Insight Focus

- Sugar markets are still being buffeted by the US Dollar

- But sugar consumption has been robust despite high inflation

- Futures curves suggest sugar markets are undersupplied.

Hi everyone, it’s Stephen from Czapp with an update on the sugar market for September 2022.

There’s this debate which crops up online every now and then: what’s the best TV show ever made? Is it The Sopranos, or is it The Wire?

The debate is really stupid because the answer is very obviously The Sopranos. Here’s Tony Soprano’s right-hand man Silvio explaining which businesses are recession-proof, “certain aspects of show business, and our thing.”

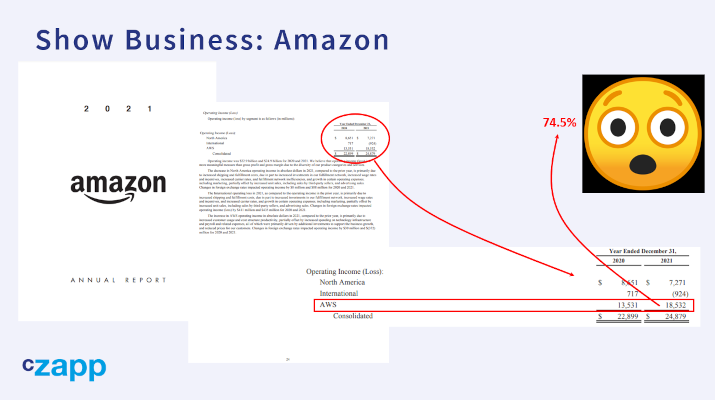

Let’s focus on show business. Amazon recently released their take on Lord of the Rings. It’ll cost more than $1b across 5 seasons, which is a lot of money for something that won’t even be in the top 2 all-time TV shows, but it’s not bad for a company which started as an online shop.

As well as being in showbusiness and being a shop, it’s also a utility. Three quarters of its operating income comes from Amazon Web Services which is effectively plumbing for the internet. And even being this much of a multi-faceted company hasn’t stopped amazon from being hit by this year’s stock market slide.

Doesn’t look so bad, does it? Certainly not in the context of the previous 10 years’ performance. But it’s lost 32% of its market capitalization since this year’s high. Why? Because sometimes micro matters: for example how many things Amazon sells through its store, what new tech it’s rolling out, how good its logistics are.

Source: Refinitiv Eikon

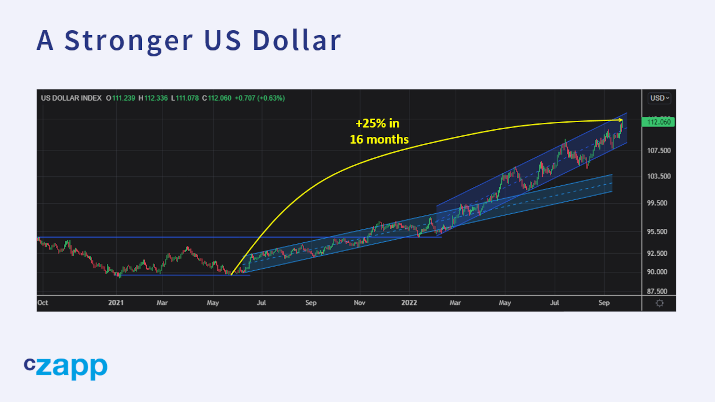

But sometimes macro matters. We’re in the middle of a widespread recession caused by rising interest rates and a stronger US Dollar caused by high inflation caused by surging commodity prices caused by supply chain disruption and the flood of cheap money unleashed by Quantitative Easing in the face of a pandemic.

Source: Refinitiv Eikon

This is why I spend so much time in these videos talking about things which at first glance don’t seem very relevant to the sugar market. If we only focus on the details of the sugar market then we’ll miss what’s important. For Amazon, they need to hope that Silvio is right and show business is recession-proof, or all that money they’ve spent on elves and orcs will be money wasted. For me, I’m going to return to the Sopranos.

I think Silvio missed another thing which is recession-proof: people’s taste for sugar. Sugar is a cheap luxury. It tastes really good to eat. It caramelizes, it helps foods to brown, it adds crunch, it adds bulk. It retains moisture. A cake made with sugar has a moist crumb, stands tall and tastes wonderful. Yes, if you hadn’t already guessed a new series of the Great British Bake Off recently began in the UK.

