Price Action

Forecast

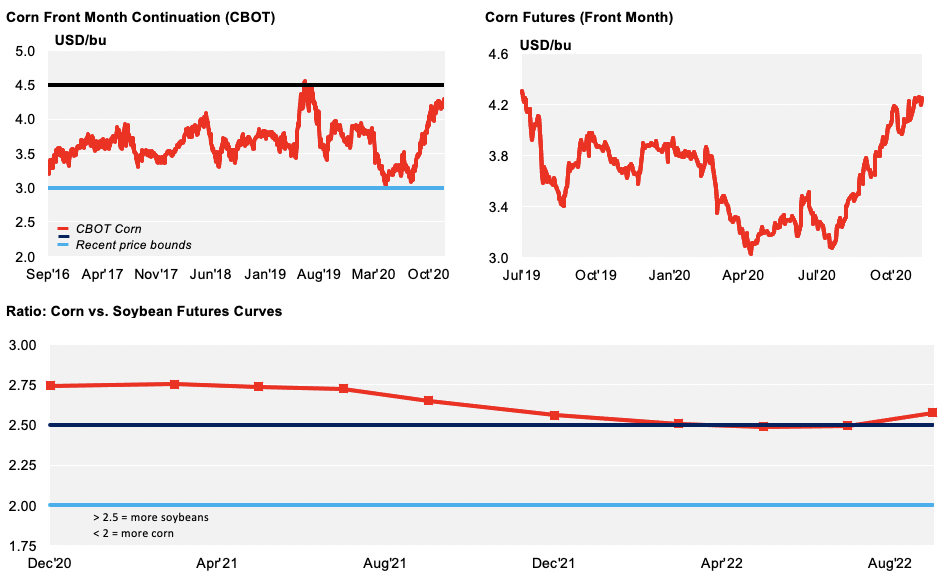

Our 2020/21 average price forecast for Sep/Oct remains unchanged, in a range of 3.4 to 3.8 USD/bu for Chicago corn. Since the start of the crop (Aug/Sep), the average price has been running at 3.95 USD/bu.

Market Commentary

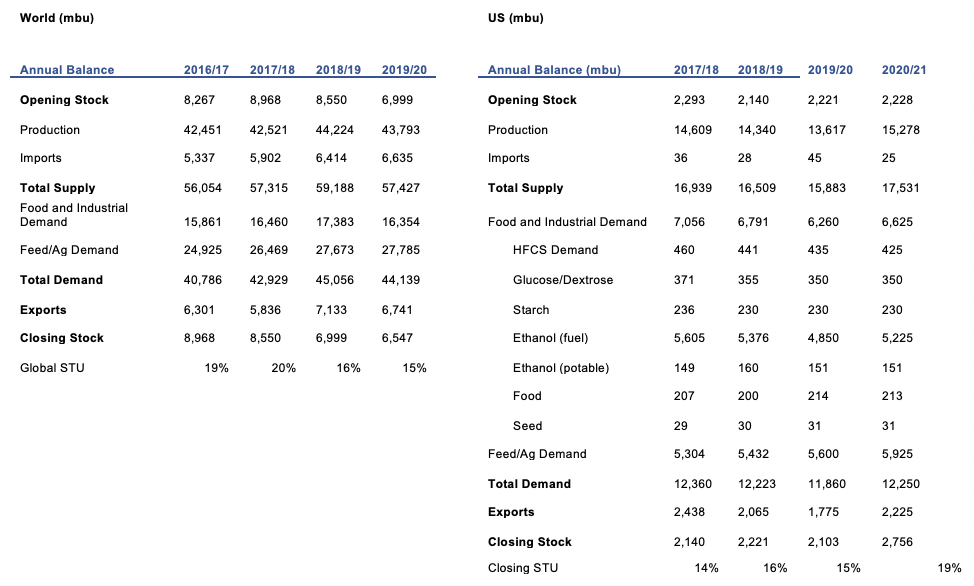

The week got off to a quiet start as the market waited for the December WASDE to be released on Thursday. The main expectations were a 1-2m tonnes production cut for South American corn, and an unchanged US production number, both of which materialised. In fact, there were literally no changes to the US corn supply and demand picture, which remained unchanged from the November release.

Corn

Global corn ending stocks were lowered by almost 3m tonnes to 289m tonnes. Argentinian production was lowered by 1m tonnes. Brazilian production was left unchanged at 110m tonnes. However, Conab lowered its projection for Brazilian corn last week from 104m tonnes to 102.6m tonnes. Ukrainian production was increased by 1m tonnes. EU production was cut by 500k tonnes to now sit at 63.7m tonnes (vs. Coceral’s 63.1m tonne estimate).

Argentinian corn planting finally made good progress, jumping 12% in the space of the week. Planting here is now 47% complete.

US corn inspections were down 29% week-on-week due to weaker Chinese buying.

