Opinions Focus

- USDA adjustments to US corn crop already expected by traders.

- EU corn crop also affected by hot and dry weather.

- Fears Ukraine grain corridor might be disrupted.

Forecast

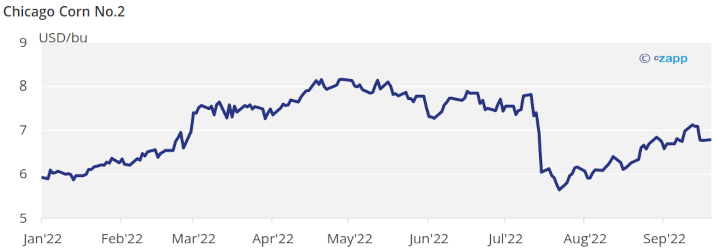

No changes to our average price forecast for the 22/23 (Sep/Aug) crop in a range of 5,8 to 6,3 USD/bu. The average price since Sep 1 is running at 6,86 USD/bu.

Market Commentary

We had the expiry of the September contracts in Chicago and Euronext and the September WASDE finally confirming a smaller US Corn crop. Doubts continue around the size of the Russian Wheat crop and the EU Corn crop.

We had the September WASDE last Monday and as expected they lowered US Corn production by reducing the number of acres and the yield. Harvested acres were down to 80,8 mill from 81,8 before. And yield was lowered to 172,5 bpa vs. 175,4 before. The market was waiting for this lower yield as Corn conditions have been deteriorating week after week following very hot and dry summer. This changes reduced production by 415 mill but ending stocks only fell by 169 mill bu as demand for feed and Ethanol as well as exports were reduced offsetting the reduction in production. US stock to use is now down to 8,5% vs. 9,6% before.

Globally, the Sep WASDE reduced Corn stocks by 2 mill ton with the bulk of it coming from lower US production of 10 mill ton and 5 mill ton of less consumption. Ukraine production was increased by 1,5 mill ton to 31,5 mill ton. EU was reduced by 1,2 mill ton to 58,8 mill ton.

Coceral did reduce EU’s Corn production to 51,9 mill ton vs. 66 they had before. This would be a sizable reduction vs. last year’s 67,2 mill ton crop and leaves the door open for the USDA to reduce their number in their October report.

US Corn condition was down again to 53% good or excellent vs. 58% last year and is 5% harvested, ahead of last year. French Corn condition was unchanged at 43% good or excellent vs. 89% last year still at an all-time low. French Corn is 14% harvested vs. 0% last year thanks to earlier maturation of Corn. Russian Corn is 3% harvested.

The French agricultural ministry forecasted Corn production of 11,3 mill ton which is 25% lower yoy all due to extreme hot and dry weather that has impacted yields.

In the Wheat front, US winter Wheat is already 10% planted in parity with last year. Russian Wheat is 85% harvested with an average yield 30% higher year on year. Wheat planting in Ukraine is 3,5% planted.

The Sep WASDE left US Wheat ending stocks unchanged buy higher stocks globally all coming from higher production in Russia which was finally increased to 91 mill ton vs. 88 of the last WASDE. We have been indicating for some time the WASDE was low in their Russian estimate. Ukraine’s production was also increased by 1 mill ton. Globally, ending stock were increased by 1,2 mill ton.

Local analysts in Russia are feeling even more optimistic about the size of the crop and 100 mill ton crop is already being talked vs. 91 mill ton of the Sep WASDE.

The market reacted positive to the WASDE but the expiry of the September contracts left the front month with the gap of the spread to the December contract resulting in a negative week.

Looking at weather, the US is expected to continue having dry and warm weather in the Corn belt. In Brazil rains are expected in the center west with the rest of the CS region expecting to become dryer. Europe is expected to see rains again which will improve soil moisture for Wheat planting in the coming weeks.

In a meeting last Friday about the grains corridor out of Ukraine, Putin raised concerns that the operation is not running as it should, saying again most of the grains are going to Europe instead of developing countries. The market fears there could be disruptions to the grain corridor and Russia might just be looking for a outlet to their bumper crop.

We think the market will tend to trade higher and close the gap with the expiry of the September contract. Dry conditions remain in the US further risking Corn yields and European Corn production will likely be reduced.