Insight Focus

Schedule reliability among major ocean carriers has dropped. This decline causes delays, increased costs for stakeholders and rising economic and environmental impacts. Longer transit times lead to higher shipping expenses and greater carbon emissions.

Schedule reliability refers to the ability of shipping carriers to adhere to their planned schedules and deliver goods on time. In the context of global shipping, this metric is crucial for ensuring the smooth functioning of supply chains and maintaining the flow of goods across industries.

This article examines the current state of schedule reliability and its far-reaching implications across the shipping and logistics industry.

Red Sea Issues Cause Delays

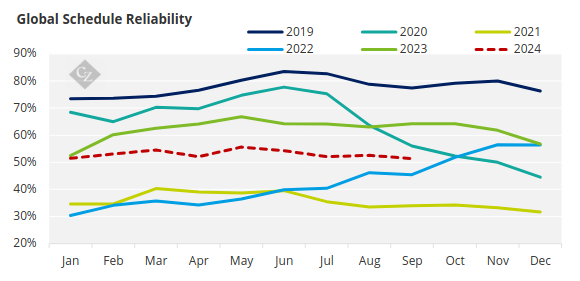

According to the latest Global Liner Performance (GLP) report from Sea-Intelligence, the schedule reliability of the world’s 13 largest ocean carriers declined by approximately 15% in September compared to the same month last year. However, it remained relatively stable compared with the rest of the year, with only a slight decrease of 1.2% from the previous month’s levels.

Source: Sea Intelligence

Throughout the first three quarters of 2024, schedule reliability has fluctuated between 50% and 60%. While this surpasses levels seen in 2021 and 2022, it has dipped below the figures recorded in 2023 and 2019. The extraordinary disruptions caused by the pandemic in 2020 render that year less comparable.

The data also reveals a notable drop in global schedule reliability following the onset of the Red Sea crisis in November 2023, which has seen Houthi forces destabilising the region. This event has contributed to a decline in reliability from the 60-70% range observed for much of 2023 to the current 50-60%.

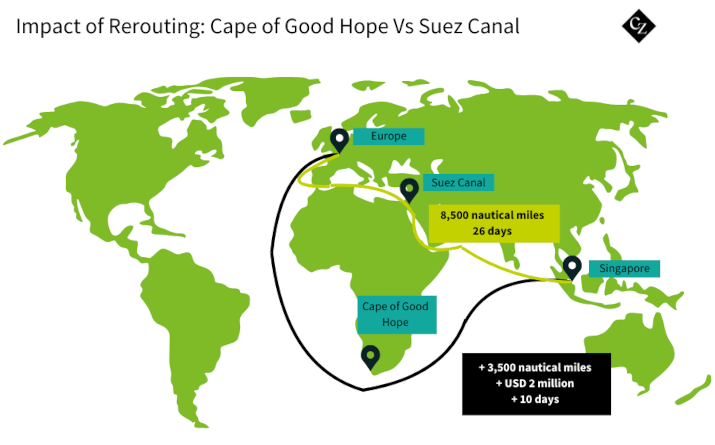

The necessity of rerouting vessels around the Cape of Good Hope has altered market dynamics, extending sailing schedules and significantly increasing transit times.

As a result, major ocean carriers are facing substantial challenges in adhering to their schedules and achieving on-time deliveries. Disruptions stemming from such outlier events often manifest most noticeably in schedule reliability.

In their efforts to adapt and implement contingency plans, carriers frequently experience delays.

Schedule Reliability Declines Among Major Carriers

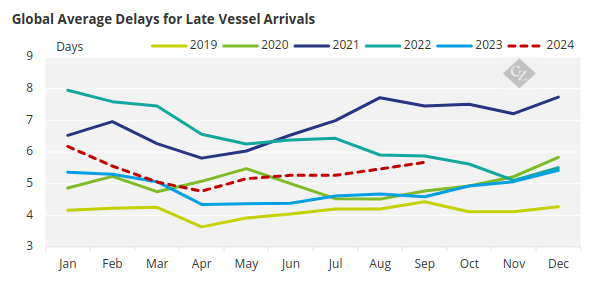

In terms of late vessel arrivals, Sea-Intelligence reports an increase of 0.21 days month-over-month, now averaging 5.67 days—making this September the third highest recorded for late arrivals, following the peaks during the Covid-19 pandemic in 2021 and 2022.

Source: Sea Intelligence

This trend of increasing late arrivals may push the average beyond six days in the final quarter of 2024, if it continues.

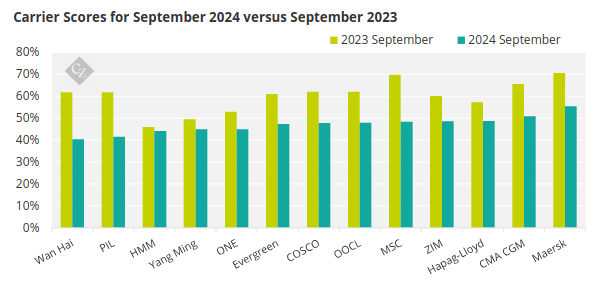

In September’s schedule reliability rankings, Maersk emerged as the most reliable container line, alongside France’s CMA CGM, both exceeding the 50% mark. The remaining top 13 liner operators recorded reliability scores between 40% and 50%, with Taiwan’s Wan Hai ranking as the least reliable.

Sea-Intelligence analysts noted that only four of the 13 largest carriers managed to improve their reliability scores month-over-month. Singapore-based PIL saw the most significant gain, increasing by 4.5 percentage points, while South Korea’s HMM experienced the largest decline, dropping by 7.8 percentage points.

Source: Sea Intelligence

Year-over-year, none of the top 13 liners improved their schedule reliability, with Swiss/Italian MSC and Wan Hai each suffering a massive decline of 21.5 percentage points.

Low Schedule Reliability Impacts Stakeholders

The decline in schedule reliability among the world’s major ocean carriers has significant repercussions for stakeholders from different sectors in the shipping and logistics ecosystem. These impacts can be categorised as follows:

Manufacturers and Suppliers

Manufacturers using just-in-time (JIT) systems risk production delays from shipment lags, leading to raw material shortages, process disruptions and higher costs for alternative sourcing.

Retailers

Retailers, especially in e-commerce, rely on timely deliveries to maintain inventory. As reliability drops, stockouts and order delays can hurt sales and customer satisfaction, pushing retailers toward costly alternative shipping options that reduce profit margins.

Consumers

End consumers are increasingly feeling the effects of schedule reliability, especially with delivery delays. Rising expectations for fast shipping, particularly in e-commerce, mean delays can lead to frustration and reduced brand trust. This shift makes timely delivery a higher priority, with brands risking customer loyalty and market share if they fail to meet expectations.

Logistics Providers

Third-party logistics (3PL) providers struggle to manage operations efficiently amid fluctuating carrier reliability. They may need contingency plans or rerouting, raising operational complexity and costs, and straining relationships with carriers and clients due to inconsistent service levels.

Economic Impact

The economic impact is significant, as reduced schedule reliability can raise shipping costs, often passed on to consumers. Industries dependent on global trade may experience delays affecting supply chain performance, economic growth and trade balances.

Environmental Concerns

Increased transit times and rerouting increase carbon emissions, creating significant environmental impacts. To curb emissions, operators may slow sailing speeds, which can cause further delays and reduce schedule reliability. This balancing act poses a complex challenge, as addressing environmental concerns may unintentionally worsen reliability issues in shipping.