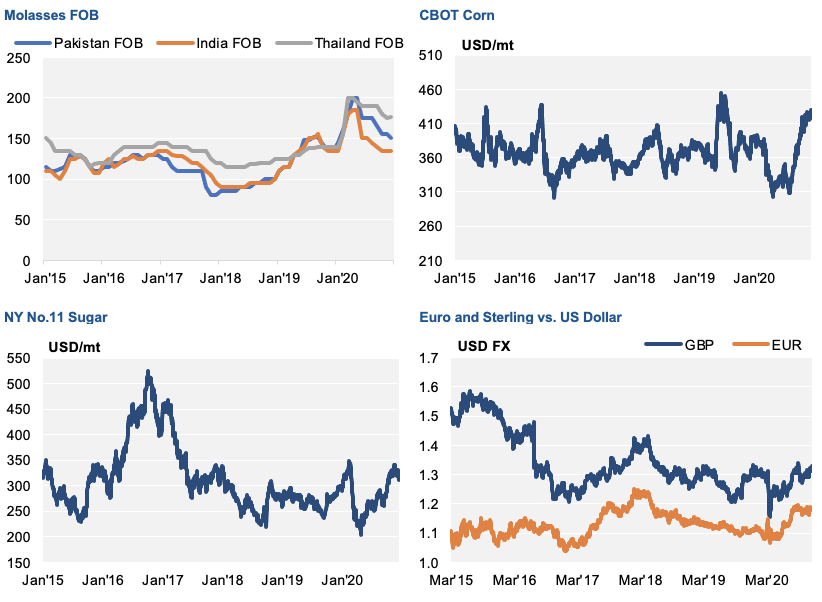

The last few weeks in the molasses market have been steady in terms of news and developments. Last month, we noted the implementation of the 25% tariff on cane molasses imports from the USA into the EU. Initially, it appears the UK government may not enforce them after the 1st January 2021. It will of course depend on how the final Brexit trade deal negotiations progress; it’s also somewhat surprising, due the fact an Airbus plant in Wales is the main manufacturer of Airbus wings!

The cane market has been fairly quiet in the last few weeks, supply from India has continued and the Central American sugar crop and molasses production seem to have escaped from too much damage from recent storms that hit the region. This has provided some calmness to the market and supply is progressing as expected.

The beet molasses market has been more challenging in terms of supply and has witnessed a consequent firming in pricing. The Russian crop has been as disappointing as forecast; around 25-30% lower than last year. This has tightened the market for supply. The Black Sea beet molasses price has rapidly increased to reflect the lack of supply and difficulty in sourcing molasses in the region. This should result in less beet being exported to Turkey from Russia. We are also seeing a similar impact on availability of Russian molasses from Baltic ports.

The EU sugar crop has broadly followed the pre-crop forecasts and will be near the five-year average in terms of yields. There are some ups and downs within the broader picture, the UK sugar beet crop looks to be much poorer than initially forecast.

Overall, the beet molasses market is tighter in terms of supply with the reduction in Russian beet molasses availability, typically Russian beet molasses some of the cheapest molasses available in the market.

The focus will switch early in the New Year to the new-crop in Egypt, with the campaign due to start in February 2021.

Other Opinions You Might Be Interested In…

- India is a Pivotal Molasses Supplier Once Again

- United Molasses Commentary: Quiet Molasses Market Continues

- How Will the EU’s Poor Crops Impact the Molasses Market?

- Thai Molasses Exports to Reduce with Poor Cane Crop

- Cane Molasses Regains Some Competitiveness

- EU Slaps 25% Duty on Cane Molasses Imports from the USA