycling Goals

- RPET Trends: Tackling Hard-to-Recycle Plastics

- RPET Trends: Growth in Compostable Packaging

Explainers You Might Be Interested In…