Opinion Focus

- The EU’s Emissions Trading Scheme will be extended to the shipping industry in 2024.

- Regulations apply to all vessels calling at EU ports, and the US and China will soon unveil their own systems.

- Implications for the industry include lower availability of vessels and higher ownership costs.

Emissions Trading Schemes (ETS) have been in force for a number of years in the EU across select industries, including heavily emitting industrial sectors. As of January 1, 2024, the scope will widen to the shipping industry. But that doesn’t mean that ships flagged outside the EU are exempt: the rules apply to any vessel calling at an EU port. And the US and China have already signalled their intention to establish their own ETS systems based on the EU scheme. So what does all this mean for the shipping industry?

EU Cracks Down on Emissions

Last July, the European Commission proposed a cap-and-trade system on greenhouse gas emissions as part of its Fit for 55 package. This means that any emissions created by companies operating in the EU must be accounted for at the end of the year.

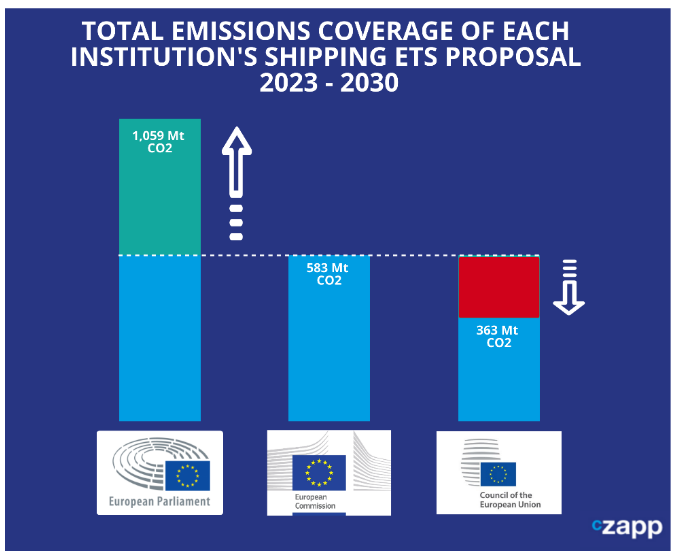

In June, individual positions on the issue were reached by the European Commission, the European Parliament and the European Council. The final decision is set to be reached by the end of the year after a series of negotiations between the three entities.

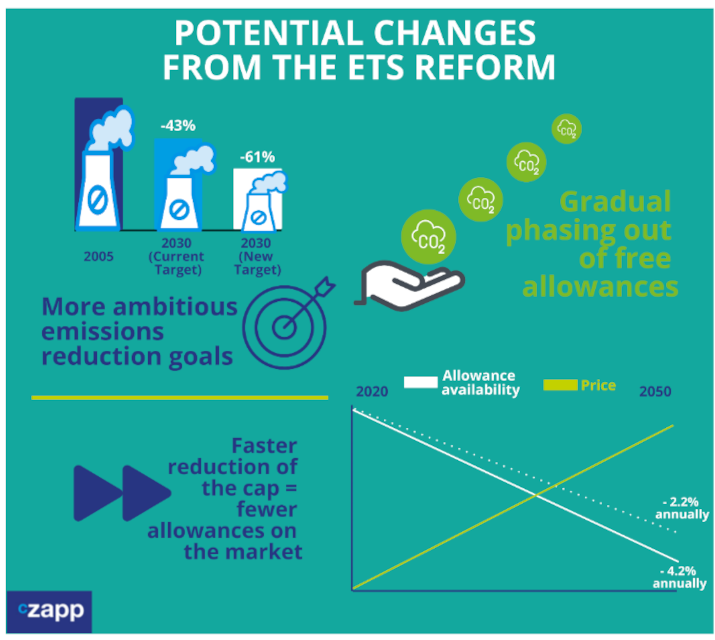

There has been an emissions trading system in place in Europe since 2005, but it only applied to heavily polluting industries such as oil, steel, cement, glass and paper production, as well as commercial aviation. Now, the EU wants to expand the scope and has set much more ambitious targets to do so.

