Insight Focus

- Risk rises for Black Sea freight on Russia-Ukraine conflict.

- Insurance companies respond by hiking premiums, refusing insurance.

- Shipping firms steer clear of Black Sea, Russian ports.

It’s becoming increasingly risky for commercial vessels to trade in the Black Sea region because of the unfolding Russia-Ukraine war. So far, at least four commercial vessels have been caught in the crossfire and insurers are reluctant to provide rates for vessels using the route.

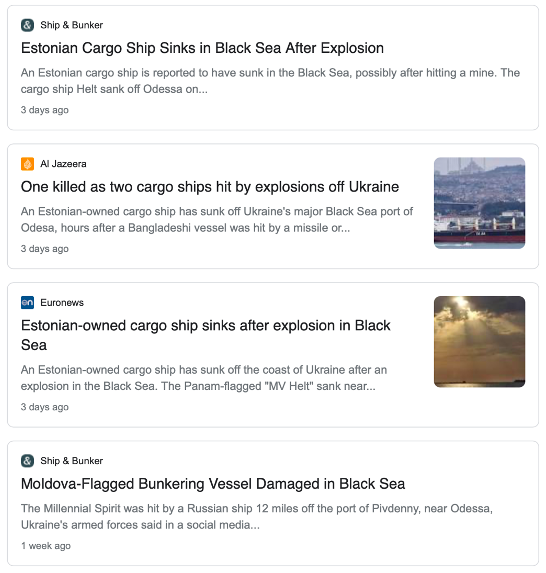

More Vessels Damaged

On the 3rd March, an Estonian-owned cargo ship was hit and sunk by a stray projectile off the Ukrainian port of Odessa. Just a day earlier, a Bangladeshi ship was struck off Olvia, killing one of its crew members. The previous week, Moldovan-flagged Millennial Spirit, Panama-flagged Namura Queen, and a Cargill-chartered Turkish bulker sailing in Ukrainian waters were all struck.

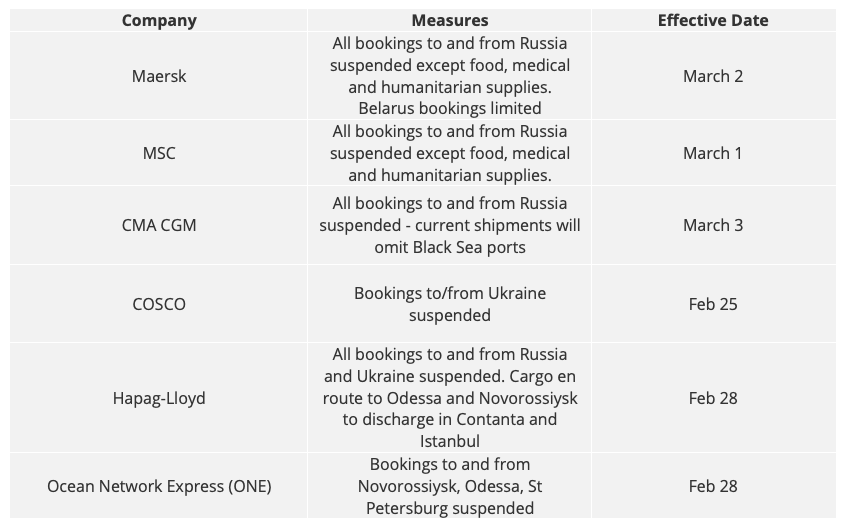

It’s becoming riskier for commercial trading firms to send vessels into the Black Sea, with many avoiding it entirely. Singapore-headquartered, Ocean Network Express (ONE), suspended bookings to and from Russian ports two weeks ago. CMA CGM did the same last week. Maersk said that container bookings have been suspended but the shipping group is still calling at Novorossiysk with “foodstuff, medical and humanitarian supplies”.

Who is Operating?

Notably, the situation seems to be mostly affecting containers. Bulk shipments of agricultural goods such as sugar are still being booked to the Black Sea port of Novorossiysk.

Insurance Premiums Rise

The bulk shipments may still be able to proceed if exporters are willing to pay more for insurance. Insurers are increasing prices for their services through the Black Sea given the higher risk involved with these shipments.

