Insight Focus

The USDA published its first wheat supply and demand estimates for 2024/25. Production could hit a new record. But frosts in Russia and drought in Australia could add to volatility over the coming months.

The Markets

The last three months have seen the major global wheat markets rise. The news headlines of ample sellers of old crop have been replaced by concerns over dwindling world stocks and weather issues reducing the upcoming 2024 harvests.

Chart 1 – London feed wheat, November 2024 contract

Chart 2 – Paris milling wheat, December 2024 contract

Chart 3 – Kansas hard red wheat December 2024 contract

Source: Barchart Commodityview

Last Friday saw the release of the latest USDA WASDE report. This report focused not only on the 2023/24 marketing year, but also gave the first official estimates for the 2024/25 year.

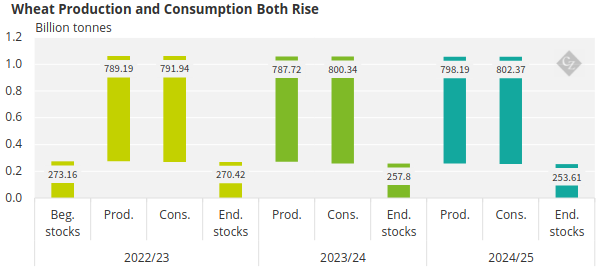

As the chart below demonstrates:

- Production continues to rise, with 2024/25 expected to be a new record.

- Consumption continues to rise, outstripping supply.

- End stocks fall year on year to levels not seen in more than eight years.

Source: USDA

Global Weather Continues to Disrupt

Weather continues to play a huge role for the wheat markets and their prices. Freezing frosts have been seen in the key Central Russian wheat growing area, with soil temperatures falling as low as -5 degrees Celsius (23 degrees Fahrenheit). These are reported to have caused ‘catastrophic’ damage, as three central regions, Lipetsk, Voronezh and Tambov, each declare a state of emergency.

This cold has also slowed spring planting. The latest estimate stands at 1.1 million hectares — hugely down on the 2.2 million hectares reported exactly 12 months ago.

In Southern Russia, weather is causing opposing issues as it remains too warm and dry. Some recent rain provided some respite, but levels were lower than anticipated.

Russian production has consequently been downgraded for the upcoming harvest by some 2-3 million tonnes by a number of sources. These include Sovecon, which is now projecting 89.6 million tonnes, down from 93 million tonnes last month.

Australia is seeing extended drought in Western regions, while persistent and excessive rains in the East are both causing planting delays.

Managed Fund Positions

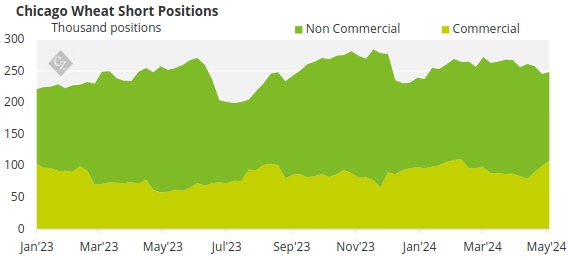

In the Paris market, funds have flipped their previous short positions to longs in recent weeks. This is indicative of the continued concern over production in 2024 combined with a likely significant drop in EU and UK end stocks, from 19 million tonnes in 2024 to potentially as low as 12 million tonnes in 2025.

Source: Chicago Board of Trade

On the other hand, both the Chicago and Kansas markets have seen funds reduce their shorts, although they are not as yet looking to go long. Interestingly the outlook for production and end stocks for 2024/25 fare better in the US with increased winter wheat acres planted.

Conclusions

- Market prices continue to rally from their lows only a few weeks ago.

- Weather is causing headaches for farmers on all continents.

- Funds have been the main drivers for the bulls in the recent wheat rally. It will be intriguing to see what wheat consumer buyers do over the coming weeks, as many have missed out on buying at lower levels.

- The USDA has given us yet more food for thought. Despite the weather, potential record global production will still not keep pace with the ever-growing consumption forecasts.

- The ongoing dwindling end stocks, especially among the European exporters, will continue to concern many.

- The 2024 northern hemisphere harvests are not far away and will likely swing news headlines back and forth over the weeks ahead.

- There is never a dull moment in the world of wheat!