Insight Focus

- Russia’s move to the east of Ukraine could mean some wheat exports resume.

- War or no war, there’s a need for Black Sea wheat exports once the summer harvest begins.

- Russia needs the money and space, while North Africa demands the cheapest wheat imports.

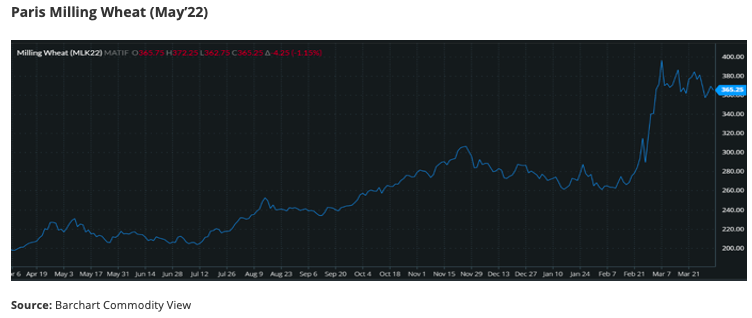

Since Russia’s invasion of Ukraine, wheat markets have been launched into orbit from already high levels. European prices have hit record highs.

Market volatility, hour by hour and even minute by minute, adds additional turmoil to an already difficult place for major buyers.

The Major Sea Ports of Ukraine

Ukrainian ports in the Sea of Azov are at a standstill as Russia continues its devastating bombardment, as seen in the port city of Mariupol.

Further West, on the northern Black Sea coast, the port city of Kherson has been the solitary city occupied by the Russian military. Meanwhile, Mykolayiv has been fiercely defended by the Ukrainians.

The port of Odessa is only too aware of the ongoing threat from the Russian military, with missile attacks being reported.

Ukrainian Wheat Production

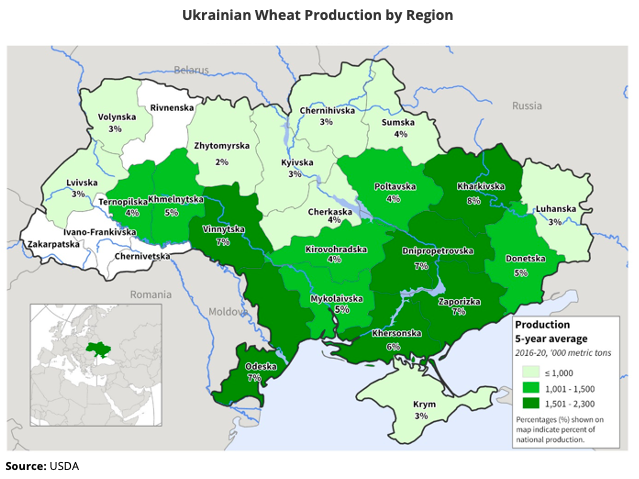

Ukraine, prior to the Russian invasion, would have expected to harvest approximately 30m tonnes of wheat in a normal year. Of this, an estimated 20m tonnes would be exported.

The main recipients of Ukrainian wheat are North African countries, who need the cheapest wheat they can buy. It’s also a significant destination for the 30-35m tonnes of Russian wheat exported annually.

Wheat from Russia and Ukraine to North Africa and the Middle East is shipped through ports in the Black Sea and the Sea of Azov.

The below map shows the distribution of wheat production within the Ukraine.

The Russian Strategy Dilemma

Russia appears to be reducing its military activity in the north of Ukraine, with focus turning to the east and southeast.

This strategy may allow President Vladimir Putin to claim some sort of victory if he can annex what he has referred to as the Donetsk and Luhansk People’s Republics.

Regardless of what Putin and his military achieve in the coming months, there will be mounting pressure from a variety of domestic and international sources to restart agricultural exports through the Black Sea. This will be in Russia’s best interest, in addition to creating calmer global commodity markets.

A prolonged and protracted war over too many fronts preventing a resumption of exports through the Black Sea will likely damage Russia’s already precarious relations with the minority of countries remaining on the fence in criticising Putin’s war. The most notable of these are North Africa, the Middle East and, significantly, China, which imports large amounts of Ukrainian corn.

Concluding Thoughts

Putin could push for an all-out offensive in the east, with a view to quickly end the war and declare some form of victory to his own nation as he annexes the east and establishes his much-desired land route to the Crimea.

This will allow a resumption of some Black Sea exports from both the Ukraine, from ports such as Odessa, and Russia.

Alternatively, Putin will face a major dilemma in a few months, with harvests being reaped in Russia with limited ability to export through the Black Sea. Finances will become an issue for the supply chain, pressure will mount quickly within Russia and significantly beyond its borders.

As the 2010/11 Arab Spring saw, food insecurity is a sure-fire way to create political unrest. Putin will need to find a small victory to call his own or potentially suffer intolerable pressure at home and abroad as the summer draws on.

Time does not appear to be on Putin and Russia’s side.

Other Insights That May Be of Interest…

Making Sense of a War-Torn Wheat Market

What the Conflict Between Russia & Ukraine Means for Wheat

Russian Invasion Could Make India a Major Global Wheat Player

Explainers That May Be of Interest…