The new rules are set to come into effect on January 1, 2024 and will initially apply to ships with a capacity of 5,000 gross tonnes and above. There is potential to extend the scope to smaller vessels from 2025.

And the requirements not only extend to EU flagged and EU incorporated ships, but also any vessel transiting through an EU port. So, any shipowners that want to do business in Europe need to understand the rules.

ETS Rules Require Negotiation, Clarification

The concept of the ETS is simple: shipowners need to ensure they have enough certificates to submit at the end of each year to cover their emissions for that year. One certificate is equal to 1 tonne of CO2. Certain industries exposed to carbon leakage are allocated a certain amount each year and anyone can buy more certificates if needed.

Sounds simple, right? Not really.

The European Commission has said that allocating certificates has proven to be counterproductive. This means the shipping industry is unlikely to be assigned any free allowances and must instead buy all the certificates that cover their emissions at auction, on the open market or through the Ocean Fund.

The good news is that the allowances are tradeable and don’t expire. The bad news is that costs are likely to rise because fewer allowances will be put on the market each year.

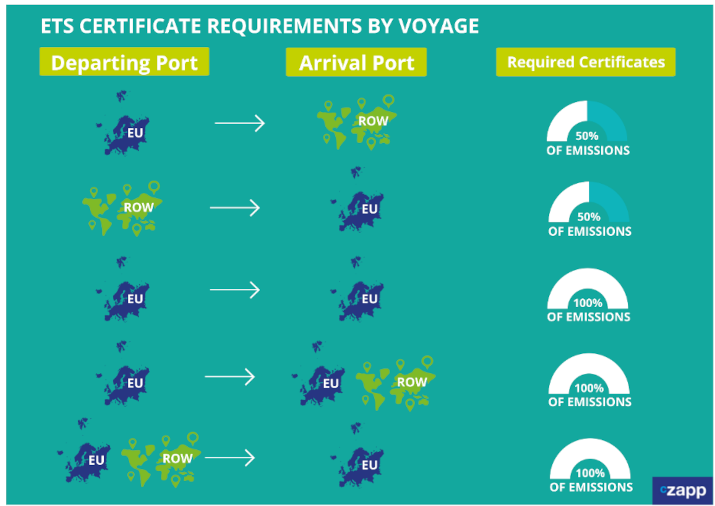

In situations where the departing or arrival port is outside of the EU, only 50% of emissions are required to be covered. In almost all other instances, 100% of emissions must be covered with certificates.

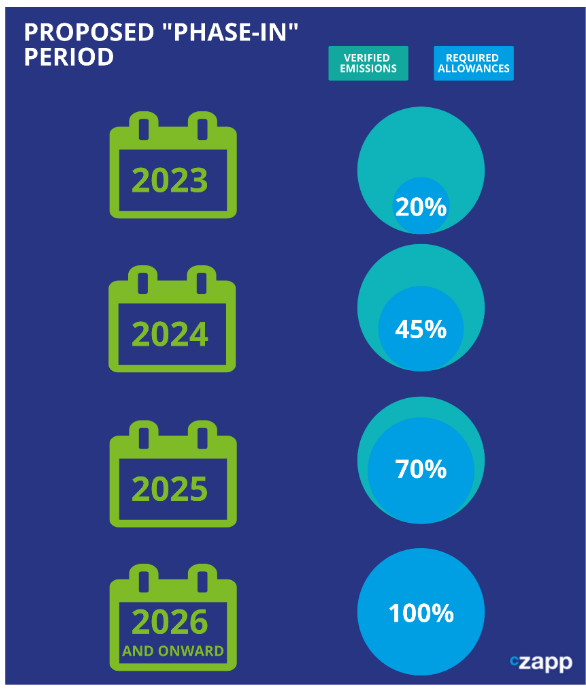

And given the huge burden of the regulations, for new industries included in the ETS, the European Commission and EU Council both want a gradual “phase-in” period.

