This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

Cash sugar trading was slow over Christmas and will remain quiet until 2025. Most corn sweetener contracts for 2025 were completed, but negotiations for 2026 are delayed. Beet piles in the Red River Valley fared well, while Michigan faced concerns, and sweetener market activity is expected to pick up in early 2025.

Slow Year-End Activity in Sugar Market

Cash sugar trading was slow during Christmas week 2024 and will remain quiet until the calendar flips to 2025. Prices remain unchanged. Corn sweetener contracting for 2025 was mostly complete.

Although sugar beet factories and cane refineries continued to operate, the sugar market was expected to be at a near standstill over the final two weeks of the year, which is typical for the industry. Most contracting for 2025 was completed weeks, if not months, ago, and there has been no rush to begin adding 2026 coverage, as sugar buyers and sellers are far apart in pricing ideas in most cases.

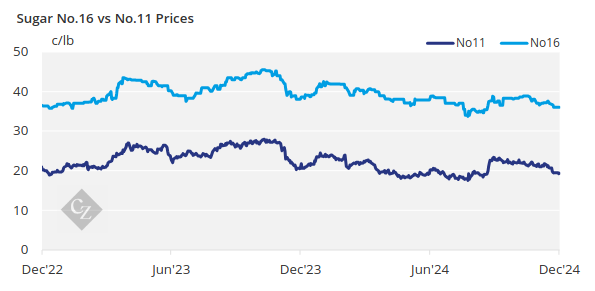

One beet processor remained out of the market for 2024-25, but all others had sugar to offer. Prices were said to be mostly within the current quoted ranges, although some beet sugar sales below the ranges were noted in December from specific sellers in some regions.

Beet Pile Concerns in Michigan

Cold temperatures resulted in near-ideal conditions for outdoor sugar beet piles in the Red River Valley. However, above-freezing temperatures continued to threaten beet piles in Michigan, where “hot spots” from fall piling were already a concern. In most cases, problem areas in piles were quickly moved to factories to limit or prevent losses.

Inquiries for 2025-26 were expected to increase in early January. Few sales were said to have been completed before the end of the year, with users sensing no urgency to buy amid indications of adequate to ample sugar supplies. Buyers sought lower prices, while sellers were hesitant to lower offers this early in the season.

Some beet sugar was said to be offered flat with 2024-25 prices in the mid- to upper-40¢/lb range FOB Midwest. Negotiations were expected to gain momentum, with mixed ideas about sales activity, as the International Sweetener Colloquium approaches in late February.

Sweetener Market Outlook, New US Policies

Contracting of corn sweeteners for 2025 was expected to be complete by year-end, except for spot buyers and the typical few stragglers who carry into the new year even as 2024 contracts expire.

Pricing for 2025 was said to be mostly lower for 42% high-fructose corn syrup and steady to slightly weaker for 55% HFCS and glucose, all depending on buyers’ 2024 contracted levels. If forecasted lower HFCS use in Mexico comes to fruition, more spot supplies may be available in the US during 2025.

The trade will monitor consumer sugar demand in the coming months, after indications of slower deliveries of bulk sugar to food manufacturers in the fall were noted by some sellers, especially as retail shipments also were expected to slow seasonally after the holiday period.

Also being watched will be news from Washington, as the Food and Drug Administration issued a definition for “healthy” that included limits on added sugars. The farm bill was extended to September 30, and President-elect Donald Trump threatened tariffs on imports from Mexico, the key source of US imported sugar supply.