Insight Focus

Despite a smaller crop, Russia continues to export at pace. The price of Russian wheat is also undercutting other origins, forcing the hand of exporters like the US to compete more aggressively. All around the world, there is huge uncertainty over crops due to weather issues.

As the marketing year progresses from July 2024 to June 2025, a surprising development is that Russia continues to be the cheapest seller, shipping out large volumes despite a smaller crop, while also indicating a shift towards a more government-controlled approach, and moving away from free trade.

This situation has forced the US to compete more aggressively, putting pressure on its prices. Meanwhile, most EU countries have maintained a price premium while reducing their exports, although there is optimism among buyers that Argentina and Australia will produce significant crops for export in the New Year.

Wheat Prices Face Supply Challenges

Russia is currently maintaining a price cap to keep its ‘Friendly Countries’ supportive on the political stage. However, it appears that there may not be enough wheat to sustain this strategy until the 2025 harvest.

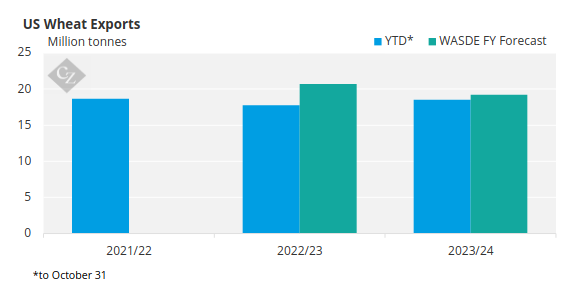

Meanwhile, US exports are running 34% higher than last year, whereas the USDA is only forecasting a 17% increase for the year. This discrepancy suggests that, like Russia, US shipments may need to slow down as the New Year approaches.

In the Southern Hemisphere, Argentina and Australia are counting on large harvests to fill the gaps for buyers in the first half of 2025, but this outcome is by no means guaranteed. Early predictions do not indicate robust Northern Hemisphere harvests for 2025, as adverse weather conditions are hindering planting.

Ultimately, supply and demand will determine prices. Dwindling global stocks can only be temporarily offset by the current willingness of major players like Russia to sell now without regard for the future. The coming months may provide reassurance to buyers if supply forecasts for the 2025 crops prove sufficient.

Conversely, it could be buyers who end up driving prices as they struggle to secure supplies. In the world of supply and demand, short-term and long-term conditions may not necessarily present the same pricing outlook.

Fair Value Remains Ongoing Debate

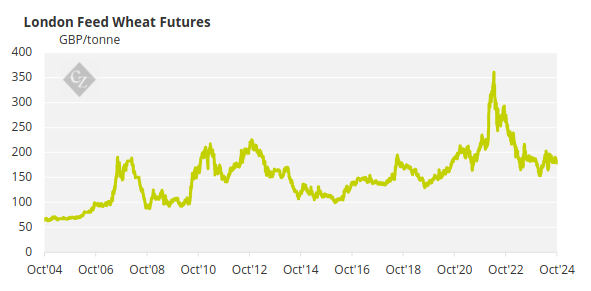

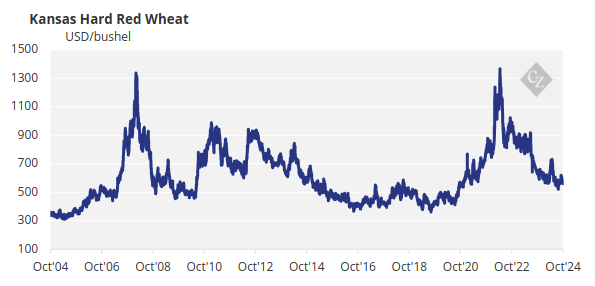

Looking at prices over the last 20 years, as shown in the charts below, suggests that today’s levels are quite ordinary and could represent fair value.

However, the situation may be more complex than it appears.

Given the assumption that supply and demand drive prices, it would seem logical for wheat prices to be even higher, as discussed in our previous article.

These factors explain why low supplies and rising demand should lead to higher wheat prices:

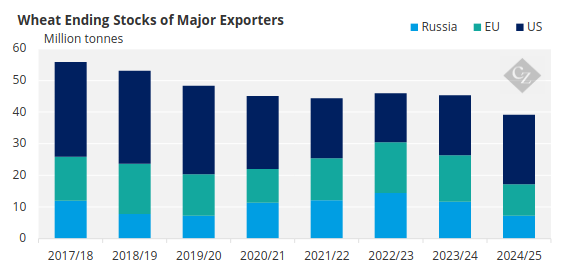

- Global wheat stocks are at an eight-year low – When the available wheat supply is the lowest it’s been in almost a decade, it puts pressure on the market, as there is less wheat available to meet demand.

- Demand for wheat keeps rising – As demand increases yearly, without a corresponding increase in supply, prices typically rise to balance the gap between what’s available and what’s needed.

- China holds over half of global stocks – China, which holds a huge portion of the world’s wheat but isn’t an exporter, keeps its stocks largely out of the global market. This concentration reduces available supply for other importing countries.

- Stocks among major exporters have dropped – Wheat reserves among the world’s primary exporters (such as Russia, the EU, and the US) were much higher eight years ago. This decline in exporter reserves further tightens the available supply for global buyers.

Source: USDA

Weather, Geopolitics Weigh

Examining the current global situation helps explain today’s prices. The world is as unsettled as it has been in 80 years, with major conflicts occurring in Europe and the Middle East. Russia, the world’s largest wheat exporter, is led by President Putin, who is openly seeking to disrupt and redefine the global order, as evidenced by his actions at the recent BRICS summit in Kazan.

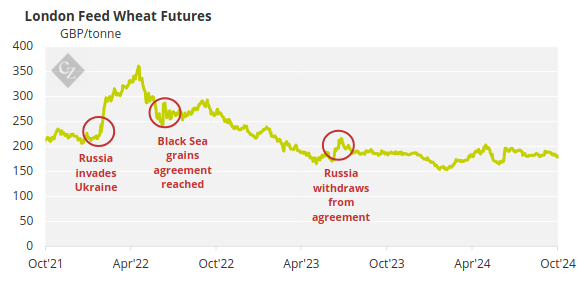

Putin created turmoil in wheat prices following Russia’s invasion of Ukraine in February 2022, which made grain exports from Ukraine’s Black Sea ports extremely difficult. Despite Putin’s efforts, Ukraine has continued to ship surprising levels of grains.

This Ukrainian resilience has calmed the market since 2022 but there have been some jitters since, including after Russia’s withdrawal from the Black Sea Grain Agreement in July 2023.

Putin has assured major importing nations, such as Egypt, the world’s second-largest importer, that those who are supportive and loyal to Russia—termed “Friendly Countries”—need not fear, as Russia will continue to sell them grain at low prices.

Egypt has been particularly impacted by rising food costs and a strengthening US dollar, given its dependence on food imports.

This year has also seen extraordinary weather patterns worldwide, resulting in:

- The US achieving a larger harvest and increasing exports.

- The EU experiencing a poor harvest, with its largest producers, France and Germany, facing their worst harvests in 40 and 20 years, respectively.

- Russia also having a poor harvest, which has reduced its exports by 8-10 million tonnes.

- Argentina and Australia hoping for improved harvests as the year comes to a close.