However, the European Parliament wants full compliance for 2023 emissions.

Shipowners could be down to the wire to make the necessary changes before the reporting period begins. While the positions of the three regulatory entities largely align, several issues still need to be ironed out through discussions. These include potential exemption for PSOs and PSCs, use of revenues, exemption for ferries, and discounts for ice class vessels and outermost regions.

And the ultimate responsibility for compliance with the ETS is not all black and white. Shipowners have the ultimate responsibility of handing in the allowances at the end of the reporting period, but importantly they can pass compliance down the chain. This must be written into a contract, but brokers, charterers and commercial managers also need to be aware of the potential liability.

EU member states will administer the scheme for the companies that are incorporated in their own jurisdiction. For non-EU shipping companies, though, the requirements are a bit more complex and potentially onerous for member states.

The rules say that the member state that the non-EU company has visited most frequently in the prior two-year period will be responsible for overseeing the company’s reporting. If no visits have been made to the EU in the previous two years, responsibility will fall on the member state whose port the company first calls to.

Compliance Challenging – But Crucial to Stay in the Game

The ETS system, while ambitious in its efforts to reduce emissions, might inadvertently have an impact of vessel availability and by extension freight prices in the coming years. For example, in an attempt to reduce emissions, ships may resort to slow steaming, which has an impact on availability.

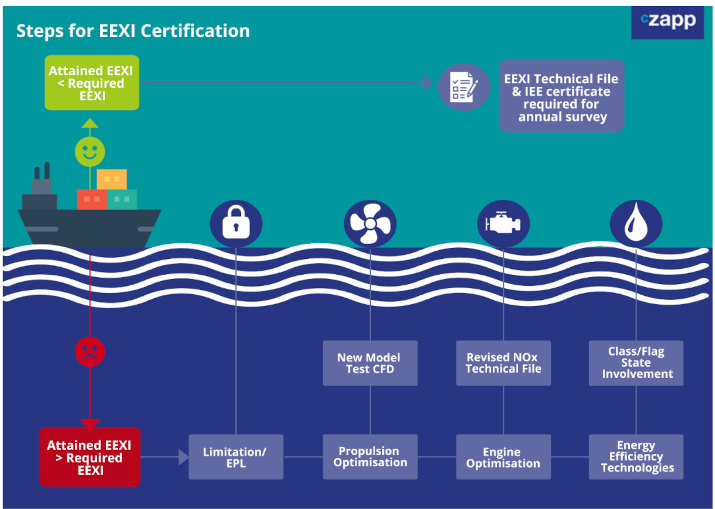

The ETS is coming into force at the same time as the new EEXI and CII regulations, which could also impact short-term availability. It is estimated that about 30% of the global fleet may not be automatically compliant with these IMO regulations, potentially taking them out of the market.

There is also likely to be increasingly regional trade with compliant companies and vessels, and some of the global fleet may be unable to transit to certain regions.

But one thing that is clear is the penalty for non-compliance with the ETS. Punitive measures could range from ships not being allowed to dock in EU ports or even detention of vessels on the more serious end of the spectrum. If two or more years pass without allowances being surrendered, the company could be subject to an expulsion order for all its vessels.

Of course, this would jeopardise business since brokers won’t be willing to charter vessels that cannot travel to EU ports. Not only this, but both the US and China have also indicated they will also implement their own systems, and these will likely be modelled on the EU system. Ships that remain non-compliant will increasingly be expelled from the world market.

Concluding Thoughts

- Shipping costs are going up.

- As compliance standards tighten, emissions certificates will be harder to come by – and more expensive.

- This means shipowners will be faced with the decision of buying expensive certificates, retrofitting ships or ordering costly new ships that can run on cleaner fuels.

- All of these factors indicate an additional burden for shipowners.

- This in turn leads to lower availability and a substantially higher freight price in the coming years.

- But all of these factors pale in comparison to the consequences of non-compliance.