The Ukrainian corn harvest is now 96% complete and yields are showing just 5.35 mt/ha compared 7.2 mt/ha last year. This suggests that Ukraine will have a good crop of around 30m tonnes. The Agricultural Ministry is forecasting a 33m tonne crop and the USDA is forecasting a 29.5m tonne crop.

Soybeans

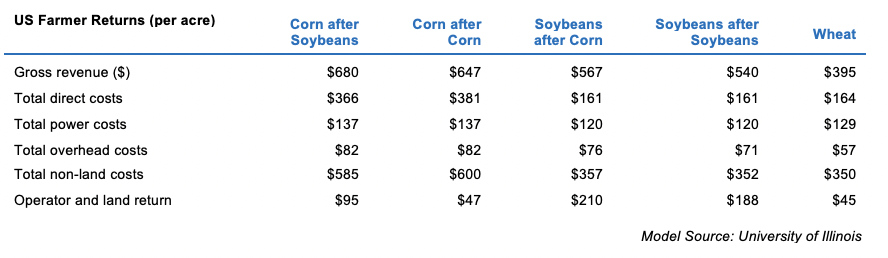

Turning to soybeans, the US’ supply and demand picture showed 15m bushel stock reductions, having crushed exactly the same volume as the year before.

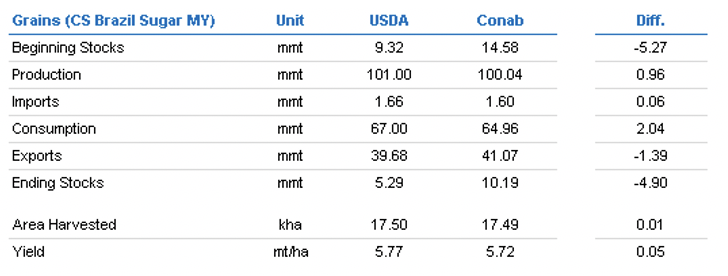

In terms of soybean planting, Brazilian planting is now 90% complete. The replanting situation is still unknown, meaning the possible impact to the safrinha corn crop is also unknown. However, some replanting is anticipated, meaning planting of the second corn crop will likely be delayed.

Wheat

Wheat rallied at the end of last week. This was helped by the supportive December WASDE, but more so by the rumours of an export tax in Russia.

The December WASDE lowered the US’ wheat ending stocks by 15m bushels, cutting import and increasing export expectations. However, there were no changes in local production or demand.

Global wheat ending stocks were snipped by 4m tonnes, despite the higher production forecasts in Australia and Russia. Increased Chinese consumption is the main reason behind this reduction.

The Russian government is thinking about taxing wheat exports as, despite setting an export quota of 17.5m tonnes for all grains, local prices have continued to rise given the increasing export demand as they are worried about food inflation. The rumored tax could be some 27 USD/mt.

France’s wheat condition remained at 96% good-to-excellent compared to last year’s 73%; this remains a three-year high.

Coceral forecasted EU27+UK production at 143m tonnes, up 11% year-on-year, mostly due to this year’s larger planted area. It’s important to highlight the UK’s forecast, as it has jumped 50% to 15.1m tonnes after suffering its worst crop in 40 years last year.

The December WASDE was basically neutral, despite some support for wheat, which was further fueled by the Russian export tax rumour. One of the doubts we have stems around Chinese corn production, which was left unchanged despite typhoons having potentially damaged the crop. Chinese authorities have also left their forecast unchanged.

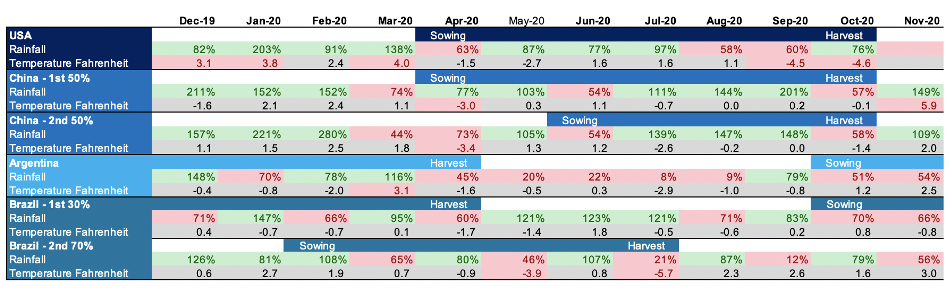

We continue to have two important supports in the market: weather in South America and the Chinese buying program. Rains are forecast this week in Brazil and Argentina, but we are carrying a rain deficit from October and November and therefore need more rain. We also wait to see how much soybean will be replanted in Brazil; this is important as it will mean safrinha corn planting will be delayed.

China seems to have slowed down its buying, but everything seems to indicate that they need to continue buying to feed their increasing pig herd.

Wheat now has a new element, which is the Russian export tax which can give further fuel to US and EU Wheat.

We think Chicago Corn will continue with the actual consolidation.

Supply

WASDE Projections

Weather in Main Corn Growing Regions

Brazil Balance

Demand