Anyway, sugar achieves all of these things for less than a dollar per kilo in many countries. I also think that during a recession people cut back on discretionary spending to ensure they have enough food to eat. Now, here’s something that I’ve been working on… it’s work in progress and nowhere near complete, but I thought it’s useful enough to show you a bit now.

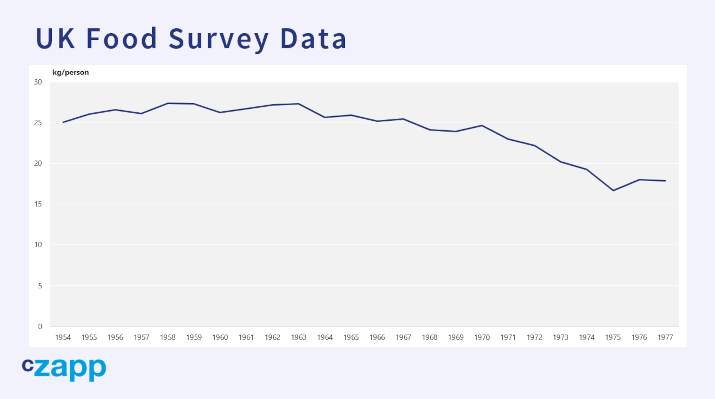

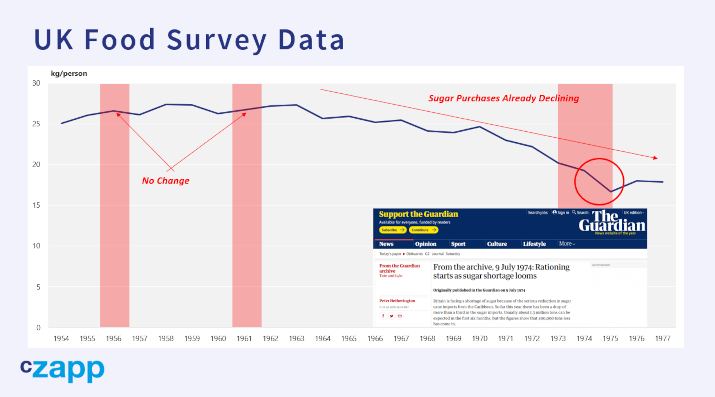

The United Kingdom government published a neat study for decades after the second world war showing household food consumption. It’s not perfect; it’s self-reported data so probably an underestimate, and it doesn’t cover food eaten out of the home, but it’s still useful, I think.

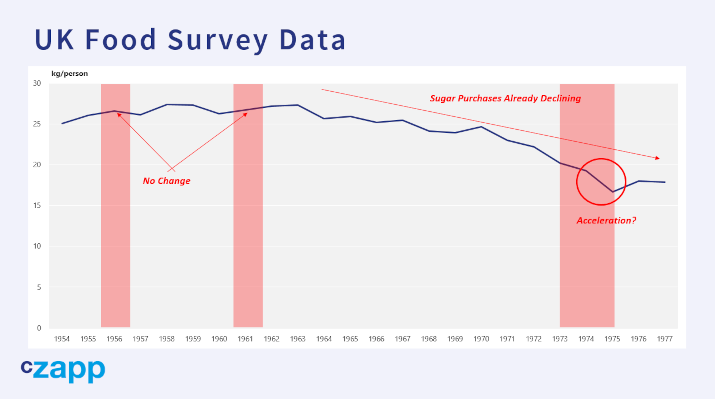

I’ve indicated recessions in red here. In the recessions of 1956 and 1961, there was no change to sugar purchases. Sugar consumption didn’t drop at all. At first glance the recession in the mid-1970s looks different. By this time sugar consumption in the UK had already peaked, and so had sugar purchases to use at home. The decline in sugar purchases seems to have been accentuated in 1974 and 1975. However, this wasn’t due to recession.

The early 1970s saw record high sugar prices around the world following the failure of the Soviet and European beet crops. This led to shortages in several countries. This applied to the UK too after some Caribbean producers opted to supply the more lucrative American market instead. This was a supply chain problem, not a fall in consumption due to recession.

