Opinions Focus

- Grains may rally as Russia exits grain corridor deal.

- This is despite favorable weather in most growing regions.

- Chinese demand in September for corn and wheat plummeted.

Forecast

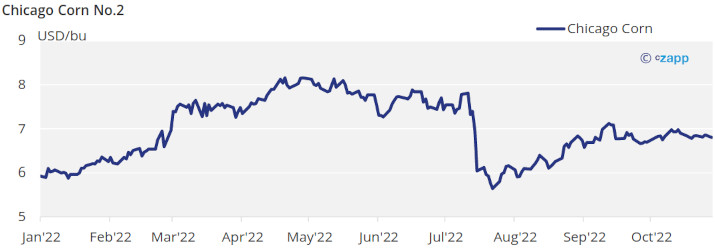

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 5,8 to 6,3 USD/bu. The average price since Sep 1 is running at 6,8 USD/bu.

Market Commentary

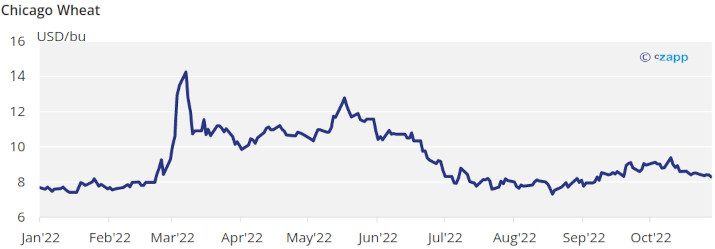

Favourable weather resulted in a slight negative week for Corn in Chicago and slight positive in Europe, while Wheat suffered bigger falls in both geographies. We will probably see a rally this week as over the weekend Putin exited the deal of the grain corridor allowing Ukrainian exports.

Last Saturday Russia said they are exiting the deal of the grain corridor which allows grains exports out of Ukraine saying the reason was the drone attack against military vessels that were monitoring the grain trade flow. Formally, the agreement ends by November 19, but Russia said the suspension of the grain agreement was indefinite somehow eliminating all options a continuation can be negotiated.

The reality is that Russia has been criticizing the corridor for quite some time now and has used the first reason they had to pull out. It may just be a negotiation tool to eliminate sanctions on Russians exports of agricultural goods as their all-time high Wheat crop -104 mill ton- is having difficulties to reach export markets.

Besides geopolitical issues, on the fundamental side Chinese Corn imports in September plummeted 56,5% yoy and Wheat import 42,2% which did not help price action last week.

In Europe, the October MARS bulletin lowered again their yield forecast for Corn and again due to the very hot and dry summer. The downgrade was immaterial taking Corn yields to 6,34 ton/ha vs. 6,39 they had before.

US Corn made a 16 point improvement in harvesting last week reaching 61% complete. Corn condition is not being published anymore.

In the Wheat front, US weather was beneficial for field work last week with soil moisture increasing which pressed prices lower. US winter Wheat is 79% planted, in line with last year and the five year average.

Russian Wheat is now virtually finished with 104,3 mill ton harvested which is 99% of the planted area.

Rains continue to be expected in Brazil this week as well as in Argentina. In the US warmer than average temperatures and rains above normal are expected. Europe is also seeing warm temperatures and rains are expected to arrive by the middle of this week.

Without the news from the Ukraine corridor, favorable weather across all geographies should be negative for grains. But the irruption of the Russian news has immediately stopped exports through the Black Sea thus disrupting supply. The risk is clearly to the upside, but expect Russia to give signals they are willing to negotiate against lifting sanctions on their agricultural exports.