- Russia is going to import duty-free white sugar.

- This is to control domestic price inflation.

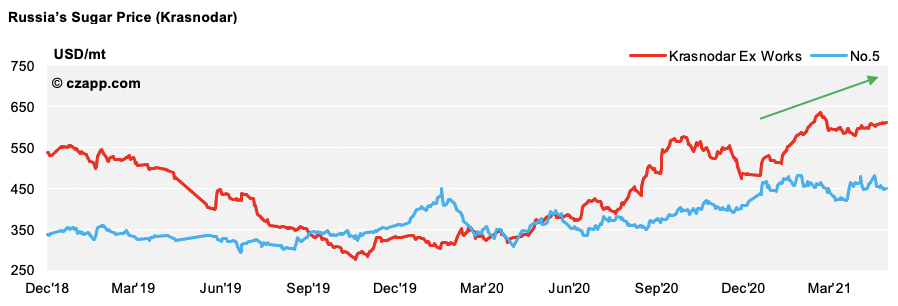

- Domestic sugar prices have almost doubled in the past year.

The Import Quota

- Russia has opened a special 350k tonne duty-free white sugar import quota for between 15th May and the end of September.

- Normally, white sugar’s import duty is set at 340 USD/mt (24,984 RUB/mt) to protect producers and farmers.

- The aim is to prevent sugar prices climbing further to help combat domestic price inflation.

- The first cargo of 11k tonnes has already been shipped from Algeria.

- Sugar prices have climbed to over 600 USD/mt (44,090 RUB/mt) since the start of 2021.

- We think the Government has chosen to import white sugar as it can start lowering the prices as soon as possible.

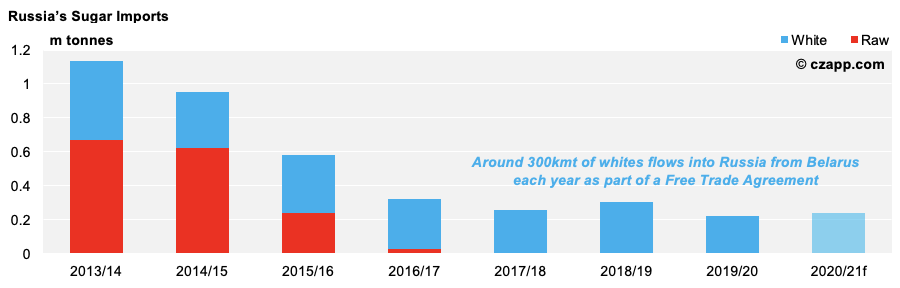

- In the past, Russia imported raw sugar to maintain stock levels.

- Russian beet processors can refine raws in their off season and the Government used to lower raws duties to enable this.

- The duty-free quota may seem counter-intuitive, as Russia’s been aiming for self-sufficiency.

- However, we don’t think this one-off quota will harm domestic production, especially as the delivery window is in the period between beet planting and the start of harvesting in August.

Why Have Prices Been So Strong?

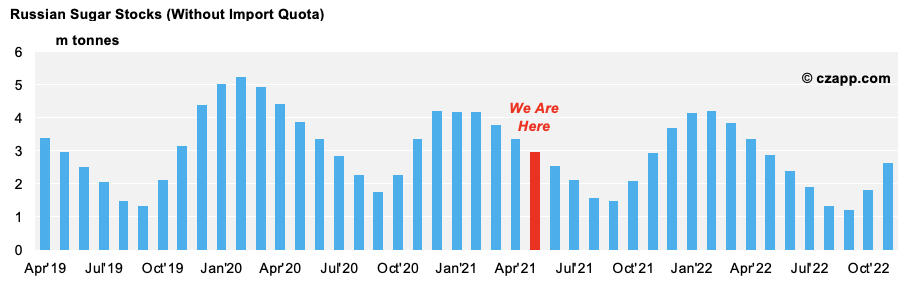

- For the last year, Russian sugar stocks have been in decline.

- Without imports, we think stocks will continue to decline over the coming year.

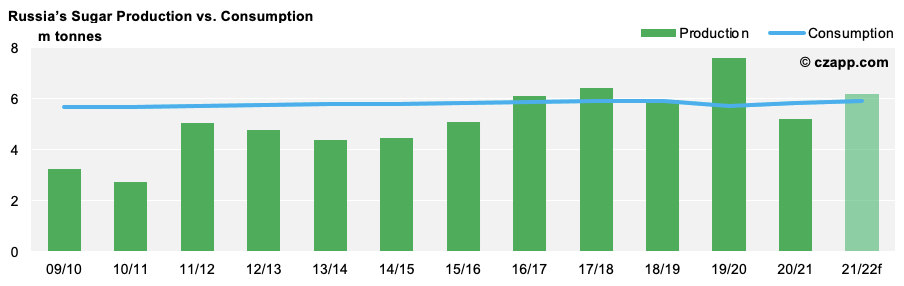

- This is because production was 650k tonnes below consumption in 2020/21.

- We think production will rebound to 6.2m tonnes in 2021/22, but stocks could still fall if exports to neighbouring continue.

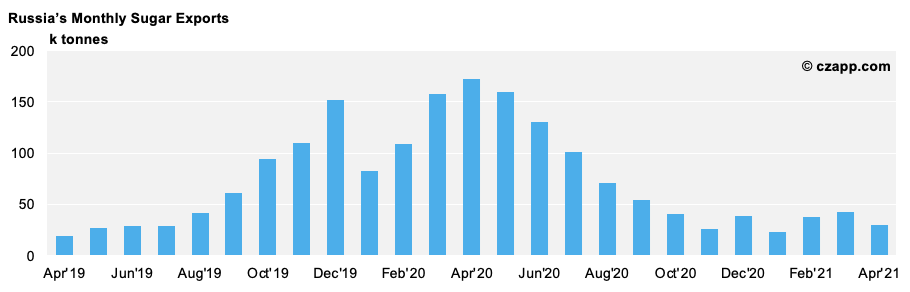

- Despite the production deficit, export flows remained strong through much of 2020.

- They have started to fall now the domestic price has risen, but still average around 40k tonnes per month.

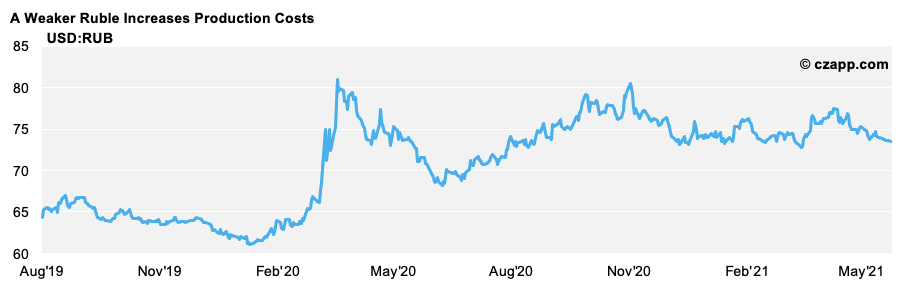

- In addition to tightening stocks, we believe the cost of production increased quite dramatically in 2020/21 due to the weaker Ruble.

- Over 60% of the cost of sugar production is made up from imported goods, such as seeds and fertilizers.

- We think most of this extra cost is passed onto the domestic consumer through higher prices.

Other Opinions You Might Be Interested In…

Explainers You Might Be Interested In…