Insight Focus

The frosts reported last week in Russia have now spread to Ukraine, causing damage and creating uncertainty over supply. The corn price rose with wheat but planting advances in the US have generated a bearish sentiment.

Last week, wheat had an expressive rally on the back of more losses in Russia and now, there seems to be indications of a worsening in the situation. Not only this, but damage was also reported to wheat crops in Ukraine, pulling corn higher.

All the unknowns in the market are risks to production and although the market has priced in some production losses, if there is no clarity on the full impact of the losses, we should see the market well supported.

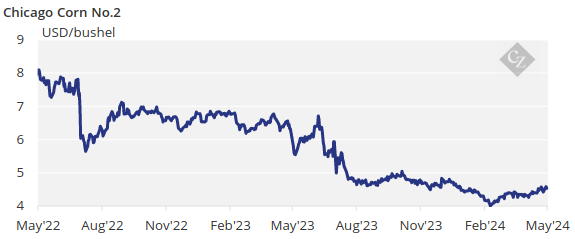

We have revised our Chicago corn forecast for the 2023/24 (September/August) crop upwards to average USD 4.60/bushel compared with a range of USD 4.15/bushel to USD 4.40/bushel previously. The average price since September 1 is running at USD 4.55/bushel.

Wheat Rallies on Russia, Ukraine Frost

There was a substantial Monday rally in wheat, both in Chicago and Euronext following rumours the damage of the frost in Russia continues to increase. Reportedly, it has now even impacting Ukrainian wheat — something the market was not expecting.

Despite the Russian government releasing information on the number of hectares damaged by the frost, and how many of them would be replanted, more and more farmers are reporting damage, and the real size of the frost is unknown as of now.

Ukrainian analysts are projecting a 20% to 30% yield loss, which was a surprise, as the frost had occurred in Russia and the market was not aware it had also impacted Ukraine.

The rally was further helped by US winter wheat conditions deteriorating when the market was expecting some improvement. US wheat condition was 49% good or excellent, down 1 point week-on-week and versus 31% last year. The market was expecting 52% good or excellent. Areas under drought conditions were unchanged at 25%.

The French wheat condition was 63% good or excellent, or 1 point lower week-on-week and versus 93% last year.

US Corn Planting Advances

Corn was pulled higher by wheat and even a big recovery in US corn planting and improving conditions were not able to stop the rally, which was moderate when compared with the wheat rally.

US corn planting made a huge advance last week, catching up with all previous delays and coming in higher than the market was expecting. The risk of lower production is now gone.

US corn is 70% planted, up from 49% the previous week and versus 76% last year and on par with the five-year average. Corn areas experiencing drought fell to 10% last week, or 2 points lower week-on-week. Corn harvesting in Argentina is 28.2% complete, up 3 points week-on-week.

Russian corn planting is 74.7% complete versus 74.9% last year. Ukrainian corn planting continued to make big weekly progress and is now 97% completed. French corn is 78% planted, up 6 points week-on-week but behind the 93% recorded last year and the five-year average of 96%.

Weather Continues to Influence

Brazil is again expected to receive rains in the south for the fourth week in a row, but this time rains will also reach the rest of the centre south. Argentina should also benefit from the same front and is expected to receive ample rains together with cold temperatures. The US is expected to receive rains across the Midwest and in Europe, France is expecting some dry weather while Germany should receive some rains.

Weather continues to significantly influence the market. We have issues in Russia and Ukraine on the wheat side, as well as in the south of Brazil in soybeans and corn. On the other hand, US corn planting has recovered, and risks have disappeared.

A correction might occur if the frost damage in Russia and Ukraine are finally assessed and are less problematic than expected. However, we would expect some volatility until full assessment of production losses are published.