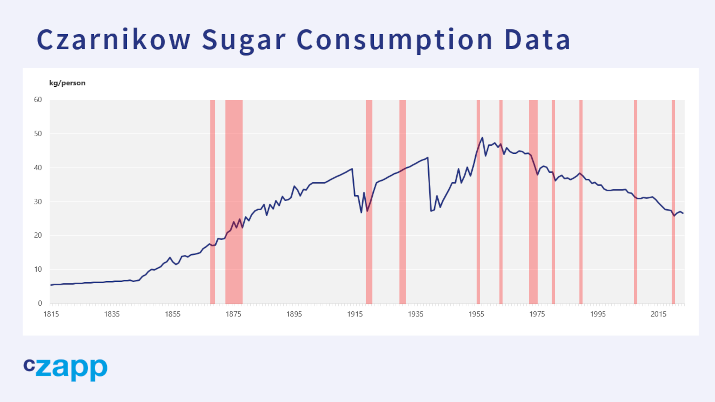

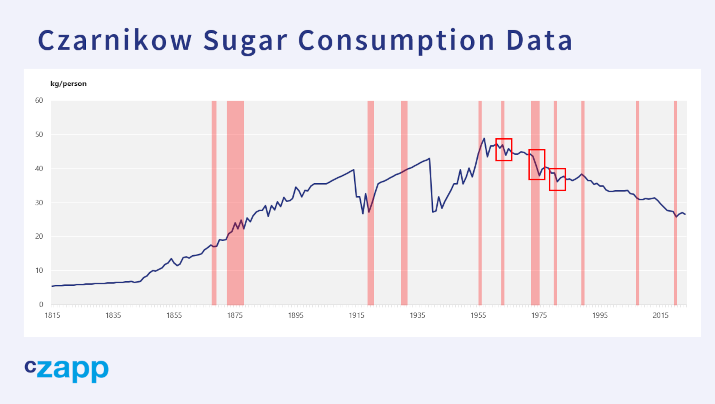

Interestingly, Czarnikow also has a record of UK sugar consumption going back through the decades. This is a top-down measure. Rather than rely on consumer surveys, we estimate sugar production and imports, then subtract exports to arrive at a best guess for consumption. This has mixed results – again recessions are shaded in red.

Some (but not all) recessions show a drop in sugar consumption, notably those in the 1970s and 1980s. However, firstly those were times when world market sugar prices had spiked to exceptional levels; that’s not the case today. Also, those decreases weren’t abnormal within the context of overall falling sugar consumption from a peak in the mid-1950s. It seems sugar consumption in the UK is quite robust during recessions.

As I said, this is work in progress. But it’s possible that during the current recession sugar demand won’t suffer. This doesn’t necessarily mean that sugar will perform better than other commodities. Like Amazon, we need to be aware of the environment we’re in. And what an environment it is. As someone who lives in Britain…..well, what a time to be alive. I’m not going on holiday to America any time soon.

For everyone in the markets, interest rates are rising. Here’s the US 10-year yield showing the collapse to close to 0% during the COVID pandemic followed by the surge to nearly 4%. The US Dollar is also strengthening rapidly.

Source: Refinitiv Eikon

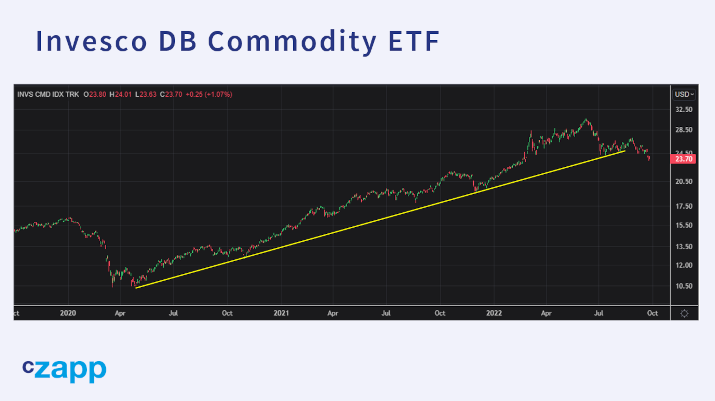

This is generally negative for commodities. Virtually all of them have stopped climbing and are now falling. Here’s a chart of Invesco’s commodity ETF, for example which has finally broken its uptrend.

