Insight Focus

Russia has declared of a state of emergency due to frosts, which is likely to damage the wheat crop. This generated an uptick in grains prices across the board.

A combination of data releases and weather last week created a supportive environment for prices. All grains rallied following a bullish WASDE report published last Friday. This momentum was helped by Russia declaring a state of emergency in growing regions due to frost.

All eyes should be on the scale of the damage to Russian wheat and the corn planting pace in the US. The market has already priced in both events so we could see a correction, but still too early to evaluate the Russian loss.

There is no change to our Chicago corn forecast for the 2023/24 (September/August) crop to average in a range of USD 4.15/bushel to USD 4.40/bushel with an upside bias. The average price since September 1 is running at USD 4.55/bushel.

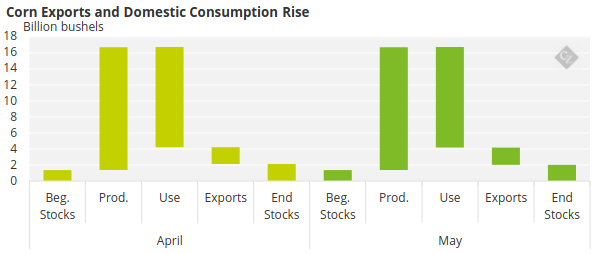

Corn Production Estimates Surprise

The May WASDE report released last Friday surprised the market by reducing US corn ending stocks by 100 million bushels due to 50 million bushels of higher demand and 50 million bushels of higher exports.

Source: USDA

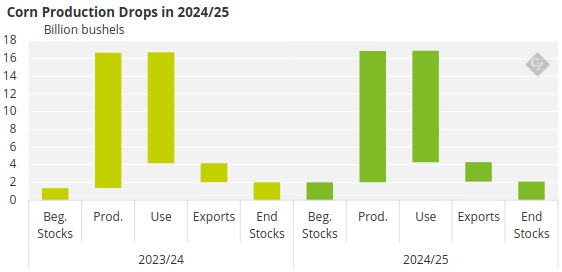

The USDA also released the first estimate for the new 2024/25 crop, showing a yearly stock build of 80 million bushels. Production is expected to fall by almost 500 million bushels due to fewer acres, partially offset by higher yield. Demand is set to increase by 100 million bushels across feed and residual use and exports. The stock-to-use moves from 13.8% of the actual 2023/24 crop to 14.2% in the new crop.

Source: USDA

The estimate for the new crop had no impact in the market at all as is simply too early. There is still too much potential for disruption from weather. The real cause of the rally was the reduction in the carry of the current crop.

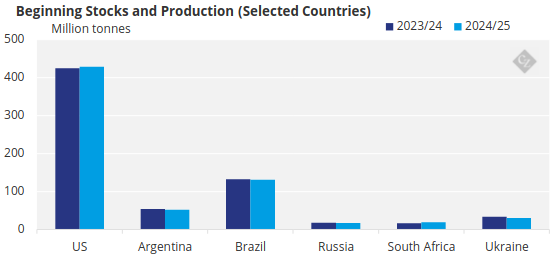

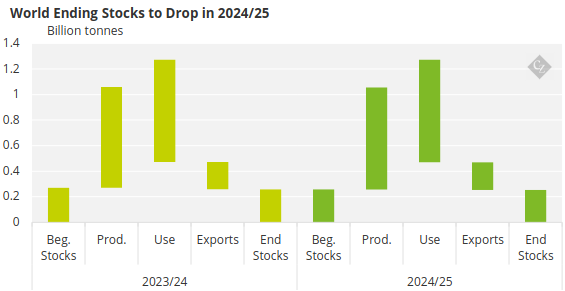

Global stocks were reduced for 2023/24 by 5 million tonnes. Argentinian production was reduced by 2 million tonnes and Brazil and South Africa by 1 million tonnes each. The first projection for the 24/25 carry out was a small stock draw of 810k ton.

Source: USDA

US corn is 36% planted, up from 27% the previous week. However, it is lower than the 42% recorded last year and the five-year average of 39%. Corn areas experiencing drought fell 5 points to 14% last week.

In Brazil, the first corn crop is 63.1% harvested, down on 67.5% last year. In Argentina, the corn crop is 23.4% harvested, marking a slow pace. Conditions worsened by 1 point to 17% good or excellent. BAGE kept its production forecast unchanged at 46.5 million tonnes.

Ukrainian corn planting continued to make big weekly progress and is now 73% completed, ahead of 63% last year. French corn is 54% planted — flat week on week but behind the five-year average of 73%.

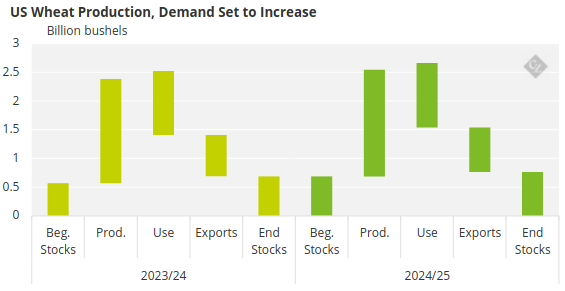

USDA Predicts Higher Wheat Consumption

US ending wheat stocks were revised upward in the May WASDE report by 15 million bushels for the current 2023/24 crop. This increase came from higher imports and lower demand. The first estimate for the new 2024/25 crop showed a stock build of 78 million bushels coming from 46 million bushels of higher production and 65 million bushels of higher demand.

Source: USDA

Global wheat stocks for 2024/25 were published for the first time with a stock draw of 4.2 million tonnes. There is expected to be a 9-million-tonne growth in production and a 2-million-tonne growth in consumption. The USDA expects consumption will surpass production by those 4.2 million tonnes.

Source: USDA

The market paid little attention to the higher supply picture from the WASDE report. Instead, all eyes were on the potential losses in Russian production due to frost risk and the government having declared state of emergency in the growing areas. This came after a period of dry weather that had already worried the market. Local analysts have reduced Russian production to 89.6 million tonnes from 93 million tonnes.

The US wheat condition was 50% good or excellent — 1-point higher week on week and substantially improved on the 29% last year. Areas under drought conditions were flat at 28% last week.

French wheat condition was 64% good or excellent, a 1-point week-on-week improvement but lower than 94% last year. The improvement, despite small, was not expected given the excess rains the crop has been receiving.

Weather Continues to Impact

Storms are forecast in the US Corn Belt together with warm weather. Brazil is forecast to continue receiving rains in the already-flooded south while dry weather is expected in the rest of the centre south. Argentina is expected to have cold and rainy weather. Europe should continue to experience rains, with warm temperatures expected in France and Germany.

After two weeks of rally, the market has now priced in a lower US corn carry out and an unknown number of production losses in Russian wheat. The slow planting of the US crop caused by almost three weeks of rains has now materialized, but as we mentioned last week, the pace was strong enough to generate some buffer time. This has now been consumed. With storms forecast this week we could continue to see a slow pace, which could cause concern.