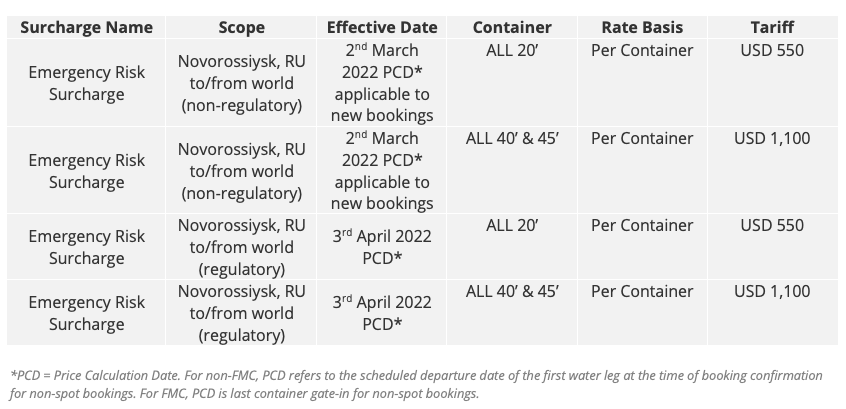

Insurers will still provide services to the Black Sea but have imposed additional premiums of between 1% and 5% of insurance costs. Maersk has now introduced new tariff rates of USD 550 for 20-foot containers and USD 1,100 for all 40-foot and 45-foot containers.

Maersk Surcharges

Patrick Tiernan, Chief of Markets at Lloyd’s, did not directly answer Czapp’s questions on pricing. He instead noted that the insurer is “working closely with the Lloyd’s market to uphold the implementation, at pace, of sanctions applied by governments around the world.”

Sanctions Create More Uncertainty

Although sanctions have been mostly limited to the economic sphere so far, there’s speculation about what further action could be taken if a peace deal is not reached. The next option may be to limit trade with Russia. The UK has already placed a ban on Russian vessels docking, including those with Russian flags or any connection to Russia.

This move has a minimal impact given the relatively small flow of goods between Russia and the UK, but if the EU is to follow suit, the ramifications could be significant. The Port of Rotterdam handles huge volumes of energy cargoes oriented either to or from Russia. According to the Port Authority, “of the roughly 470m tonnes transhipped through the port of Rotterdam, 62m tonnes are oriented towards Russia (13%)”. The Port of Rotterdam also handles 30% of Russian crude oil exports, 25% of its LNG and 20% of oil and coal products.

If this flow is disrupted, there could be another rise in the crude price. As we’ve seen, a rising oil price has knock-on effects on fertilisers and freight costs for the agricultural industry.

Brent Crude Oil Prices at 13-Year High

Additional Customs Inspections Slow Shipments

Due to the Russian sanctions, container shipments will now be subject to additional checks to ensure they contain no prohibited goods. The EU prohibited the export of a number of “dual use” items, which can be used for both civilian and military purposes. These include but are not limited to night vision systems, parachutes, plant pathogens, bacteria, and electronic components such as transistors. These additional checks will likely add more burdens to an already stretched global logistics network.

Likewise, the Port of Hamburg has said that it’ll no longer handle containers either coming from or going to Russia given the enhanced inspection requirements demanded by the sanctions. This also applies to cargo transported by rail, barge or truck, the port authority said.

Shipping Firms Tread Lightly

To tackle the uncertainty, many shipping firms and ports have opted to stay away from Russian shipments for the time being. While no retroactive sanctions are likely to be imposed, there’s the risk that vessels that come into contact with Russian ports or cargoes may be restricted in the future.

The uncertainty in the market won’t likely lift as long as the conflict continues, but as Ukraine and Russia are both major grains exporters, it’s unclear whether this will be a tenable situation for global food security. Current inflation concerns will also be exacerbated by a further spike in energy prices.

As the conflict extends, Ukraine is looking at different options for exporting grains. “Every tenth loaf of bread in the world is baked from Ukrainian grain,” said Ukraine Crisis Media Center in a post on its website. “To prevent the global food crisis and save Ukrainian exports, JSC Ukrainian Railways is ready to organize agricultural products delivery by rail urgently.” Ukrainian Railways said it’s working on logistics routes that will allow grain delivery through rail links to Romania, Poland, Hungary, and Slovakia.

However, the Ukrainian government has suspended exports of certain agricultural products such as wheat and corn. Exports of rye, oats, millet, buckwheat, salt, sugar, meat, and livestock have been suspended until further notice.

Other Insights That May Be of Interest…

Black Sea Sugar Freight Suffers Little War Disruption

Is ‘Fortress Russia’ Self-Sufficient in Sugar?

Explainers That May Be of Interest…