Source: Refinitiv Eikon

Central Banks around the world continue to work as hard as they can to slay inflation, even if it means causing recessions. We will probably need to wait for this period of blood-letting to pass before we can think about what comes next. This is a shame because taken in isolation, sugar looks quite positive. With a calmer macroeconomic situation, I’d be quite bullish.

Firstly, check out this month’s refined sugar expiry. The October/December spread expired at an 11 year high at nearly $80 premium. This is a screengrab from a few hours before the expiry showing an $86 premium spread. This is a market that’s simply screaming for more supply.

Source: Refinitiv Eikon

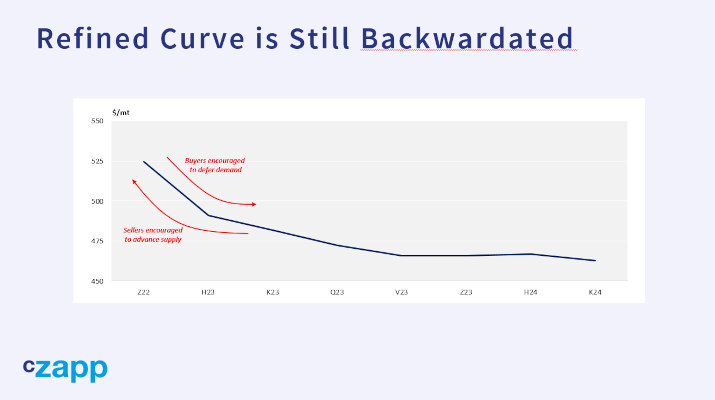

European beets have been hit by this year’s heatwave. Thai cane crushing won’t recover over 100m tonnes as we’d hoped. They’re both low-cost refined sugar suppliers and they can’t really help the market. Toll refiners for various reasons have been unable to respond: take the Algerian refiners, for example, who are banned from exporting. The forward curve for refined is backwardated, itself a sign of stress. This isn’t a market that would be falling in a more normal environment.

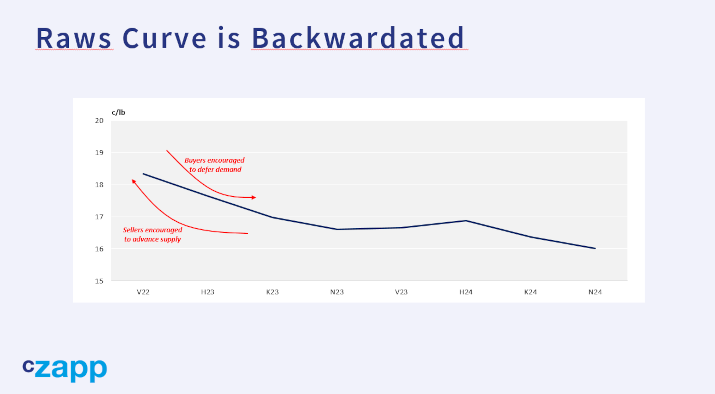

It’s a similar situation on the raw sugar market. Sure, India is about to have a huge cane crop and supply a lot of sugar to the world market. Sure, Centre-South Brazil is maximizing sugar production once more. Also, we’ve heard rumours that Chinese refiners are trying to cut a deal with the government to not be penalized if they don’t use their full 2022 import allocations. China is one of the world’s largest buyers of raw sugar. This should all be bearish.

Yet the forward curve is backwardated even as the futures gently fall. The market clearly isn’t terribly well-supplied after all. For a start, under current rules, the sugar market needs to be close to 18c for all that Indian sugar to be exported. And the government is nervous about compromising food security by over-exporting. There’s no guarantee the Chinesegovernment allows its refiners to under-import this year; they’re also nervous about food security. Alongside China, Indonesia is another major sugar buyer and rumours suggest they will advance 2023 import permits into 2022.

So dotted around there are pockets of tightness in the sugar world. In today’s market you’ve got to be smart. Don’t fight against the huge tide of rising interest rates and a stronger US Dollar. But also recognize that sugar’s own bullish factors haven’t gone away and at some point they’ll be back.

I try to help premium Czapp subscribers manage their sugar price risk by publishing a weekly market view report and a quarterly 5-year price outlook. If you’d like help with your hedging, please talk to me.

Perhaps the final word can go to Uncle Junior Soprano. Thank you for your time today. “You steer the ship the best way you know. Sometimes it’s smooth. Sometimes you hit the rocks. In the meantime, you find your pleasures where you can.”