Insight Focus

- Delays to Ukrainian grains exports due to slow vessel inspections.

- Reports of a 45 day wait after Russia slows inspection process.

- Appears to be move from Russia to prioritise their own wheat exports.

Forecast

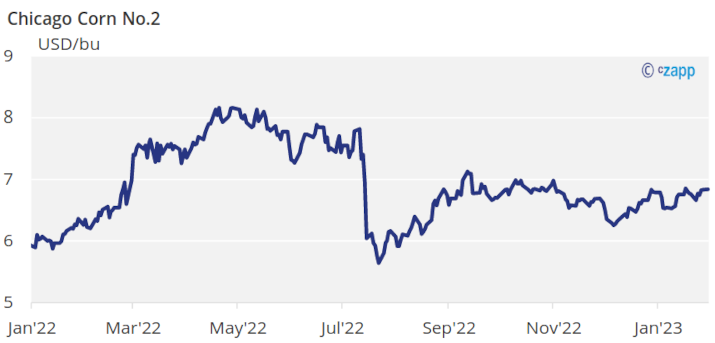

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,7 USD/bu.

Market Commentary

Lateral week but slightly positive for grains all geographies with the US leading the gains which were smaller in Europe. Black Sea exports are slowing down. Argentinian Corn conditions rallied.

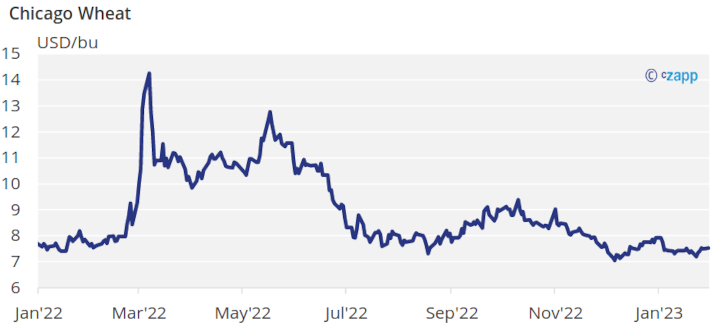

Corn and Wheat were stable last week with small fundamental changes and the major influence being favorable weather in Argentina and Russia slowing down the pace of exports through the Black Sea.

In Europe, the European Commission published its MARS report and showed concerns of Wheat winter killing as the crop has not developed cold protection, something we have been highlighting for some time. The report is based on December reading and we will have to wait until the February report and see what is their assessment of the cold temperatures we are having in the last few weeks. We think this risk is lower now once January has now finished and temperatures in February are expected above average.

Corn harvesting in Ukraine continues and is now 90% complete with 25,2 mill ton harvested vs. 27 of the Jan WASDE and 42 mill ton produced last crop. Corn planting in Argentina is 94% complete in line with last year and conditions rallied 7 points reaching 12% good or excellent thanks to ample rains.

In Brazil, the Soybean harvest has started and is 2% complete which is lower than the 5,5% of last year’s pace. This delay should not be a problem except for the fact that Mato Grosso’s pace is 7% vs. 15,6% last year and is by far the biggest producing state. After Soybeans are harvested safrinha (second corn crop) is planted. First Corn crop is 5,5% harvested vs. 7,7% last year.

The major fundamental change can come from Argentina as we had ample rains and Corn condition rallied. Planting is still occurring thus any rain at this stage has the potential to multiply Corn condition which was at their lowest. The market is expecting some 45 mill ton of production vs. 52 mill ton last year. The weather forecast is showing favorable conditions this week which should result in another improvement to Corn conditions. The upside potential in production is big at this stage if weather remains favorable during the growing season.

In the Wheat front, the Indian Government freed up 3 mill ton of government stocks aiming to lower local Wheat prices and the USDA local office in Australia raised their forecast to 37 mill ton just 400k ton higher than their previous estimate.

There are some reports indicating huge delays in cargoes out of Ukraine sometimes up to 45 days due to vessel inspections and the result is that the number of vessels leaving Turkey after being inspected is the lowest since the corridor started. Apparently is Russia who is deliberately slowing down the inspection process. January total exports are running at 2,4 mill ton (actual plus expected) vs. 4,2 mill ton we had back in October. This appears to be a move from Russia to favor exports of their bumper Wheat crop.

In the weather front, rains are expected to continue in Argentina, and Brazil is also expected to see rains in the center south region. Weather in the US should see cold temperatures but winter crops have been covered by snow already and cold should not post any risk. Is not the case in Europe where cold and warmer weather is mixing up potentially leaving Wheat vulnerable to frost.

The focus turns now to South America with rains in Brazil continuing to delay harvesting of the first Corn crop, as well as Soybean harvesting which can delay the second -and bigger- Corn crop. This can be partially offset by rains in Argentina alleviating the very bad condition for Corn. We think the potential of improvement in Argentinian Corn is more certain that the potential planting delays in Brazil’s second Corn crop.

The pace of exports out of the Black Sea region and Ukrainian Corn harvest are also important to watch.

Expect further sideways trading with some downside risk if conditions in Argentina improve, which we think will be the case.